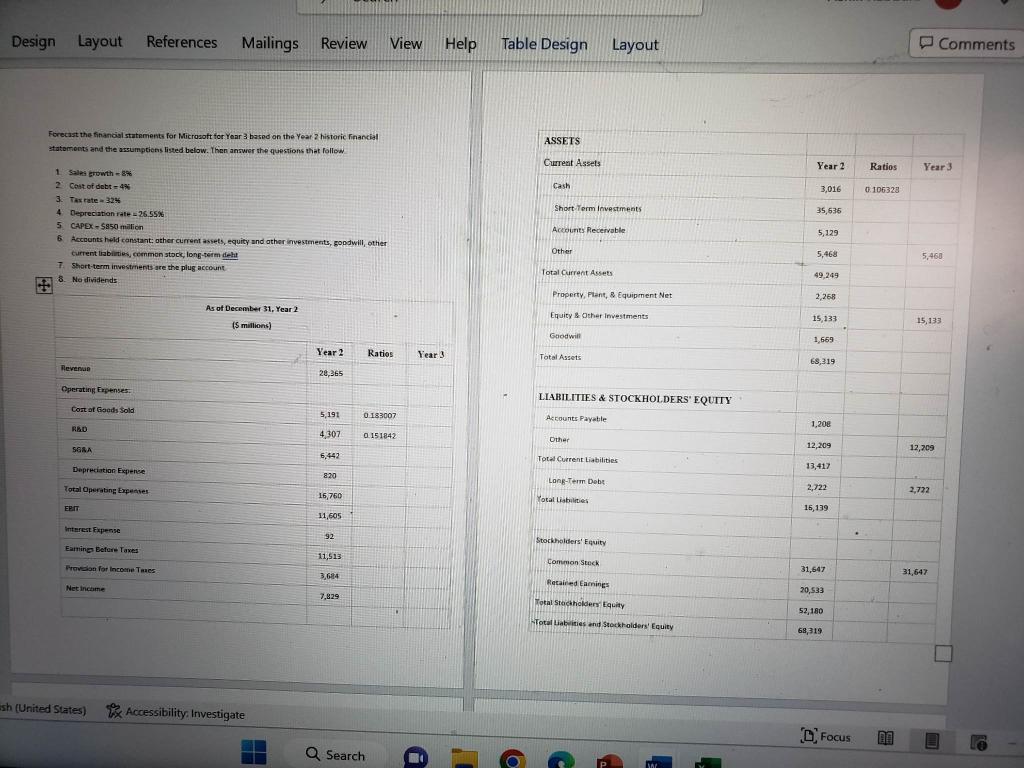

Question: Forecast the tinancial statements for Microsott for Yoar 3 baspd on the Year 2 historic financia! statemonts and the assumptiens listed below. Then answer the

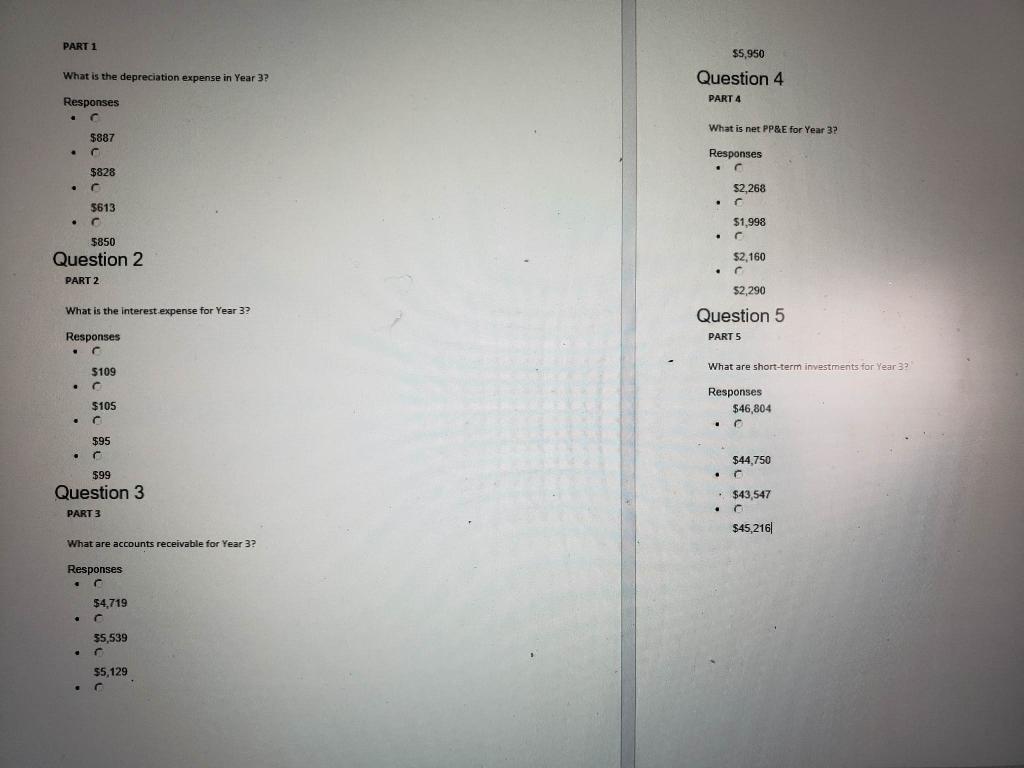

Forecast the tinancial statements for Microsott for Yoar 3 baspd on the Year 2 historic financia! statemonts and the assumptiens listed below. Then answer the questions that follow 1. Salla krowth -896 2. Cout of debt =48 3. Tix rate -324 4 Depreciation rate =26.55% 5. CAPEx - 5850 milion 6. Accounts held canstant, ather current assets, equity and ather investments, goodwill, other current liabilitios, cemman stoci, long-7erm deht 7. Shart-term investinents are the plug account. 8. No divilends What is the depreciation expense in Year 3? Question 4 Responses PART 4 - r What is net PPgE for Year 3 ? Responses - r - r - r5613 $850 Question 2 PART 2 What is the interest expense for Year 3? Question 5 Responses PART 5 - r - 5109 What are short-term investments for Year 3? Responses r - r - 5,539 r55,129 Forecast the tinancial statements for Microsott for Yoar 3 baspd on the Year 2 historic financia! statemonts and the assumptiens listed below. Then answer the questions that follow 1. Salla krowth -896 2. Cout of debt =48 3. Tix rate -324 4 Depreciation rate =26.55% 5. CAPEx - 5850 milion 6. Accounts held canstant, ather current assets, equity and ather investments, goodwill, other current liabilitios, cemman stoci, long-7erm deht 7. Shart-term investinents are the plug account. 8. No divilends What is the depreciation expense in Year 3? Question 4 Responses PART 4 - r What is net PPgE for Year 3 ? Responses - r - r - r5613 $850 Question 2 PART 2 What is the interest expense for Year 3? Question 5 Responses PART 5 - r - 5109 What are short-term investments for Year 3? Responses r - r - 5,539 r55,129

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts