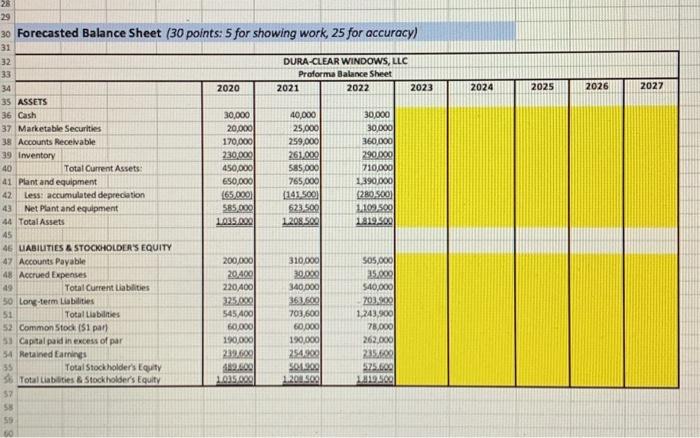

Question: Forecasted Balance Sheet ( 30 points: 5 for showing work, 25 for accuracy) It's STILL January 1, 2023, and you'll be going on Shark Tank

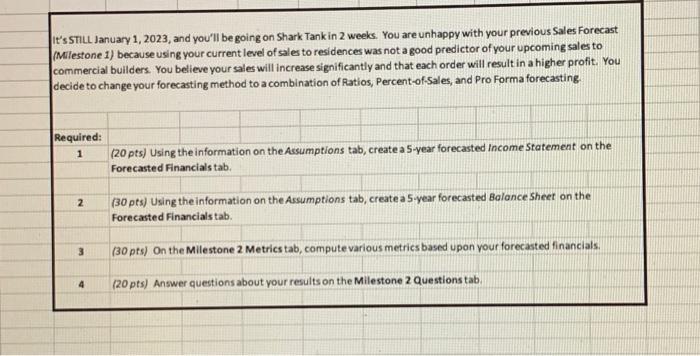

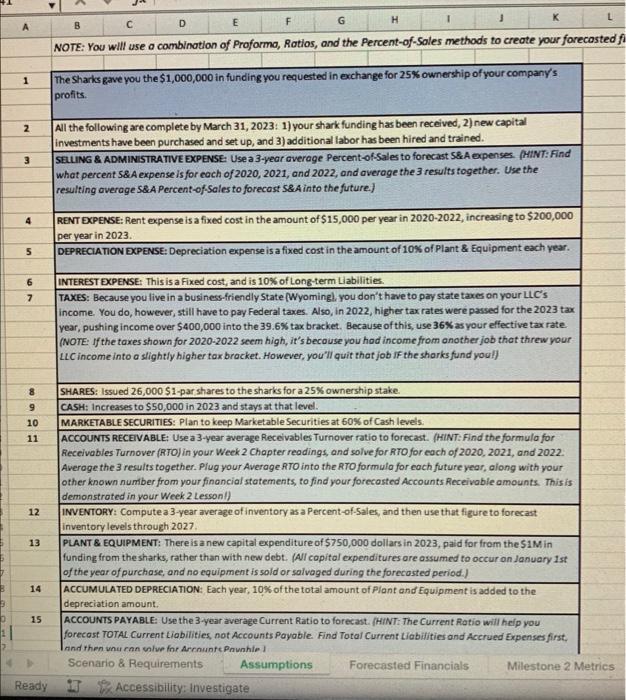

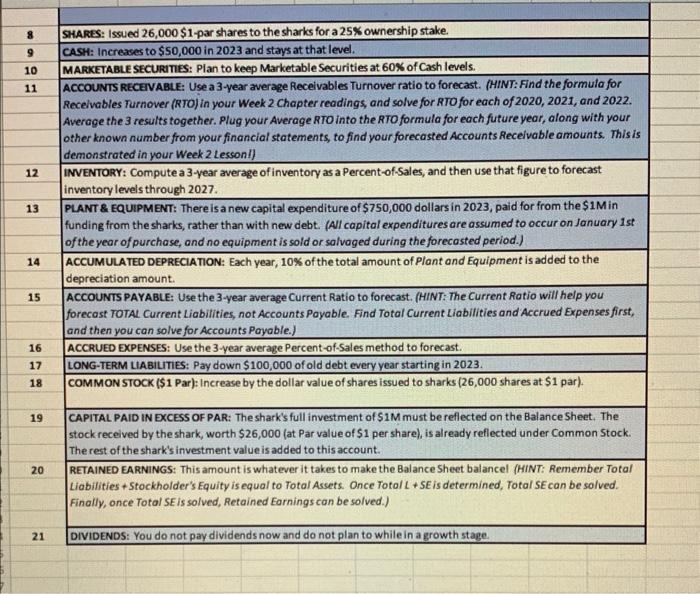

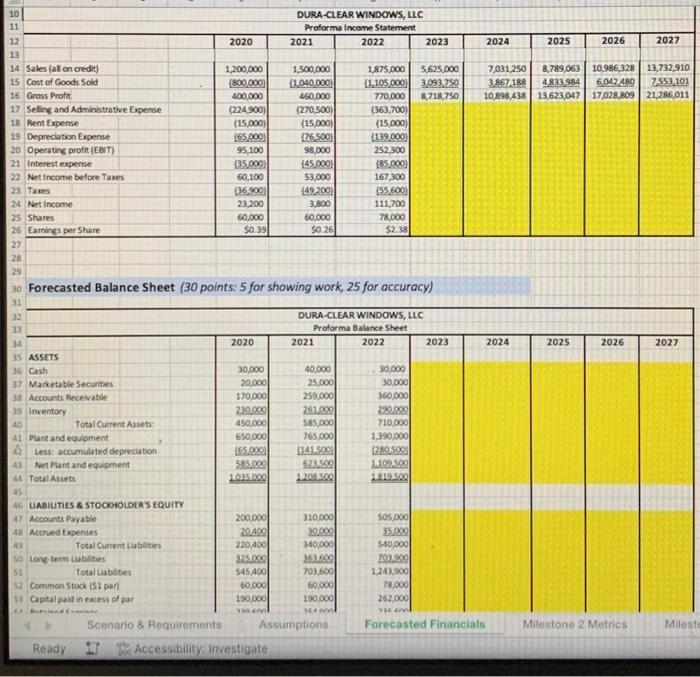

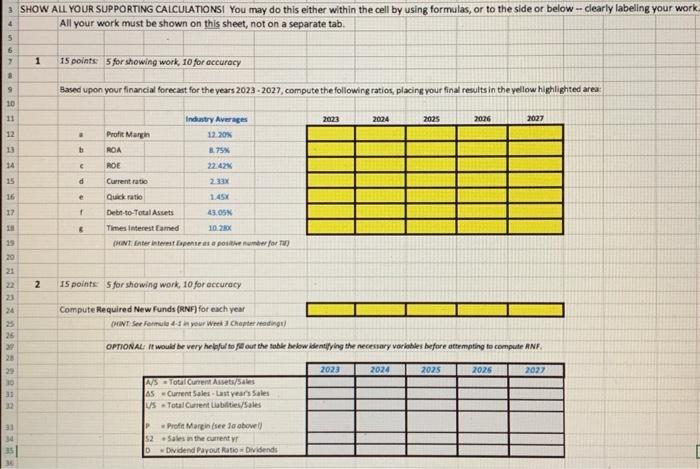

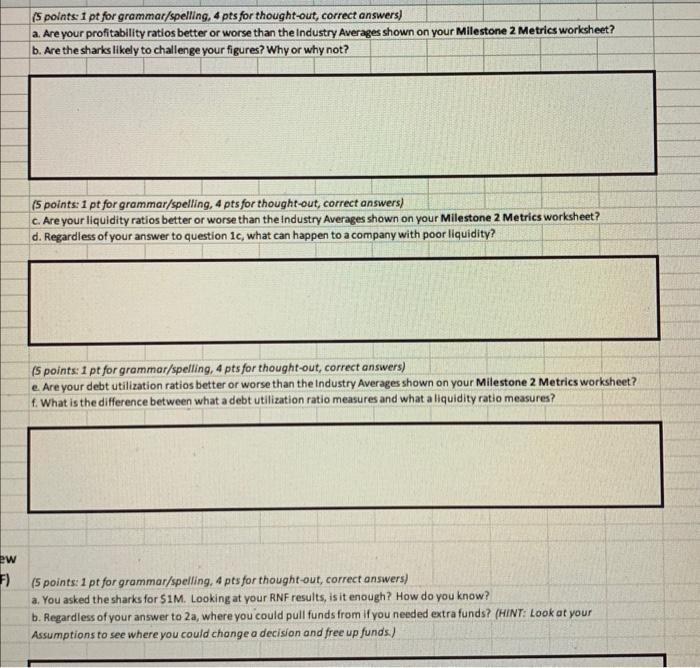

Forecasted Balance Sheet ( 30 points: 5 for showing work, 25 for accuracy) It's STILL January 1, 2023, and you'll be going on Shark Tank in 2 weeks. You are unhappy with your previous Sales Forecast DURA-CLEAR WINDOWS, LLC Forecasted Balance Sheet ( 30 points: 5 for showing work, 25 for accuracy) pravt, fater interest fapenie as a posable nunder for fap (5 points: 1 pt for grammar/spelling, 4 pts for thought-out, correct answers) a. You asked the sharks for $1M. Looking at your RNF results, is it enough? How do you know? b. Regardless of your answer to 2 a, where you could pull funds from if you needed extra funds? (HINT: Look at your Assumptions to see where you could change a decision and free up funds.) \begin{tabular}{|c|c|} \hline 8 & SHARES: Issued 26,000 \$1-par shares to the sharks for a 25% ownership stake. \\ \hline 9 & CASH: Increases to $50,000 in 2023 and stays at that level. \\ \hline 10 & MARIKETABLE SECURInES: Plan to keep Marketable Securities at 60% of Cash levels. \\ \hline 11 & ACCOUNTSRECEVABLE:Usea3-yearaverageReceivablesTurnoverratiotoforecast.(HINT:FindtheformulaforReceivablesTurnover(RTO)inyourWeek2Chapterreadings,andsolveforRTOforeachof2020,2021,and2022.Averagethe3resultstogether.PlugyourAverageRTOintotheRTOformulaforeachfutureyear,alongwithyourotherknownnumberfromyourfinancialstatements,tofindyourforecastedAccountsReceivableamounts.ThisisdemonstratedinyourWeek2LessonI) \\ \hline 12 & INVENTORY:Computea3-yearaverageofinventoryasaPercent-of-Sales,andthenusethatfiguretoforecastinventorylevelsthrough2027. \\ \hline 13 & PLANT&EQUIPMENT:Thereisanewcapitalexpenditureof$750,000dollarsin2023,paidforfromthe$1Minfundingfromthesharks,ratherthanwithnewdebt.(AllcapitalexpendituresareassumedtooccuronJanuary1stoftheyearofpurchase,andnoequipmentissoldorsalvagedduringtheforecastedperiod.) \\ \hline 14 & ACCUMULATEDDEPRECIATION:Eachyear,10%ofthetotalamountofPlantandEquipmentisaddedtothedepreciationamount. \\ \hline 15 & ACCOUNTSPAYABLE:Usethe3-yearaverageCurrentRatiotoforecast.(HINT:TheCurrentRatiowillhelpyouforecastTOTALCurrentLiabilities,notAccountsPayable.FindTotalCurrentLiabilitiesandAccruedExpensesfirst,andthenyoucansolveforAccountsPayable.) \\ \hline 16 & ACCRUED EXPENSES: Use the 3 -year average Percent-of-Sales method to forecast. \\ \hline 17 & LONG-TERM LIABIUTIES: Pay down $100,000 of old debt every year starting in 2023. \\ \hline 18 & COMMON STOCK (\$1 Par): Increase by the dollar value of shares issued to sharks (26,000 shares at $1 par). \\ \hline 19 & CAPITALPAIDINEXCESSOFPAR:Thesharksfullinvestmentof$1MmustbereflectedontheBalanceSheet.Thestockreceivedbytheshark,worth$26,000(atParvalueof$1pershare),isalreadyreflectedunderCommonStock.Therestofthesharksinvestmentvalueisaddedtothisaccount. \\ \hline 20 & RETAINEDEARNINGS:ThisamountiswhateverittakestomaketheBalanceSheetbalancel(HINT:RememberTotalLiabilities+StockholdersEquityisequaltoTotalAssets.OnceTotalL+SEisdetermined,TotalSEcanbesolved.Finally,onceTotalSEissolved,RetainedEarningscanbesolved.) \\ \hline 21 & DIVIDENDS: You do not pay \\ \hline \end{tabular} Forecasted Balance Sheet ( 30 points: 5 for showing work, 25 for accuracy) It's STILL January 1, 2023, and you'll be going on Shark Tank in 2 weeks. You are unhappy with your previous Sales Forecast DURA-CLEAR WINDOWS, LLC Forecasted Balance Sheet ( 30 points: 5 for showing work, 25 for accuracy) pravt, fater interest fapenie as a posable nunder for fap (5 points: 1 pt for grammar/spelling, 4 pts for thought-out, correct answers) a. You asked the sharks for $1M. Looking at your RNF results, is it enough? How do you know? b. Regardless of your answer to 2 a, where you could pull funds from if you needed extra funds? (HINT: Look at your Assumptions to see where you could change a decision and free up funds.) \begin{tabular}{|c|c|} \hline 8 & SHARES: Issued 26,000 \$1-par shares to the sharks for a 25% ownership stake. \\ \hline 9 & CASH: Increases to $50,000 in 2023 and stays at that level. \\ \hline 10 & MARIKETABLE SECURInES: Plan to keep Marketable Securities at 60% of Cash levels. \\ \hline 11 & ACCOUNTSRECEVABLE:Usea3-yearaverageReceivablesTurnoverratiotoforecast.(HINT:FindtheformulaforReceivablesTurnover(RTO)inyourWeek2Chapterreadings,andsolveforRTOforeachof2020,2021,and2022.Averagethe3resultstogether.PlugyourAverageRTOintotheRTOformulaforeachfutureyear,alongwithyourotherknownnumberfromyourfinancialstatements,tofindyourforecastedAccountsReceivableamounts.ThisisdemonstratedinyourWeek2LessonI) \\ \hline 12 & INVENTORY:Computea3-yearaverageofinventoryasaPercent-of-Sales,andthenusethatfiguretoforecastinventorylevelsthrough2027. \\ \hline 13 & PLANT&EQUIPMENT:Thereisanewcapitalexpenditureof$750,000dollarsin2023,paidforfromthe$1Minfundingfromthesharks,ratherthanwithnewdebt.(AllcapitalexpendituresareassumedtooccuronJanuary1stoftheyearofpurchase,andnoequipmentissoldorsalvagedduringtheforecastedperiod.) \\ \hline 14 & ACCUMULATEDDEPRECIATION:Eachyear,10%ofthetotalamountofPlantandEquipmentisaddedtothedepreciationamount. \\ \hline 15 & ACCOUNTSPAYABLE:Usethe3-yearaverageCurrentRatiotoforecast.(HINT:TheCurrentRatiowillhelpyouforecastTOTALCurrentLiabilities,notAccountsPayable.FindTotalCurrentLiabilitiesandAccruedExpensesfirst,andthenyoucansolveforAccountsPayable.) \\ \hline 16 & ACCRUED EXPENSES: Use the 3 -year average Percent-of-Sales method to forecast. \\ \hline 17 & LONG-TERM LIABIUTIES: Pay down $100,000 of old debt every year starting in 2023. \\ \hline 18 & COMMON STOCK (\$1 Par): Increase by the dollar value of shares issued to sharks (26,000 shares at $1 par). \\ \hline 19 & CAPITALPAIDINEXCESSOFPAR:Thesharksfullinvestmentof$1MmustbereflectedontheBalanceSheet.Thestockreceivedbytheshark,worth$26,000(atParvalueof$1pershare),isalreadyreflectedunderCommonStock.Therestofthesharksinvestmentvalueisaddedtothisaccount. \\ \hline 20 & RETAINEDEARNINGS:ThisamountiswhateverittakestomaketheBalanceSheetbalancel(HINT:RememberTotalLiabilities+StockholdersEquityisequaltoTotalAssets.OnceTotalL+SEisdetermined,TotalSEcanbesolved.Finally,onceTotalSEissolved,RetainedEarningscanbesolved.) \\ \hline 21 & DIVIDENDS: You do not pay \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts