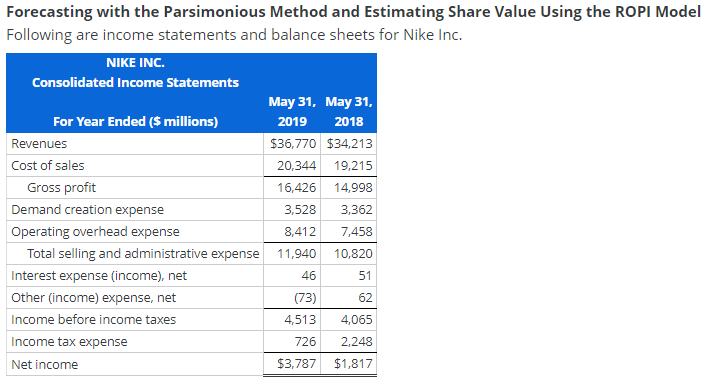

Question: Forecasting with the Parsimonious Method and Estimating Share Value Using the ROPI Model Following are income statements and balance sheets for Nike Inc. NIKE INC.

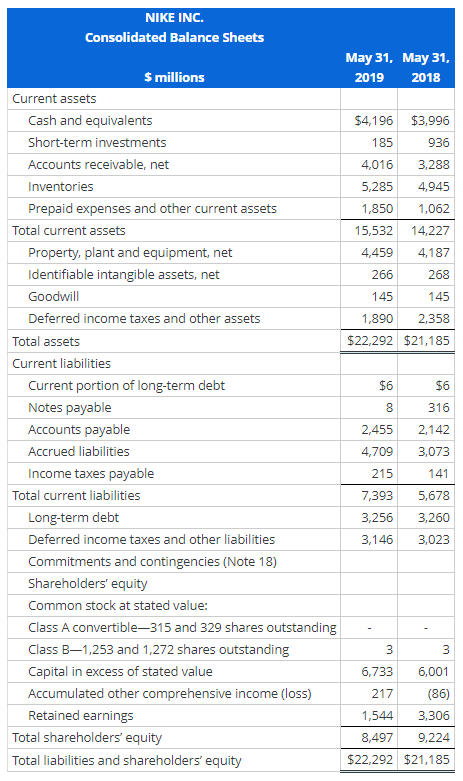

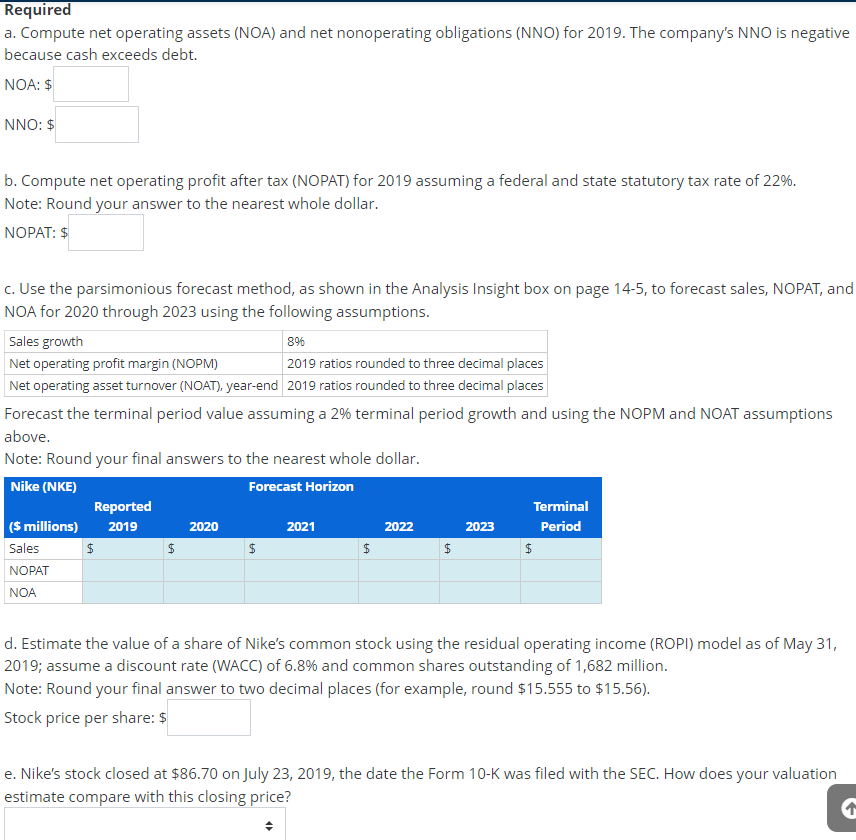

Forecasting with the Parsimonious Method and Estimating Share Value Using the ROPI Model Following are income statements and balance sheets for Nike Inc. NIKE INC. Consolidated Balance Sheets a. Compute net operating assets (NOA) and net nonoperating obligations (NNO) for 2019. The company's NNO is negative because cash exceeds debt. NOA: $ NNO: $ b. Compute net operating profit after tax (NOPAT) for 2019 assuming a federal and state statutory tax rate of 22%. Note: Round your answer to the nearest whole dollar. NOPAT: c. Use the parsimonious forecast method, as shown in the Analysis Insight box on page 14-5, to forecast sales, NOPAT, and NOA for 2020 through 2023 using the following assumptions. Forecast the terminal period value assuming a 2% terminal period growth and using the NOPM and NOAT assumptions above. Note: Round your final answers to the nearest whole dollar. d. Estimate the value of a share of Nike's common stock using the residual operating income (ROPI) model as of May 31 , 2019; assume a discount rate (WACC) of 6.8% and common shares outstanding of 1,682 million. Note: Round your final answer to two decimal places (for example, round $15.555 to $15.56 ). Stock price per share: $ e. Nike's stock closed at $86.70 on July 23, 2019, the date the Form 10-K was filed with the SEC. How does your valuation estimate compare with this closing price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts