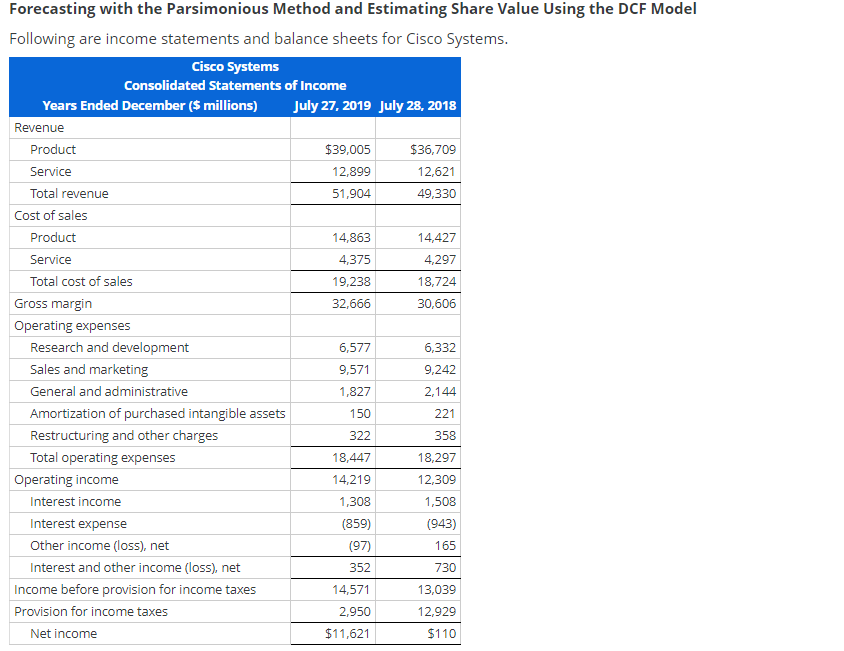

Question: Forecasting with the Parsimonious Method and Estimating Share Value Using the DCF Model Following are income statements and balance sheets for Cisco Systems. Forecasting with

Forecasting with the Parsimonious Method and Estimating Share Value Using the DCF Model Following are income statements and balance sheets for Cisco Systems.

Forecasting with the Parsimonious Method and Estimating Share Value Using the DCF Model Following are income statements and balance sheets for Cisco Systems.

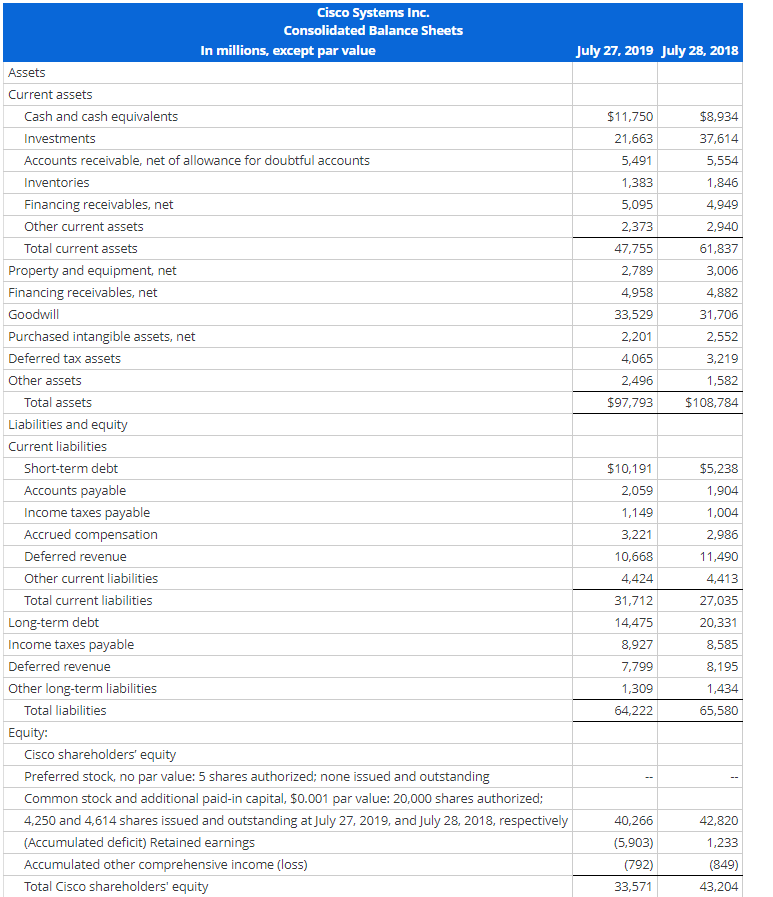

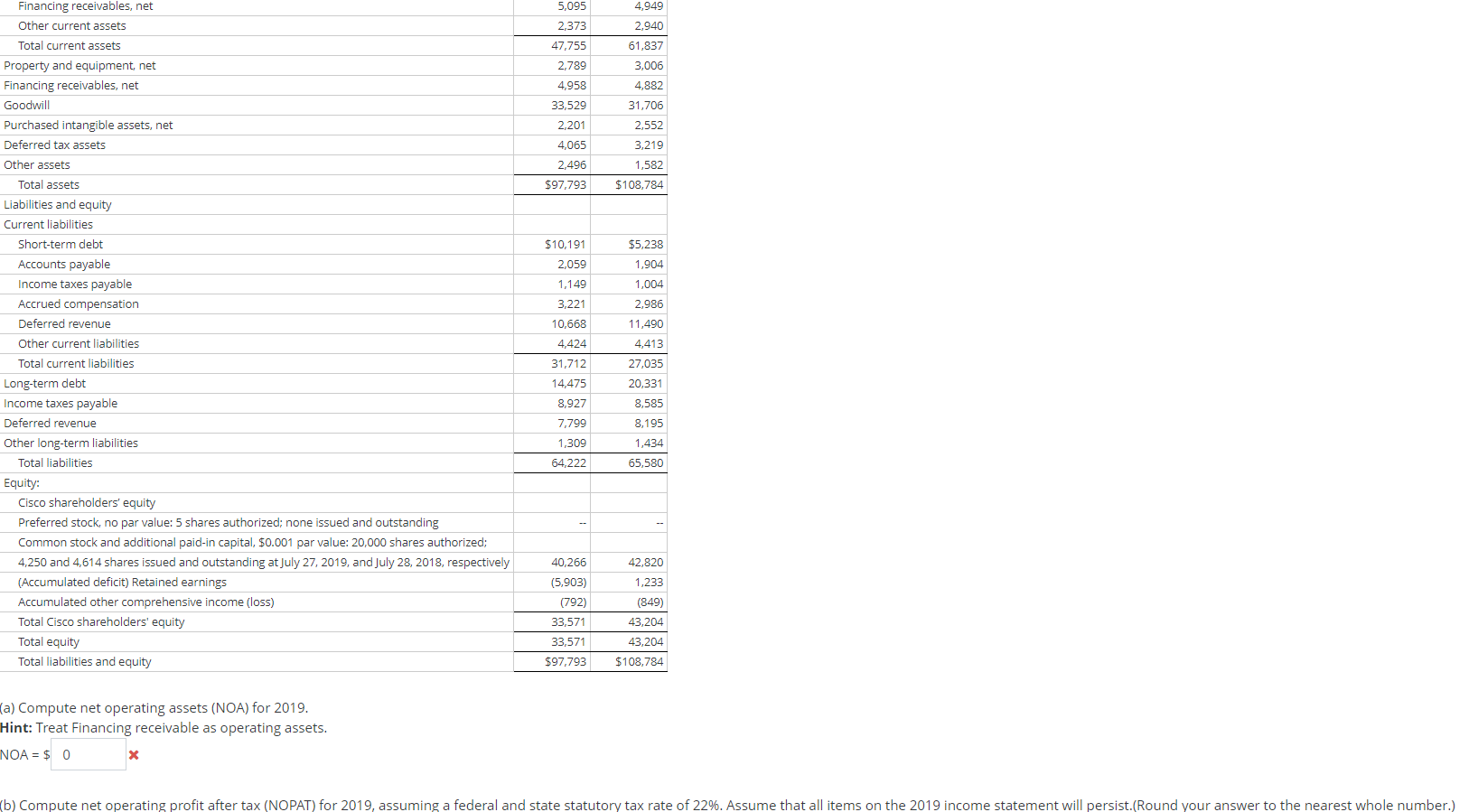

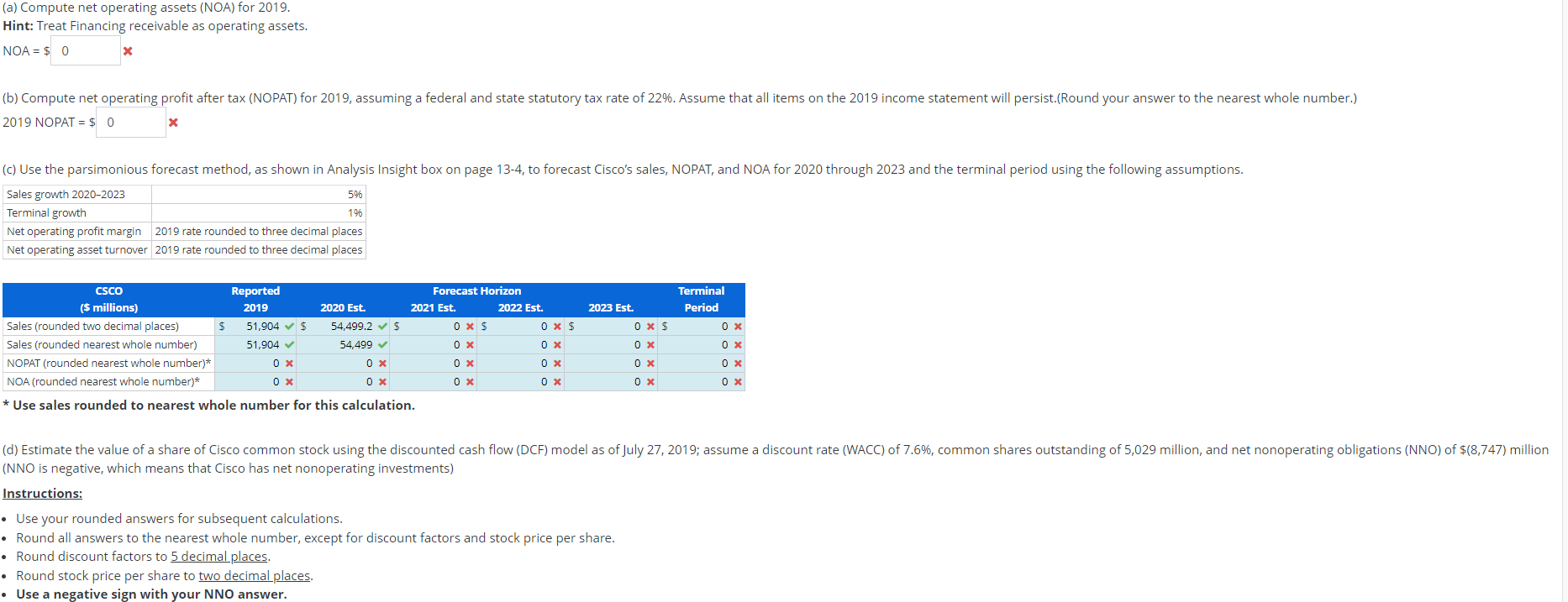

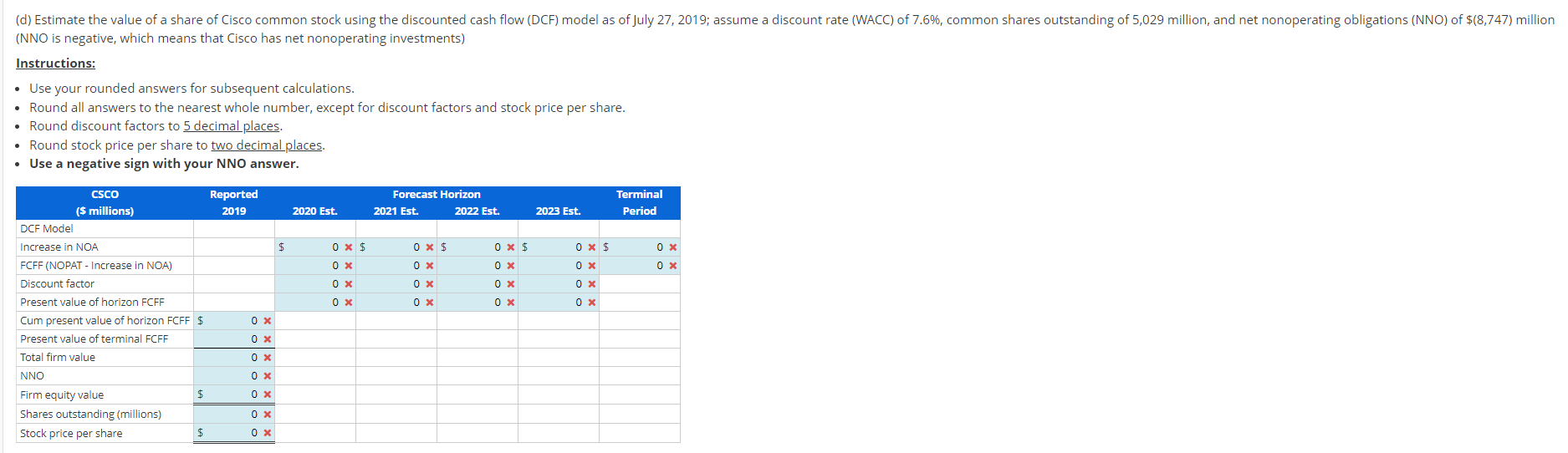

Forecasting with the Parsimonious Method and Estimating Share Value Using the DCF Model .... e.. Cisco Systems Inc. Consolidated Balance Sheets In millions, except par value July 27, 2019 July 28, 2018 Assets Current assets (a) Compute net operating assets (NOA) for 2019. Hint: Treat Financing receivable as operating assets. NOA=$ lint: Treat Financing receivable as operating assets. JOA=! 019 NOPAT =$ Use sales rounded to nearest whole number for this calculation. NNO is negative, which means that Cisco has net nonoperating investments) nstructions: Use your rounded answers for subsequent calculations. Round all answers to the nearest whole number, except for discount factors and stock price per share. Round discount factors to 5 decimal places. Round stock price per share to two decimal places. Use a negative sign with your NNO answer. (NNO is negative, which means that Cisco has net nonoperating investments) Instructions: - Use your rounded answers for subsequent calculations. - Round all answers to the nearest whole number, except for discount factors and stock price per share. - Round discount factors to 5 decimal places. - Round stock price per share to two decimal places. Forecasting with the Parsimonious Method and Estimating Share Value Using the DCF Model .... e.. Cisco Systems Inc. Consolidated Balance Sheets In millions, except par value July 27, 2019 July 28, 2018 Assets Current assets (a) Compute net operating assets (NOA) for 2019. Hint: Treat Financing receivable as operating assets. NOA=$ lint: Treat Financing receivable as operating assets. JOA=! 019 NOPAT =$ Use sales rounded to nearest whole number for this calculation. NNO is negative, which means that Cisco has net nonoperating investments) nstructions: Use your rounded answers for subsequent calculations. Round all answers to the nearest whole number, except for discount factors and stock price per share. Round discount factors to 5 decimal places. Round stock price per share to two decimal places. Use a negative sign with your NNO answer. (NNO is negative, which means that Cisco has net nonoperating investments) Instructions: - Use your rounded answers for subsequent calculations. - Round all answers to the nearest whole number, except for discount factors and stock price per share. - Round discount factors to 5 decimal places. - Round stock price per share to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts