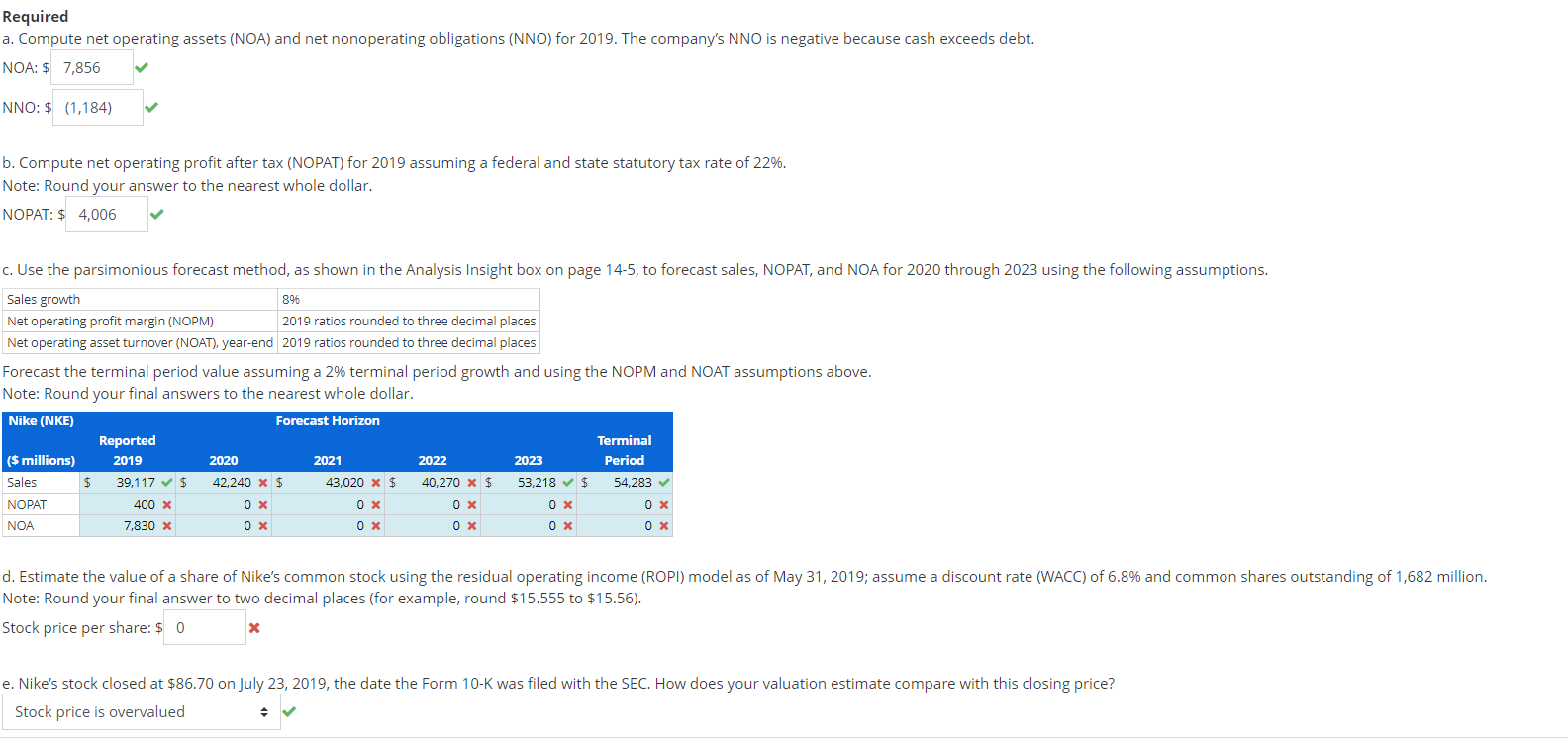

Question: Forecasting with the Parsimonious Method and Estimating Share Value Using the ROPI Model Following are income statements and balance sheets for Nike Inc. NIKE

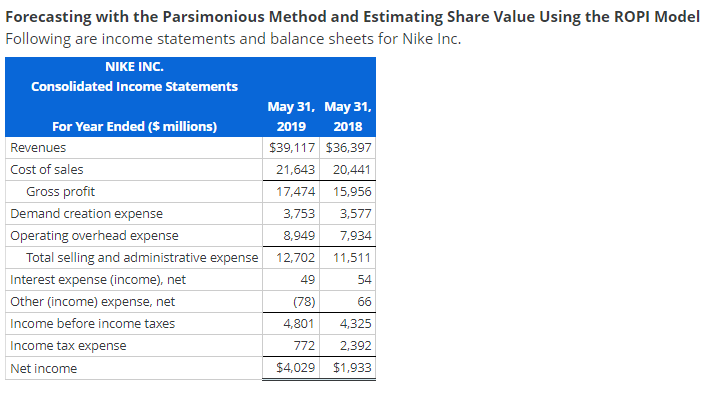

Forecasting with the Parsimonious Method and Estimating Share Value Using the ROPI Model Following are income statements and balance sheets for Nike Inc. NIKE INC. Consolidated Income Statements For Year Ended ($ millions) Revenues Cost of sales May 31, May 31, 2019 2018 $39,117 $36,397 21,643 20,441 Gross profit Demand creation expense 17,474 15,956 3,753 3,577 Operating overhead expense 8,949 7,934 Total selling and administrative expense 12,702 11,511 Interest expense (income), net 49 54 Other (income) expense, net (78) 66 Income before income taxes 4,801 4,325 Income tax expense Net income 772 2,392 $4,029 $1,933

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts