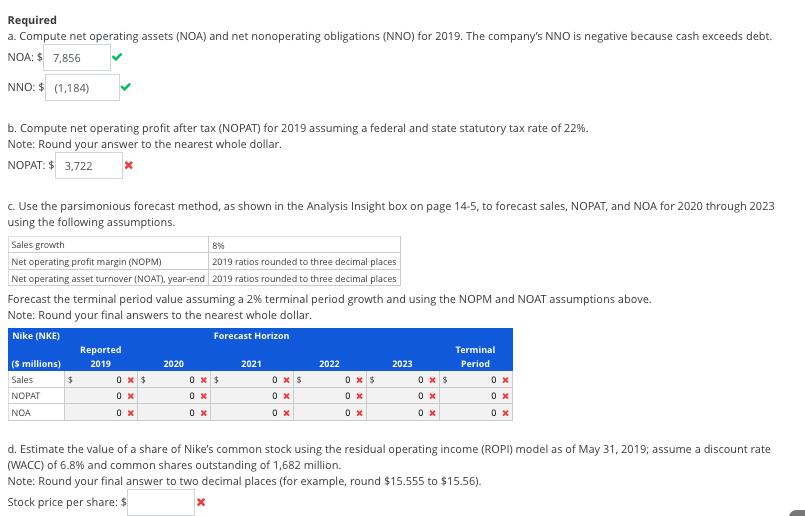

Question: Forecasting with the Parsimonious Method and Estimating Share Value Using the ROPI Model Following are income statements and balance sheets for Nike Inc. NIKE

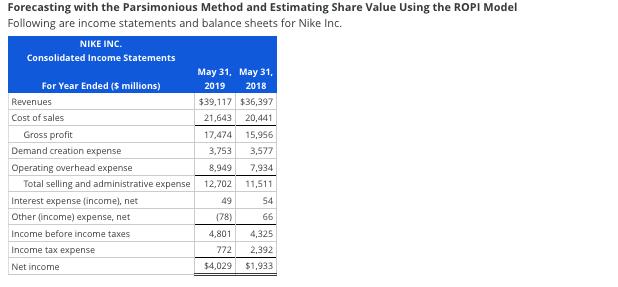

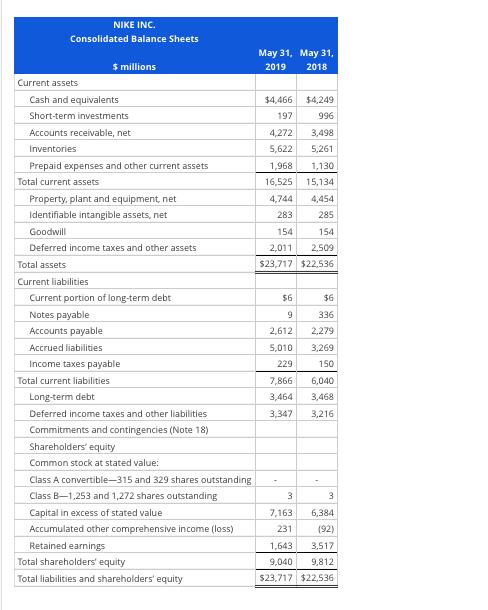

Forecasting with the Parsimonious Method and Estimating Share Value Using the ROPI Model Following are income statements and balance sheets for Nike Inc. NIKE INC. Consolidated Income Statements May 31, May 31, Revenues For Year Ended ($ millions) Cost of sales Gross profit 2019 2018 $39,117 $36,397 21,643 20,441 17,474 15,956 Demand creation expense 3,753 3,577 Operating overhead expense 8,949 7,934 Total selling and administrative expense 12,702 11,511 Interest expense (income), net 49 54 Other (income) expense, net (78) 66 Income before income taxes 4,801 4,325 Income tax expense 772 2,392 Net income $4,029 $1,933

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts