Question: Foreign Currency Transactions Exercises Exercise 2 XYZ Ltd has a financial year end of 31 December. In October it enters into a contract to buy

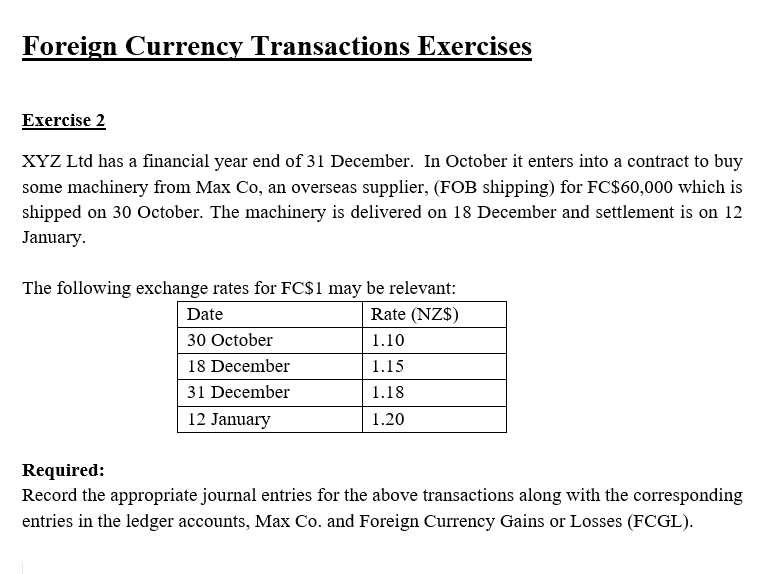

Foreign Currency Transactions Exercises Exercise 2 XYZ Ltd has a financial year end of 31 December. In October it enters into a contract to buy some machinery from Max Co, an overseas supplier, (FOB shipping) for FC$60,000 which is shipped on 30 October. The machinery is delivered on 18 December and settlement is on 12 January The following exchange rates for FC$1 may be relevant: Date Rate (NZ$) 30 October 1.10 18 December 1.15 31 December 1.18 12 January 1.20 Required: Record the appropriate journal entries for the above transactions along with the corresponding entries in the ledger accounts, Max Co. and Foreign Currency Gains or Losses (FCGL)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts