Question: Foreign Stock 1 0 . 0 6 1 3 . 1 2 1 3 . 4 7 4 5 . 4 2 - 2 1

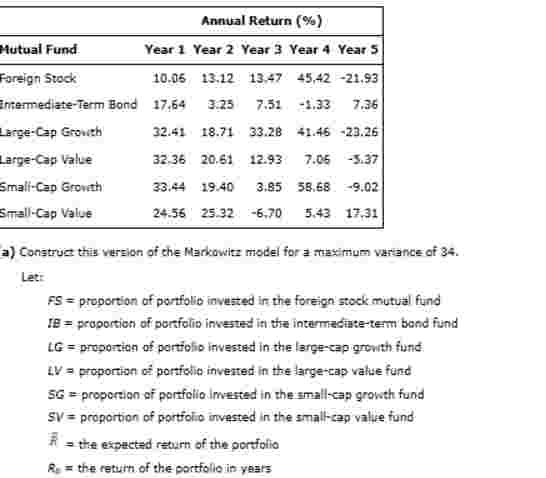

Foreign StockIntermediateTerm BondLargeCap GrowthLargeCap ValueSmallCap GrowthSmallCap ValueaConstruct this version of the Markowitz model for a maximum variance of Let:FS proportion of portfolio invested in the foreign stock mutual fundIB proportion of portfolio invested in the intermediateterm bond fundLG proportion of portfolio invested in the largecap growth fundLV proportion of portfolio invested in the largecap value fundSG proportion of portfolio invested in the smallcap growth fundSV proportion of portfolio invested in the smallcap value fund the expected return of the portfolioRs the return of the portfolio in years If required, round your answers to two decimal places. For subtractive or negative numbers use a minus sign even if there is a sign before the blank Example: If the constant is it must be entered in the box. If your answer is zero enter Max st FS IB LG LV SG SV Select your answer Item R FS IB LG LV SG SV Select your answer Item R FS IB LG LV SG SV Select your answer Item R FS IB LG LV SG SV Select your answer Item R FS IB LG LV SG SV Select your answer Item R FS IB LG LV SG SV Select your answer Item Select your answer Item Select your answer Item FS IB LG LV SG SV Select your answer Item bSolve the model developed in part aIf required, round your answers to two decimal places. If your answer is zero, enter FS IB LG LV SG SV Portfolio Expected Return

a Construcs this version of the Markowitz model for a rusimum variance of

Let:

FS proportion of porffolio invested in the foreign stock mutual fund

IE proportion of portfolis invested in the intermedatetem band fund

L Q proportion of portiolio invested in the largecap growth fund.

L V proportion of portiolio inverted in the largecap value fund

S G proportion of portfolio imested in the mallscap growth fund

S V proportion of portfolio invested in the smallcap value fund

B the expected return of the portfolio

Rp the retuith of the portfolio in years a Construct this version of the Markowitz model for a maximum variance of

Let:

FS proportion of portfolio invested in the foreign stock mutual fund

I B proportion of portfolio invested in the intermediateterm bond fund

LG proportion of portfolio invested in the largecap growth fund

L V proportion of portfolio invested in the largecap value fund

S G proportion of portfolio invested in the smallcap growth fund

S V proportion of portfolio invested in the smallcap value fund

barR the expected return of the portfolio

RS the return of the portfolio in years b Solve the model developed in part a

If required, round your answers to two decimal places. If your answer is zero, enter

Portfolio Expected Return

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock