Question: Form 1 0 4 1 , U . S . Income Tax Return for Estates and Trusts Using the information below, complete a 2 0

Form US Income Tax Return for Estates and Trusts

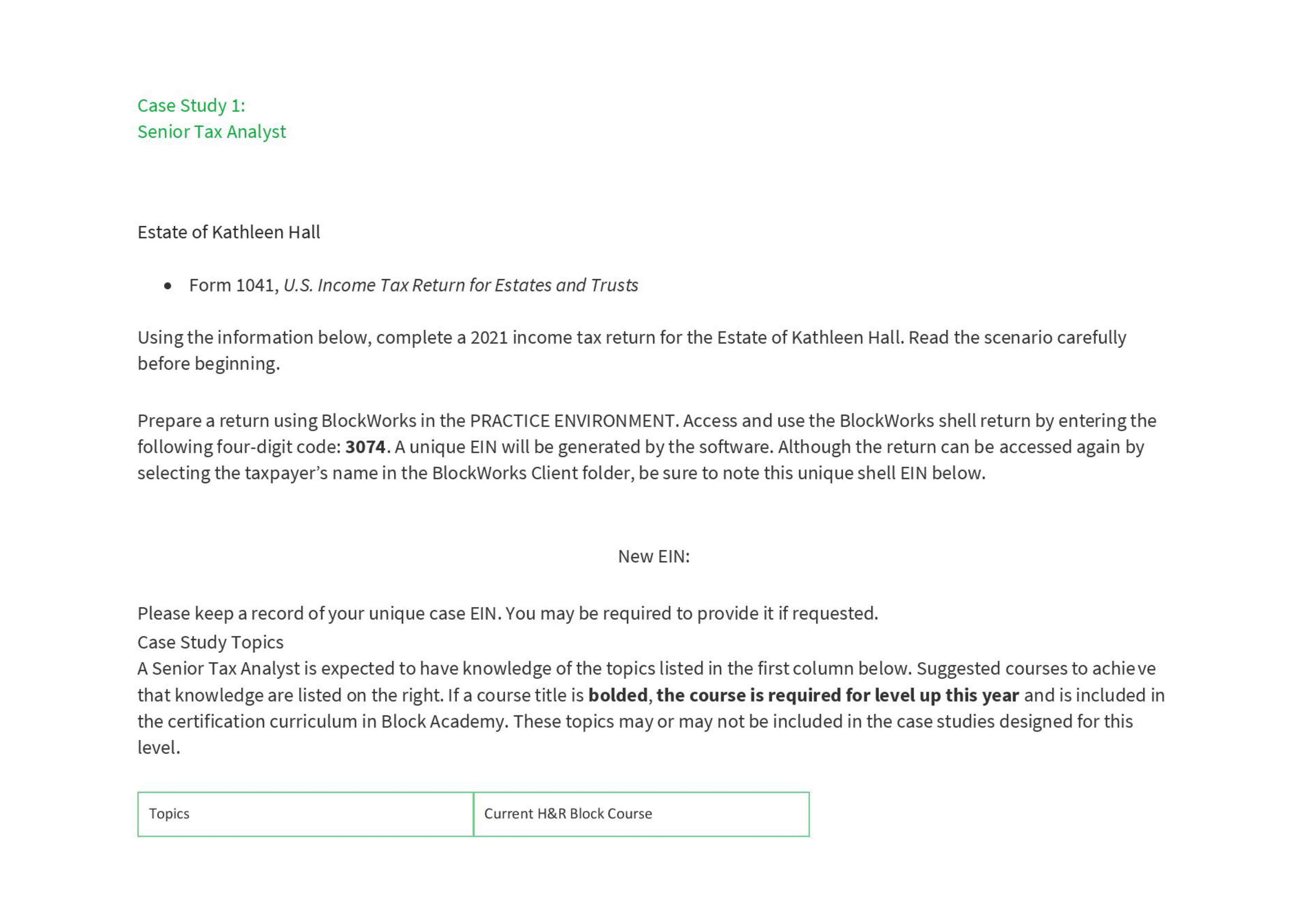

Using the information below, complete a income tax return for the Estate of Kathleen Hall. Read the scenario carefully

before beginning.

Prepare a return using BlockWorks in the PRACTICE ENVIRONMENT. Access and use the BlockWorks shell return by entering the

following fourdigit code: A unique EIN will be generated by the software. Although the return can be accessed again by

selecting the taxpayer's name in the BlockWorks Client folder, be sure to note this unique shell EIN below.

New EIN:

Please keep a record of your unique case EIN. You may be required to provide it if requested.

Case Study Topics

A Senior Tax Analyst is expected to have knowledge of the topics listed in the first column below. Suggested courses to achieve

that knowledge are listed on the right. If a course title is bolded, the course is required for level up this year and is included in

the certification curriculum in Block Academy. These topics may or may not be included in the case studies designed for this

level.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock