Question: Form 1 1 2 0 - S . ( Obj . 5 ) Prince Corporation ( EIN 7 0 - 2 1 5 2 9

Form SObj Prince Corporation EIN an S corporation, operates as a small variety store on the accrual basis. It is located at Governors Drive, College Station, TX The company was incorporated on January and elected S corporation status on the same day. The business code is John R Prince SSN and his wife, Joyce B Prince SSN each own of the corporation's outstanding shares. Joyce was an original shareholder. Her stock basis was $ at the beginning of the year. Together they manage the store. The remaining stock is owned by John's father. John is President; Joyce is VP and Treasurer.

At the end of the calendar year the income statement accounts, balance sheet accounts, and other information taken from the records are as follows.

tableInventory January at costInventory December at costPurchases netSales revenue,Sales returns and allowances,Taxable interest income,Tax exempt interest,Depreciation expense book depreciation was $Bad debts expense book bad debt expense was $Repairs and maintenance,Interest expense business relatedPayroll taxes,Compensation of officers,Salaries and wages,Rental of equipment,Charitable contributions,AdvertisingDistributions made during the year,Total assets, December

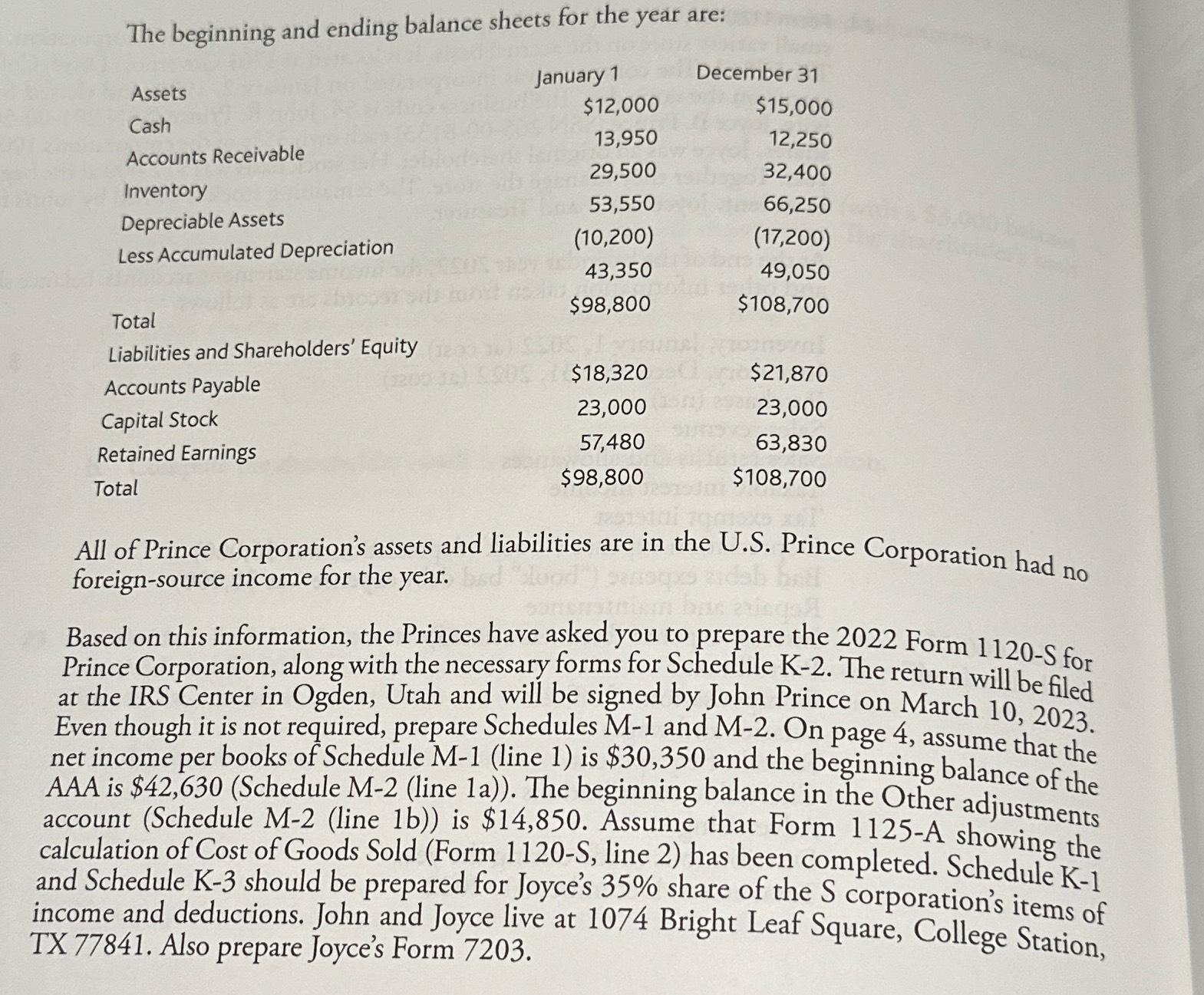

The beginning and ending balance sheets for the year are:

tableAssetsJanuary December Cash$$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock