Question: Format Painter BI U dox x Av.A. 1 Normal AUDUCUDU AdBbc 1 No Spac... Heading 1 Clipboard Turvuru yuvor your TV Font yurulur. Paragraph Present

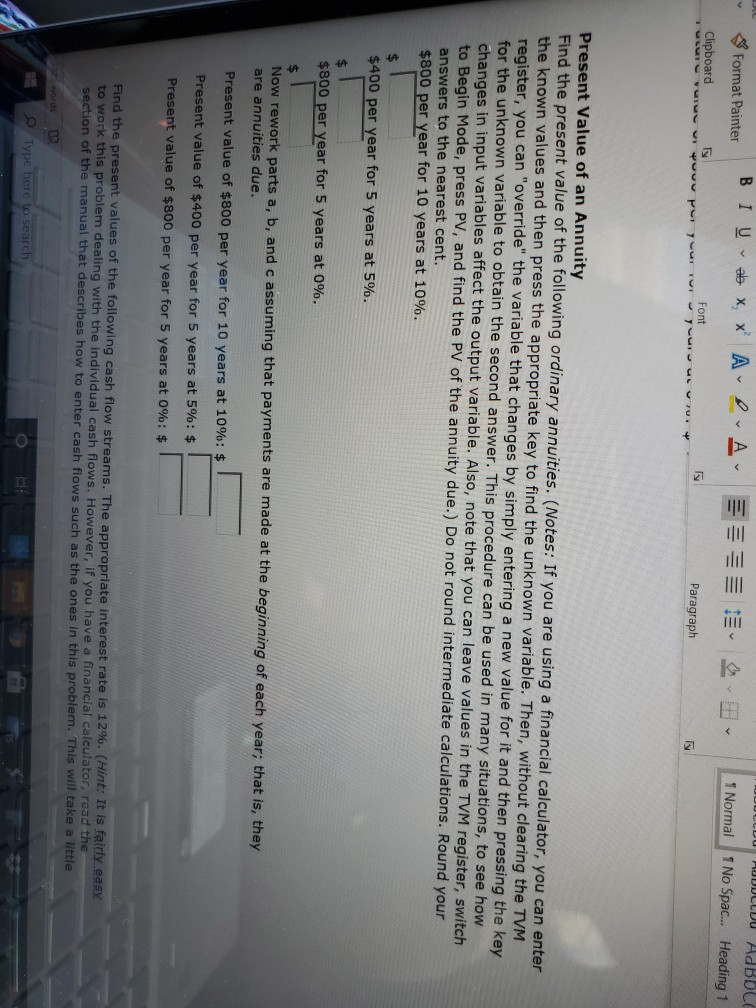

Format Painter BI U dox x Av.A. 1 Normal AUDUCUDU AdBbc 1 No Spac... Heading 1 Clipboard Turvuru yuvor your TV Font yurulur. Paragraph Present Value of an Annuity Find the present value of the following ordinary annuities. (Notes: If you are using a financial calculator, you can enter the known values and then press the appropriate key to find the unknown variable. Then, without clearing the TVM register, you can "override" the variable that changes by simply entering a new value for it and then pressing the key for the unknown variable to obtain the second answer. This procedure can be used in many situations, to see how changes in input variables affect the output variable. Also, note that you can leave values in the TVM ister, switch to Begin Mode, press PV, and find the PV of the annuity due.) Do not round intermediate calculations. Round your answers to the nearest cent. $800 per year for 10 years at 10%. $ $400 per year for 5 years at 5%. $ $800 per year for 5 years at 0%. $ Now rework parts a, b, and c assuming that payments are made at the beginning of each year, that is, they are annuities due. Present value of $800 per year for 10 years at 10%: $ Present value of $400 per year for 5 years at 5%: $ Present value of $800 per year for 5 years at 0%: $ Find the present values of the following cash flow streams. The appropriate interest rate is 12%. (Hint: It is fairly easy to work this problem dealing with the individual cash flows. However, if you have a financial calculator, read the section of the manual that describes how to enter cash flows such as the ones in this problem. This will take a little Type here to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts