Question: FORMATIVE ASSESSMENT 2 Question ONE and TWO are based on the information provided below for Mia Limited: INFORMATION In December 2 0 2 3 ,

FORMATIVE ASSESSMENT

Question ONE and TWO are based on the information provided below for Mia Limited:

INFORMATION

In December Mia Limited was planning its financial needs for the coming year. As a first indication, the firm's

management required a pro forma Statement of Financial Position as at December to gauge the financial needs at

that time. The financial condition as at December was reflected in this Statement of Financial Position:

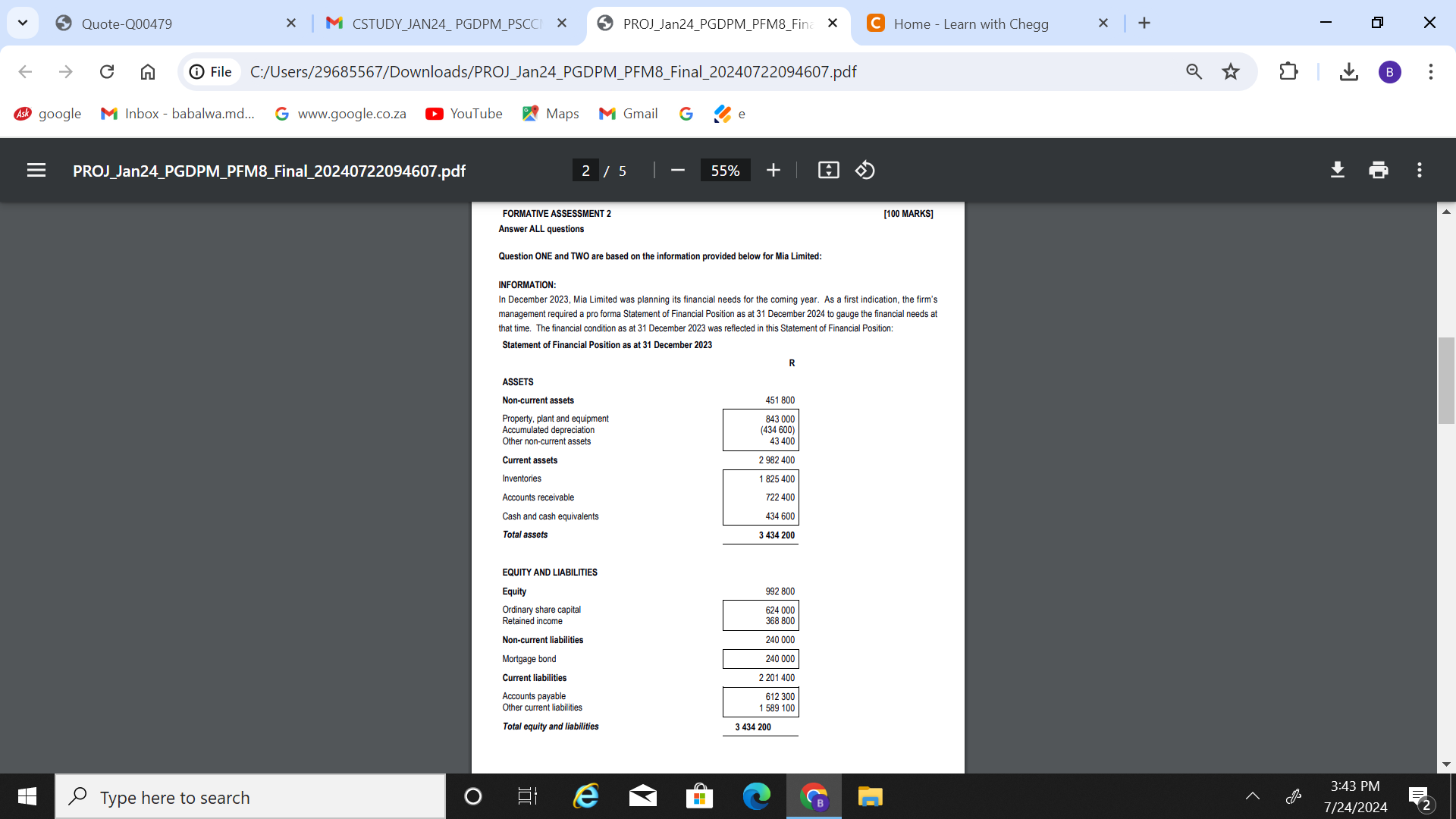

Statement of Financial Position as at December

ASSETS

Noncurrent assets

Property, plant and equipment

Accumulated depreciation

Other noncurrent assets

Current assets

Inventories

Accounts receivable

Cash and cash equivalents

Total assets

EQUITY AND LIABILITIES

Equity

Ordinary share capital

Retained income

Noncurrent liabilities

Mortgage bond

Current liabilities

Accounts payable

ADDITIONAL INFORMATION:

Operations for the following year were projected using the following working assumptions to plan the financial results:

Sales were forecast at R

Capital expenditures were scheduled at R for a delivery van and R for warehouse improvements.

Depreciation is expected to be R for the year.

Inventories, Accounts receivable and Accounts payable are estimated to be and of sales respectively.

Cash balances are desired to be no less than R

Net profit after tax is expected at a level of of sales.

Dividends for the year were estimated at R

A mortgage loan repayment of R is expected to be made.

Other current liabilities will be allowed to fluctuate with seasonal needs.

QUESTION ONE Marks

REQUIRED

Use the information provided to Prepare the pro forma Statement of Financial Position as at December

Discuss the purpose of projected financial statements in business planning and decisionmaking,

highlighting their significance for managerial decisionmaking, investor relations, and strategic

planning.

QUESTION TWO Marks

Using the information provided above, answer the following questions:

Calculate the following ratios for the year ending :

Current ratio

Debt to equity ratio

Inventory turnover ratio

Return on equity

Acid test ratio

Capital gearing ratio

Explain how the company's decision to maintain a cash balance of at least R affects its liquidity position.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock