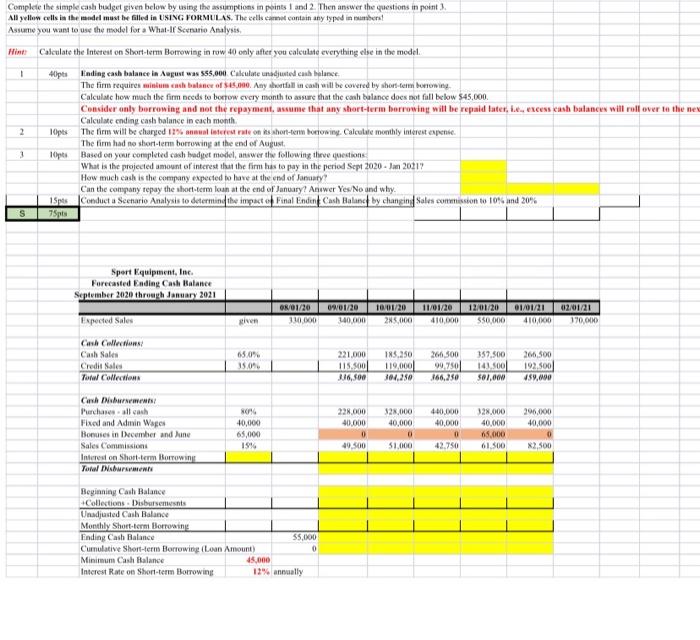

Question: formatting needed 1 Complete the simple cash budget given below by using the assumptions in points 1 and 2. Then answer the questions in point)

1 Complete the simple cash budget given below by using the assumptions in points 1 and 2. Then answer the questions in point) All yellow cells in the model must be filled in USING FORMULAS. The cel care contain any typed in numbers! Assume you want to use the model for a What If Scenario Analysis, Hind Calculate the Interest on Short-term Borrowing in row 40 only after your calculate everything else in the model Alipi Ending cash balance in August was $55,000 Calculate unadjusted cash balance The firm requires minum cache balance of $15.000. Any ball in cash will be covered by short-term burrowing Calculate how much the firm needs to borrow every month to assure that the cash balance does not full below 545,000 Consider only borrowing and not the repayment, assume that any short-term borrowing will be repaid later, ib. excess cash balances will roll over to the nex Calculate ending cash balance in each month, 10pt The firm will be charged 17% annullaterest rate on its short-term Borowing. Calculate monthly interest expense. The firm had no short-term borrowing at the end of August Opel Based on your completed cash budget model answer the following thieve questions What is the projected amount of interest that the firm has to pay in the period Sept 2020. Jan 2017 How much each is the company expected to have at the end of January Can the company repay the short-term loan at the end of January? Answer Yes/ No and why. 15ptsconduct a Scenario Analysis to determined the impact Final Endin Cash Boland by changing Sales commission to f0 and 20% 75pts 2 3 S Sport Equipment, Inc. Forecasted Ending Cash Balance September 2020 through January 2021 08/01/20 110.000 0901/20 340.000 10/01/20 285.000 11/01/20 110,000 12/01/20 550.000 01/01/21 410,000 02/01/21 170,000 Expected Sales given Cash Cwlwm Cash Sales Credit Sales Total Collezione 65.0% 35.0 221.000 115.500 16,500 185,250 119,000 304,250 2615,500 99.2501 166,250 357.500 141.500 507.000 266.500 192.500 459,000 440.000 40,000 296.000 40,000 Cash Dharm Purchases all cash Fixed and Admin Wages Bonuses in December and June Sales Commission Interest on Short term Borrowin Total Insurance 40,000 65,000 19% 228.000 40.000 0 49.500 $28.000 40,000 0 51,000 328,000 40,000 65,000 61.500 42.750 82,500 Beginning Cash Balance Collections Disbursements Unadjusted Cash Balance Monthly Short-term Borrowing Ending Cash Balance 55,000 Cumulative Short-term Borrowing (Loan Amount) 0 Minimum Cash Balance 45,000 Interest Rate on Short-term Borrowing 12% annually 1 Complete the simple cash budget given below by using the assumptions in points 1 and 2. Then answer the questions in point) All yellow cells in the model must be filled in USING FORMULAS. The cel care contain any typed in numbers! Assume you want to use the model for a What If Scenario Analysis, Hind Calculate the Interest on Short-term Borrowing in row 40 only after your calculate everything else in the model Alipi Ending cash balance in August was $55,000 Calculate unadjusted cash balance The firm requires minum cache balance of $15.000. Any ball in cash will be covered by short-term burrowing Calculate how much the firm needs to borrow every month to assure that the cash balance does not full below 545,000 Consider only borrowing and not the repayment, assume that any short-term borrowing will be repaid later, ib. excess cash balances will roll over to the nex Calculate ending cash balance in each month, 10pt The firm will be charged 17% annullaterest rate on its short-term Borowing. Calculate monthly interest expense. The firm had no short-term borrowing at the end of August Opel Based on your completed cash budget model answer the following thieve questions What is the projected amount of interest that the firm has to pay in the period Sept 2020. Jan 2017 How much each is the company expected to have at the end of January Can the company repay the short-term loan at the end of January? Answer Yes/ No and why. 15ptsconduct a Scenario Analysis to determined the impact Final Endin Cash Boland by changing Sales commission to f0 and 20% 75pts 2 3 S Sport Equipment, Inc. Forecasted Ending Cash Balance September 2020 through January 2021 08/01/20 110.000 0901/20 340.000 10/01/20 285.000 11/01/20 110,000 12/01/20 550.000 01/01/21 410,000 02/01/21 170,000 Expected Sales given Cash Cwlwm Cash Sales Credit Sales Total Collezione 65.0% 35.0 221.000 115.500 16,500 185,250 119,000 304,250 2615,500 99.2501 166,250 357.500 141.500 507.000 266.500 192.500 459,000 440.000 40,000 296.000 40,000 Cash Dharm Purchases all cash Fixed and Admin Wages Bonuses in December and June Sales Commission Interest on Short term Borrowin Total Insurance 40,000 65,000 19% 228.000 40.000 0 49.500 $28.000 40,000 0 51,000 328,000 40,000 65,000 61.500 42.750 82,500 Beginning Cash Balance Collections Disbursements Unadjusted Cash Balance Monthly Short-term Borrowing Ending Cash Balance 55,000 Cumulative Short-term Borrowing (Loan Amount) 0 Minimum Cash Balance 45,000 Interest Rate on Short-term Borrowing 12% annually

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts