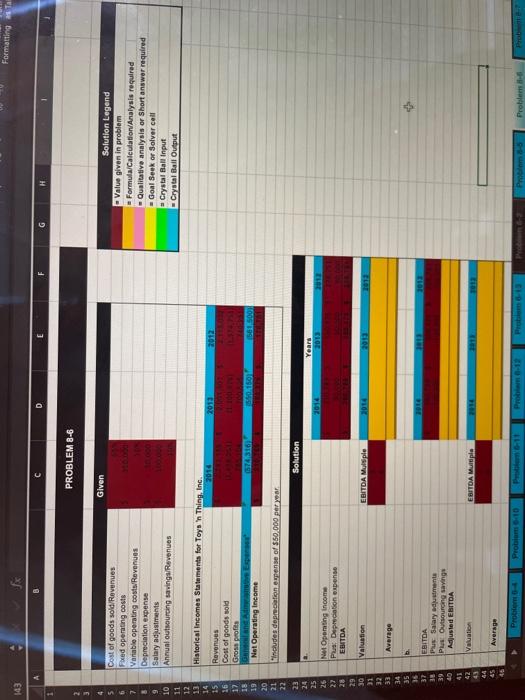

Question: Formatting Ta 143 B C D G H PROBLEM 8-6 Solution Legend - Value given in problem Formula/Calculation Analysis required - Qualitative analysis or Short

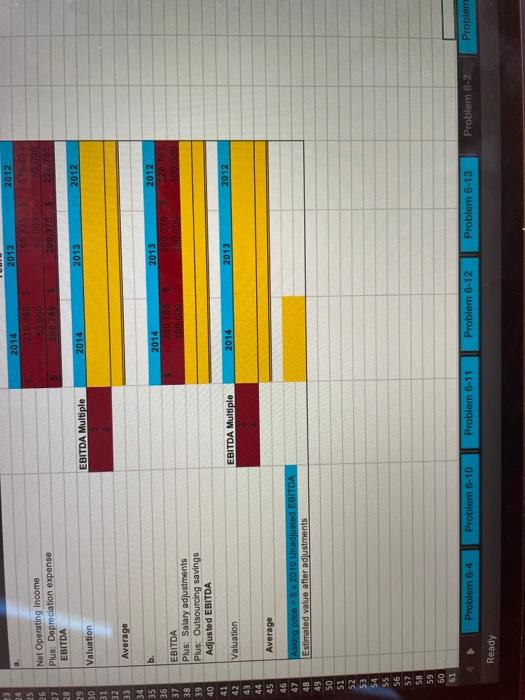

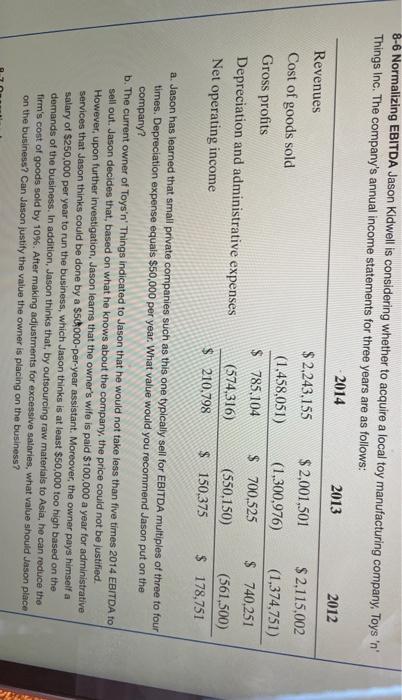

Formatting Ta 143 B C D G H PROBLEM 8-6 Solution Legend - Value given in problem Formula/Calculation Analysis required - Qualitative analysis or Short answer required Goal Seek or solver call - Crystal Ball Input - Crystal Ball Output 2013 2012 5650ON Given Cost of goods sold/Revenues 6 Pored operating costs 7 Variable operating costs Revenues Depreciation expense 9 Salary adjustments 10 Annual outsourcing savings/Revenues 11 12 13 Historical Incomes Statements for Toys 'n Thing, Inc. 14 2014 15 Revenues 16 Cost of goods sold 17 Groots 18 and All 19 Net Operating income 20 21 includes depreciation wense of 550.000 per year 22 23 Solution 24 25 25 Nel Operating income 22 PusDepreciation expense 28 EBITDA 29 30 Valuation EBITDA Multiple 31 32 33 Average 34 35 35 37 EBITDA 30 Plus Salary duwmente sy Ps Outsourcing saving 40 Adjusted EBITDA 41 42 Valuation EBITDA Mona Years 2014 2014 2013 2212 AS 12 Average Problem Probim 10 Prom-11 Problem 6.13 Problem 2014 2013 2012 2. Net Operating Income Plus: Depreciation expense EBITDA 700 2012 2013 2014 EBITDA Multiple Valuation Average b. 2013 2012 2014 . 100.000 00.000 EBITDA Plus: Salary adjustments Plus: Outsourcing savings Adjusted EBITDA 2014 EBITDA Multiple 2013 2012 Valuation 27 28 39 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 Average Ang price = 5 2010 Unadjusted EBITDA Estimated value after adjustments Problem 6-4 Problem 6-10 Problem 6-11 Problem 6-12 Problem 6-13 Problem 8-2 Problem Ready 8-6 Normalizing EBITDA Jason Kidwell is considering whether to acquire a local toy manufacturing company, Toys 'n' Things Inc. The company's annual income statements for three years are as follows: 2014 2013 2012 Revenues Cost of goods sold Gross profits Depreciation and administrative expenses Net operating income $ 2.243.155 (1.458,051) $ 785,104 (574,316) $ 210.798 $2,001,501 (1,300,976) $ 700.525 (550,150) $ 150,375 $ 2.115,002 (1,374,751) $ 740.251 (561,500) $ 178,751 a. Jason has learned that small private companies such as this one typically sell for EBITDA multiples of three to four times. Depreciation expense equals $50,000 per year. What value would you recommend Jason put on the company? b. The current owner of Toys'n' Things indicated to Jason that he would not take less than five times 2014 EBITDA to sell out. Jason decides that, based on what he knows about the company, the price could not be justified. However, upon further investigation, Jason learns that the owner's wife is paid $100.000 a year for administrative services that Jason thinks could be done by a $5000-per-year assistant. Moreover, the owner pays himself a salary of $250,000 per year to run the business, which Jason thinks is at least $50,000 too high based on the demands of the business. In addition, Jason thinks that, by outsourcing raw materials to Asia, he can reduce the firm's cost of goods sold by 10%. After making adjustments for excessive salaries, what value should Jason place on the business? Can Jason justify the value the owner is placing on the business? Formatting Ta 143 B C D G H PROBLEM 8-6 Solution Legend - Value given in problem Formula/Calculation Analysis required - Qualitative analysis or Short answer required Goal Seek or solver call - Crystal Ball Input - Crystal Ball Output 2013 2012 5650ON Given Cost of goods sold/Revenues 6 Pored operating costs 7 Variable operating costs Revenues Depreciation expense 9 Salary adjustments 10 Annual outsourcing savings/Revenues 11 12 13 Historical Incomes Statements for Toys 'n Thing, Inc. 14 2014 15 Revenues 16 Cost of goods sold 17 Groots 18 and All 19 Net Operating income 20 21 includes depreciation wense of 550.000 per year 22 23 Solution 24 25 25 Nel Operating income 22 PusDepreciation expense 28 EBITDA 29 30 Valuation EBITDA Multiple 31 32 33 Average 34 35 35 37 EBITDA 30 Plus Salary duwmente sy Ps Outsourcing saving 40 Adjusted EBITDA 41 42 Valuation EBITDA Mona Years 2014 2014 2013 2212 AS 12 Average Problem Probim 10 Prom-11 Problem 6.13 Problem 2014 2013 2012 2. Net Operating Income Plus: Depreciation expense EBITDA 700 2012 2013 2014 EBITDA Multiple Valuation Average b. 2013 2012 2014 . 100.000 00.000 EBITDA Plus: Salary adjustments Plus: Outsourcing savings Adjusted EBITDA 2014 EBITDA Multiple 2013 2012 Valuation 27 28 39 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 Average Ang price = 5 2010 Unadjusted EBITDA Estimated value after adjustments Problem 6-4 Problem 6-10 Problem 6-11 Problem 6-12 Problem 6-13 Problem 8-2 Problem Ready 8-6 Normalizing EBITDA Jason Kidwell is considering whether to acquire a local toy manufacturing company, Toys 'n' Things Inc. The company's annual income statements for three years are as follows: 2014 2013 2012 Revenues Cost of goods sold Gross profits Depreciation and administrative expenses Net operating income $ 2.243.155 (1.458,051) $ 785,104 (574,316) $ 210.798 $2,001,501 (1,300,976) $ 700.525 (550,150) $ 150,375 $ 2.115,002 (1,374,751) $ 740.251 (561,500) $ 178,751 a. Jason has learned that small private companies such as this one typically sell for EBITDA multiples of three to four times. Depreciation expense equals $50,000 per year. What value would you recommend Jason put on the company? b. The current owner of Toys'n' Things indicated to Jason that he would not take less than five times 2014 EBITDA to sell out. Jason decides that, based on what he knows about the company, the price could not be justified. However, upon further investigation, Jason learns that the owner's wife is paid $100.000 a year for administrative services that Jason thinks could be done by a $5000-per-year assistant. Moreover, the owner pays himself a salary of $250,000 per year to run the business, which Jason thinks is at least $50,000 too high based on the demands of the business. In addition, Jason thinks that, by outsourcing raw materials to Asia, he can reduce the firm's cost of goods sold by 10%. After making adjustments for excessive salaries, what value should Jason place on the business? Can Jason justify the value the owner is placing on the business

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts