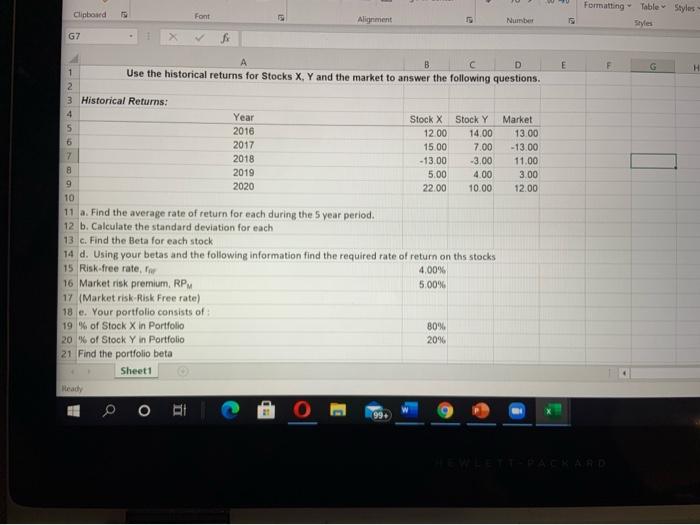

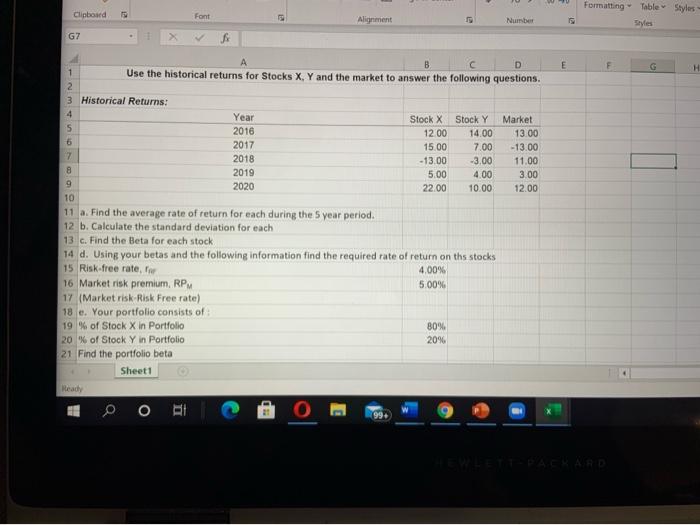

Question: Formatting Table Styles Clipboard Font Alignment Number Styles G7 A F G . 1 Use the historical returns for Stocks X, Y and the market

Formatting Table Styles Clipboard Font Alignment Number Styles G7 A F G . 1 Use the historical returns for Stocks X, Y and the market to answer the following questions. 2 3 Historical Returns: 4 Year Stock X Stock Y Market 5 2016 1200 14.00 13.00 6 2017 15.00 7.00 - 13.00 7 2018 -13.00 -3.00 11.00 8 2019 5.00 4.00 3.00 9 2020 22.00 10.00 12.00 10 11 a. Find the average rate of return for each during the 5 year period. 12 b. Calculate the standard deviation for each 13 c. Find the Beta for each stock 14 d. Using your betas and the following information find the required rate of return on ths stocks 15 Risk-free rate, 4.00% 16 Market risk premium, RPM 5.00% 17 (Market risk Risk Free rate) 18 e. Your portfolio consists of 19 % of Stock X in Portfolio 80% 20 % of Stock Y in Portfolio 20% 21 Find the portfolio beta Sheet1 Reachy Formatting Table Styles Clipboard Font Alignment Number Styles G7 A F G . 1 Use the historical returns for Stocks X, Y and the market to answer the following questions. 2 3 Historical Returns: 4 Year Stock X Stock Y Market 5 2016 1200 14.00 13.00 6 2017 15.00 7.00 - 13.00 7 2018 -13.00 -3.00 11.00 8 2019 5.00 4.00 3.00 9 2020 22.00 10.00 12.00 10 11 a. Find the average rate of return for each during the 5 year period. 12 b. Calculate the standard deviation for each 13 c. Find the Beta for each stock 14 d. Using your betas and the following information find the required rate of return on ths stocks 15 Risk-free rate, 4.00% 16 Market risk premium, RPM 5.00% 17 (Market risk Risk Free rate) 18 e. Your portfolio consists of 19 % of Stock X in Portfolio 80% 20 % of Stock Y in Portfolio 20% 21 Find the portfolio beta Sheet1 Reachy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts