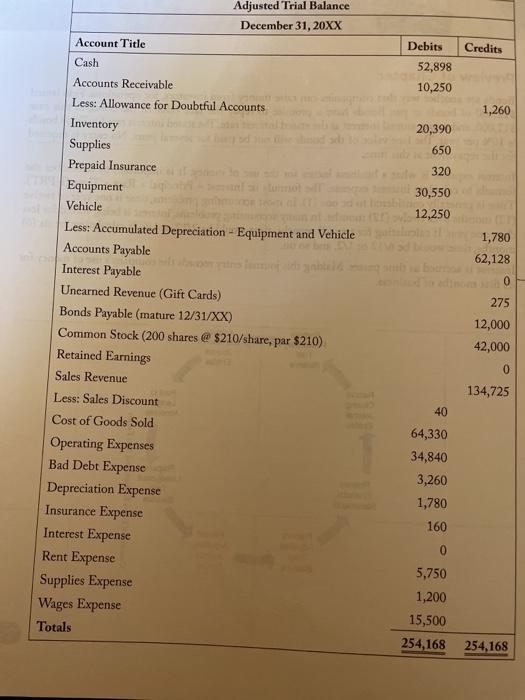

Question: formula: interest = principal x rate x time please make clear , thanks you Adjusted Trial Balance December 31, 20XX Account Title Debits Credits 52,898

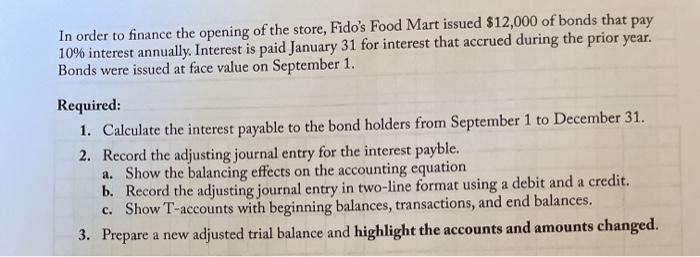

Adjusted Trial Balance December 31, 20XX Account Title Debits Credits 52,898 10,250 1,260 20,390 650 320 30,550 12,250 1,780 62,128 0 275 Cash Accounts Receivable Less: Allowance for Doubtful Accounts Inventory Supplies Prepaid Insurance Equipment Vehicle Less: Accumulated Depreciation - Equipment and Vehicle Accounts Payable Interest Payable Unearned Revenue (Gift Cards) Bonds Payable (mature 12/31/XX) Common Stock (200 shares @ $210/share, par $210) Retained Earnings Sales Revenue Less: Sales Discount Cost of Goods Sold Operating Expenses Bad Debt Expense Depreciation Expense Insurance Expense Interest Expense Rent Expense Supplies Expense Wages Expense Totals 12,000 42,000 0 134,725 40 64,330 34,840 3,260 1,780 160 0 5,750 1,200 15,500 254,168 254.168 In order to finance the opening of the store, Fido's Food Mart issued $12,000 of bonds that pay 10% interest annually. Interest is paid January 31 for interest that accrued during the prior year. Bonds were issued at face value on September 1. Required: 1. Calculate the interest payable to the bond holders from September 1 to December 31. 2. Record the adjusting journal entry for the interest payble. a. Show the balancing effects on the accounting equation b. Record the adjusting journal entry in two-line format using a debit and a credit. c. Show T-accounts with beginning balances, transactions, and end balances. 3. Prepare a new adjusted trial balance and highlight the accounts and amounts changed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts