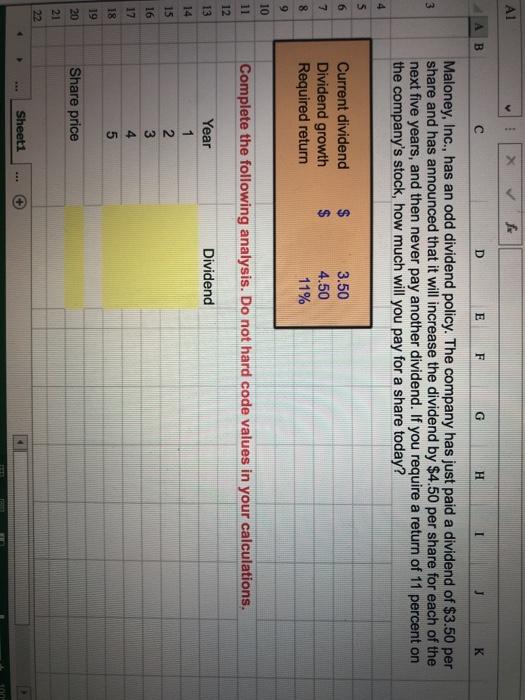

Question: formulas A1 X A B D E F G H I J K 3 Maloney, Inc., has an odd dividend policy. The company has just

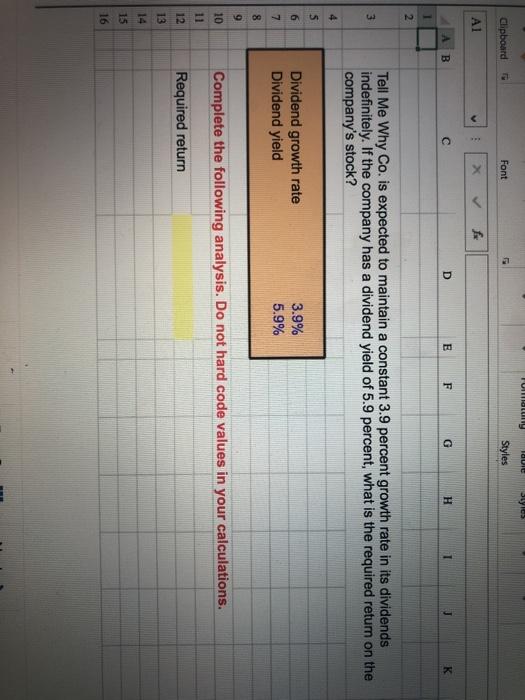

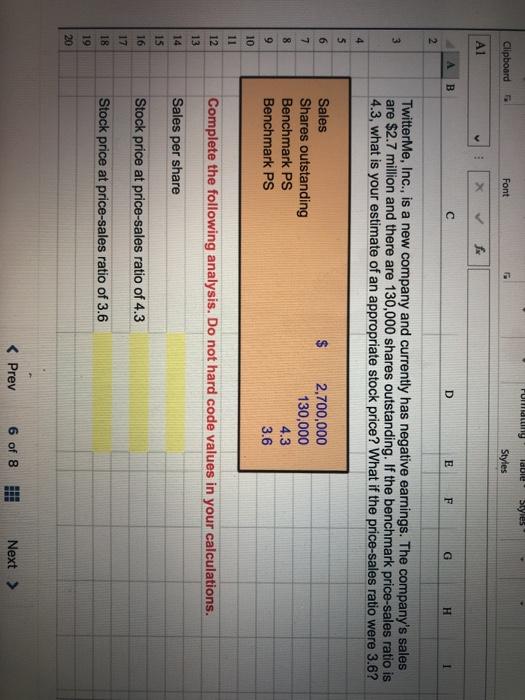

A1 X A B D E F G H I J K 3 Maloney, Inc., has an odd dividend policy. The company has just paid a dividend of $3.50 per share and has announced that it will increase the dividend by $4.50 per share for each of the next five years, and then never pay another dividend. If you require a return of 11 percent on the company's stock, how much will you pay for a share today? 4 5 6 7 Current dividend Dividend growth Required return $ $ 3.50 4.50 11% 8 9 10 11 12 Complete the following analysis. Do not hard code values in your calculations. Dividend 13 14 15 Year 1 16 AN 17 5 18 19 20 Share price 21 22 Sheet1 TUOLIT TOUIL SLYIS Clipboard Font Styles AL A B D E F G H T J 2 Tell Me Why Co. is expected to maintain a constant 3.9 percent growth rate in its dividends indefinitely. If the company has a dividend yield of 5.9 percent, what is the required return on the company's stock? 4 5 6 Dividend growth rate Dividend yield 3.9% 5.9% 7 OG 9 10 Complete the following analysis. Do not hard code values in your calculations. 11 12 Required return 13 14 15 16 FUM Idbie Styles Clipboard Font Styles Al X A B D E F G H 2 3 Twitter Me, Inc., is a new company and currently has negative earnings. The company's sales are $2.7 million and there are 130,000 shares outstanding. If the benchmark price-sales ratio is 4.3, what is your estimate of an appropriate stock price? What if the price-sales ratio were 3.6? 4 no $ 7 8 Sales Shares outstanding Benchmark PS Benchmark PS 2,700,000 130,000 4.3 3.6 9 10 11 12 Complete the following analysis. Do not hard code values in your calculations. 13 14 Sales per share 15 16 Stock price at price-sales ratio of 4.3 17 18 19 Stock price at price-sales ratio of 3.6 20 A1 X A B D E F G H I J K 3 Maloney, Inc., has an odd dividend policy. The company has just paid a dividend of $3.50 per share and has announced that it will increase the dividend by $4.50 per share for each of the next five years, and then never pay another dividend. If you require a return of 11 percent on the company's stock, how much will you pay for a share today? 4 5 6 7 Current dividend Dividend growth Required return $ $ 3.50 4.50 11% 8 9 10 11 12 Complete the following analysis. Do not hard code values in your calculations. Dividend 13 14 15 Year 1 16 AN 17 5 18 19 20 Share price 21 22 Sheet1 TUOLIT TOUIL SLYIS Clipboard Font Styles AL A B D E F G H T J 2 Tell Me Why Co. is expected to maintain a constant 3.9 percent growth rate in its dividends indefinitely. If the company has a dividend yield of 5.9 percent, what is the required return on the company's stock? 4 5 6 Dividend growth rate Dividend yield 3.9% 5.9% 7 OG 9 10 Complete the following analysis. Do not hard code values in your calculations. 11 12 Required return 13 14 15 16 FUM Idbie Styles Clipboard Font Styles Al X A B D E F G H 2 3 Twitter Me, Inc., is a new company and currently has negative earnings. The company's sales are $2.7 million and there are 130,000 shares outstanding. If the benchmark price-sales ratio is 4.3, what is your estimate of an appropriate stock price? What if the price-sales ratio were 3.6? 4 no $ 7 8 Sales Shares outstanding Benchmark PS Benchmark PS 2,700,000 130,000 4.3 3.6 9 10 11 12 Complete the following analysis. Do not hard code values in your calculations. 13 14 Sales per share 15 16 Stock price at price-sales ratio of 4.3 17 18 19 Stock price at price-sales ratio of 3.6 20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts