Question: Formulas Data Review View Help * Cut Be Copy Peste Format Painter Calibri 11 A A A 2 Wrap Te BIU FB E Merge Clipboard

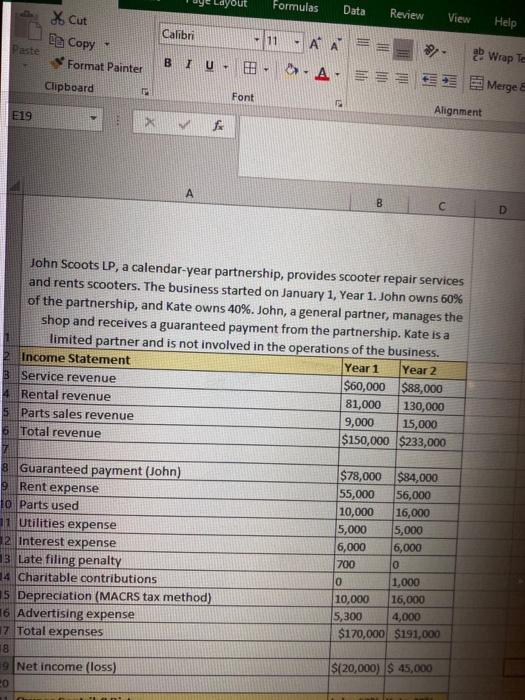

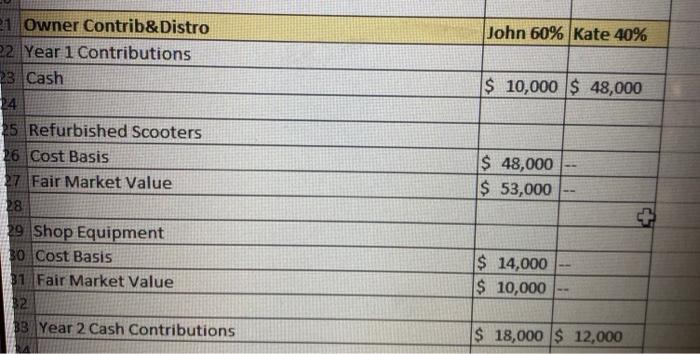

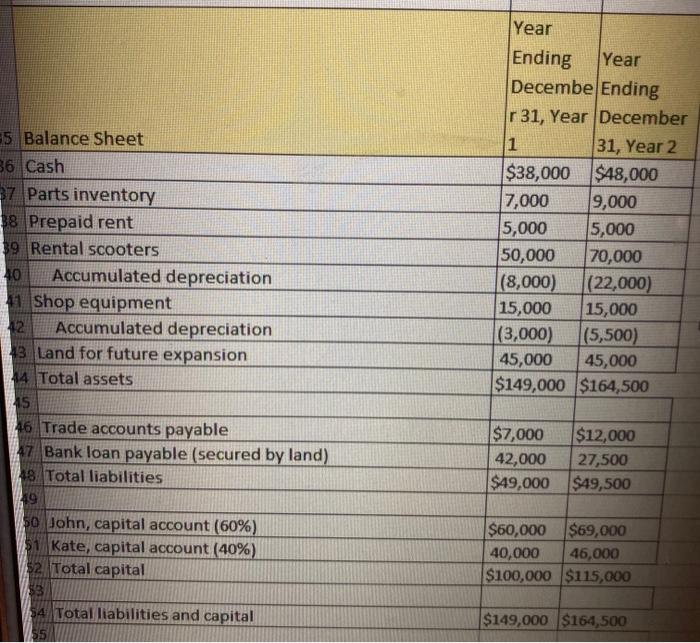

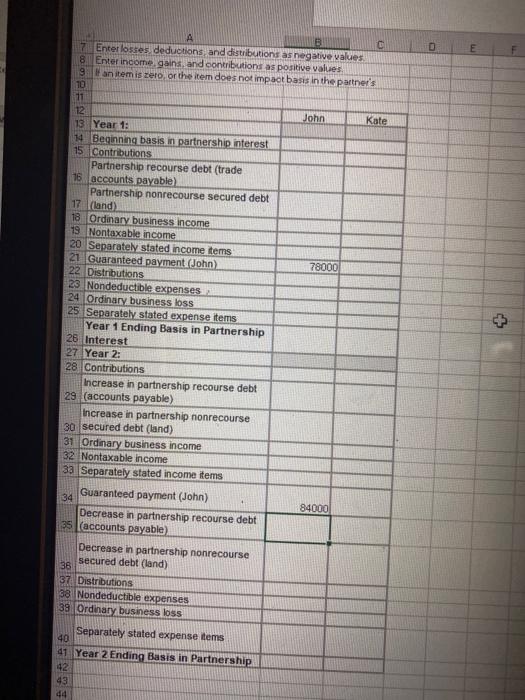

Formulas Data Review View Help * Cut Be Copy Peste Format Painter Calibri 11 A A A 2 Wrap Te BIU FB E Merge Clipboard Font F119 Alignment A B D John Scoots LP, a calendar-year partnership, provides scooter repair services and rents scooters. The business started on January 1, Year 1. John owns 60% of the partnership, and Kate owns 40%. John, a general partner, manages the shop and receives a guaranteed payment from the partnership. Kate is a limited partner and is not involved in the operations of the business. 2 Income Statement Year 1 Year 2 3 Service revenue $60,000 $88,000 Rental revenue 81,000 130,000 Parts sales revenue 9,000 15,000 6 Total revenue $150,000 $233,000 5 8. Guaranteed payment (John) 9 Rent expense 1o Parts used 11 Utilities expense 2 Interest expense 13 Late filing penalty 14 Charitable contributions 15 Depreciation (MACRS tax method) 16 Advertising expense 17 Total expenses 18 9 Net income (loss) O $78,000 $84,000 55,000 56,000 10,000 16,000 5,000 5,000 6,000 6,000 700 0 10 1,000 10,000 16,000 15,300 4,000 $170,000 $191,000 $120,000) $ 45,000 ni John 60% Kate 40% $ 10,000 $ 48,000 1 Owner Contrib&Distro 22 Year 1 Contributions 23 Cash 24 25 Refurbished Scooters 26 Cost Basis 27 Fair Market Value 28 229 Shop Equipment 130 Cost Basis 31 Fair Market Value 32 33 Year 2 Cash Contributions $ 48,000 $ 53,000 $ 14,000 $ 10,000 $ 18,000 $ 12,000 5 Balance Sheet 36 Cash 37 Parts inventory 38 Prepaid rent 39 Rental scooters 40 Accumulated depreciation 1 Shop equipment 42 Accumulated depreciation 43 Land for future expansion 44 Total assets 15 46 Trade accounts payable 47 Bank loan payable (secured by land) 48. Total liabilities 249 so John, capital account (60%) $1 Kate, capital account (40%) $2 Total capital Year Ending Year Decembe Ending r 31, Year December 1 31, Year 2 $38,000 $48,000 7,000 9,000 5,000 5,000 50,000 70,000 (8,000) (22,000) 15,000 15,000 (3,000) (5,500) 45,000 45,000 $149,000 $164,500 $7,000 $12,000 42,000 27,500 $49,000 $49,500 $60,000 $69,000 40,000 46,000 $100,000 $115,000 34 Total liabilities and capital $5 $149,000 $164,500 E A B 7 Enteresses deductions and distributions as negative values 8 Enter income gains, and contributions as positive values 9 an item is zero, or the item does not impact basis in the partner's TO 11 12 John Kate 13 Year 1: 14 Beginning basis in partnership interest 15 Contributions Partnership recourse debt (trade 16 accounts payable Partnership nonrecourse secured debt 17 (Land) 18 Ordinary business income 19 Nontaxable income 20 Separately stated income tems 21 Guaranteed payment (John) 78000 22 Distributions 23 Nondeductible expenses 24 Ordinary business loss 25 Separately stated expense items Year 1 Ending Basis in Partnership 26 Interest 27 Year 2: 28 Contributions Increase in partnership recourse debt 29 (accounts payable) Increase in partnership nonrecourse 30 secured debt (land) 31 Ordinary business income 32 Nontaxable income 33 Separately stated income items Guaranteed payment (John) 34 84000 Decrease in partnership recourse debt 35 accounts payable) Decrease in partnership nonrecourse secured debt (land) 38 37 Distributions 38 Nondeductible expenses 39 Ordinary business loss Separately stated expense items 40 41 Year 2 Ending Basis in Partnership 42 43 44 Formulas Data Review View Help * Cut Be Copy Peste Format Painter Calibri 11 A A A 2 Wrap Te BIU FB E Merge Clipboard Font F119 Alignment A B D John Scoots LP, a calendar-year partnership, provides scooter repair services and rents scooters. The business started on January 1, Year 1. John owns 60% of the partnership, and Kate owns 40%. John, a general partner, manages the shop and receives a guaranteed payment from the partnership. Kate is a limited partner and is not involved in the operations of the business. 2 Income Statement Year 1 Year 2 3 Service revenue $60,000 $88,000 Rental revenue 81,000 130,000 Parts sales revenue 9,000 15,000 6 Total revenue $150,000 $233,000 5 8. Guaranteed payment (John) 9 Rent expense 1o Parts used 11 Utilities expense 2 Interest expense 13 Late filing penalty 14 Charitable contributions 15 Depreciation (MACRS tax method) 16 Advertising expense 17 Total expenses 18 9 Net income (loss) O $78,000 $84,000 55,000 56,000 10,000 16,000 5,000 5,000 6,000 6,000 700 0 10 1,000 10,000 16,000 15,300 4,000 $170,000 $191,000 $120,000) $ 45,000 ni John 60% Kate 40% $ 10,000 $ 48,000 1 Owner Contrib&Distro 22 Year 1 Contributions 23 Cash 24 25 Refurbished Scooters 26 Cost Basis 27 Fair Market Value 28 229 Shop Equipment 130 Cost Basis 31 Fair Market Value 32 33 Year 2 Cash Contributions $ 48,000 $ 53,000 $ 14,000 $ 10,000 $ 18,000 $ 12,000 5 Balance Sheet 36 Cash 37 Parts inventory 38 Prepaid rent 39 Rental scooters 40 Accumulated depreciation 1 Shop equipment 42 Accumulated depreciation 43 Land for future expansion 44 Total assets 15 46 Trade accounts payable 47 Bank loan payable (secured by land) 48. Total liabilities 249 so John, capital account (60%) $1 Kate, capital account (40%) $2 Total capital Year Ending Year Decembe Ending r 31, Year December 1 31, Year 2 $38,000 $48,000 7,000 9,000 5,000 5,000 50,000 70,000 (8,000) (22,000) 15,000 15,000 (3,000) (5,500) 45,000 45,000 $149,000 $164,500 $7,000 $12,000 42,000 27,500 $49,000 $49,500 $60,000 $69,000 40,000 46,000 $100,000 $115,000 34 Total liabilities and capital $5 $149,000 $164,500 E A B 7 Enteresses deductions and distributions as negative values 8 Enter income gains, and contributions as positive values 9 an item is zero, or the item does not impact basis in the partner's TO 11 12 John Kate 13 Year 1: 14 Beginning basis in partnership interest 15 Contributions Partnership recourse debt (trade 16 accounts payable Partnership nonrecourse secured debt 17 (Land) 18 Ordinary business income 19 Nontaxable income 20 Separately stated income tems 21 Guaranteed payment (John) 78000 22 Distributions 23 Nondeductible expenses 24 Ordinary business loss 25 Separately stated expense items Year 1 Ending Basis in Partnership 26 Interest 27 Year 2: 28 Contributions Increase in partnership recourse debt 29 (accounts payable) Increase in partnership nonrecourse 30 secured debt (land) 31 Ordinary business income 32 Nontaxable income 33 Separately stated income items Guaranteed payment (John) 34 84000 Decrease in partnership recourse debt 35 accounts payable) Decrease in partnership nonrecourse secured debt (land) 38 37 Distributions 38 Nondeductible expenses 39 Ordinary business loss Separately stated expense items 40 41 Year 2 Ending Basis in Partnership 42 43 44

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts