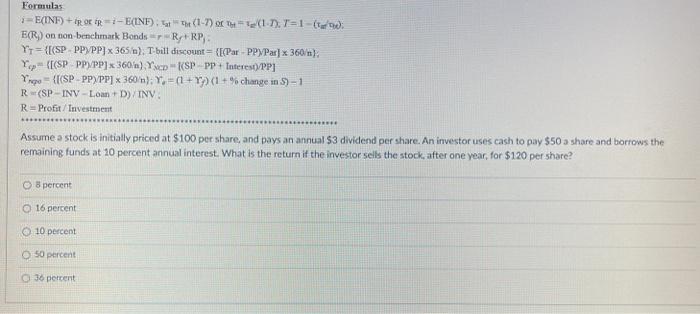

Question: Formulas -E(INF) + Rot-E(INF): at the (1-7) (1.1). T=1 E(R) on non benchmark Bonds - RRP Yr={[(SP PP/PP] x 365 m). T-bill discount = ((Par

Formulas -E(INF) + Rot-E(INF): at the (1-7) (1.1). T=1 E(R) on non benchmark Bonds - RRP Yr={[(SP PP/PP] x 365 m). T-bill discount = ((Par PP/Par] x 360m): Yep CSP PP/PP] x 360) Yep (SP PP+ Interest/PP] Yrpo {{CSP PP/PP] * 360n): Y = (1 + Y) (1 + % change in S) 1 R(SP-INV - Loan D) INV. R=Profit/ Investment Assume a stock is initially priced at $100 per share, and pays an annual S3 dividend per share. An investor uses cash to pay $50 a share and borrows the remaining funds at 10 percent annual interest. What is the return it the investor sells the stock, after one year, for $120 per share? 8 percent 16 percent percent 50 percent 36 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts