Question: formula's given Moving to another question will save this response. Question 6 You are given the information below to answer questions that follow: a. Jones

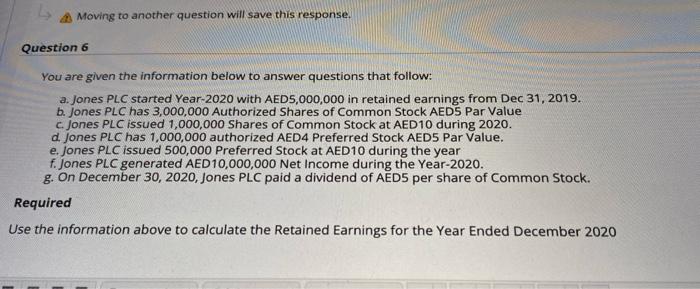

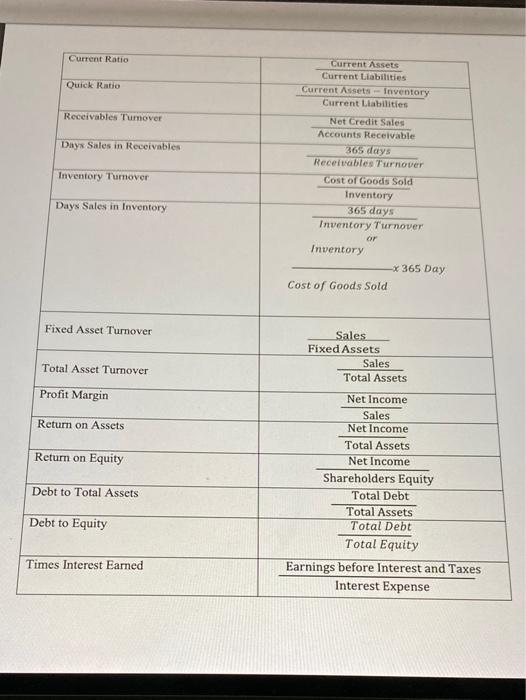

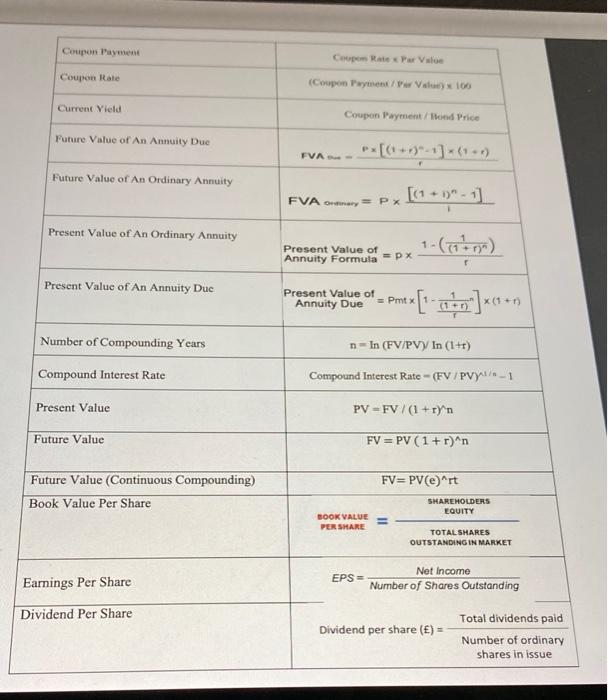

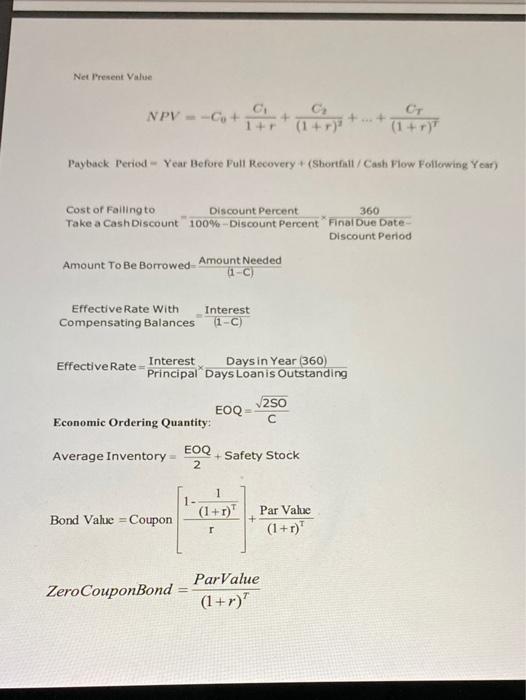

Moving to another question will save this response. Question 6 You are given the information below to answer questions that follow: a. Jones PLC started Year-2020 with AED5,000,000 in retained earnings from Dec 31, 2019. b. Jones PLC has 3,000,000 Authorized Shares of Common Stock AED5 Par Value Jones PLC issued 1,000,000 Shares of Common Stock at AED10 during 2020. d Jones PLC has 1,000,000 authorized AED4 Preferred Stock AED5 Par Value. e. Jones PLC issued 500,000 Preferred Stock at AED10 during the year f. Jones PLC generated AED10,000,000 Net Income during the Year-2020. g. On December 30, 2020, Jones PLC paid a dividend of AED5 per share of Common Stock. Required Use the information above to calculate the Retained Earnings for the Year Ended December 2020 Current Ratio Quick Ratio Receivables Tumover Days Sales in Receivables Current Assets Current Liabilities Current Assets - Inventory Current Liabilities Net Credit Sales Accounts Receivable 365 days Recetables Turnover Cost of Goods Sold Inventory 365 days Inventory Turnover Inventory Turnover Days Sales in Inventory OF Inventory X 365 Day Cost of Goods Sold Fixed Asset Turnover Sales Fixed Assets Sales Total Assets Total Asset Turnover Profit Margin Net Income Return on Assets Sales Net Income Total Assets Return on Equity Net Income Debt to Total Assets Debt to Equity Shareholders Equity Total Debt Total Assets Total Debt Total Equity Earnings before Interest and Taxes Interest Expense Times Interest Eamed Coupon Payment Coupon Rate Per Value Coupon Rate Coupon Payment/Per Vs 100 Current Yield Coupon Payment/ond Price Future Value of An Annuity Due FVA - Future Value of An Ordinary Annuity FVA Omary = Px Present Value of An Ordinary Annuity Present Value of Annuity Formula = px Present Value of An Annuity Due Present Value of Annuity Due Pmtx x(1+) Number of Compounding Years n-in (FV/PV) In (1+r) Compound Interest Rate Compound Interest Rate - (FV/PVR - 1 Present Value PV - FV /(1+rY n Future Value FV = PV (1+r)^n FV=PVe)`rt Future Value (Continuous Compounding) Book Value Per Share SHAREHOLDERS EQUITY BOOK VALUE PER SHARE TOTAL SHARES OUTSTANDING IN MARKET Net Income EPS Earnings Per Share Number of Shares Outstanding Dividend Per Share Total dividends paid Dividend per share (E) = Number of ordinary shares in issue Net Present Valve Cr NPV - + (1+r) Payback Period Year Before Pull Recovery (Shortfatt/Cash Flow Following Year) 360 Cost of Falling to Discount Percent Take a Cash Discount 100%-Discount Percent Final Due Date Discount Period Amount To Be Borrowed Amount Needed 11-C) Effective Rate With Interest Compensating Balances (1-C) Interest Effective Rate Days in Year 360) Principal Days Loanis Outstanding EOQ Economic Ordering Quantity: 250 Average Inventory EOQ + Safety Stock 2 1 1- (1+1) Bond Vahe = Coupon Par Vale + (1+r)" r Zero CouponBond ParValue (1+r)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts