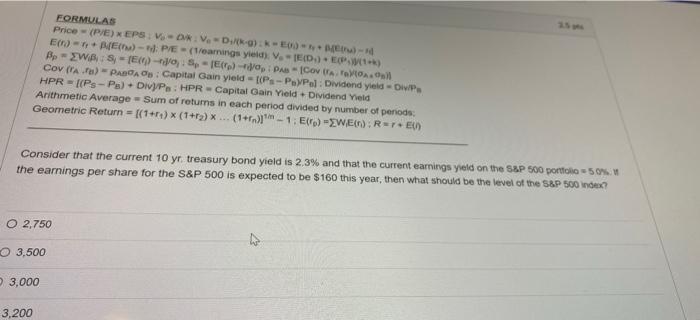

Question: FORMULAS Price - (P/E) EPS: VOR. V-D/-) KED) E() + E) - PE - (/earings yield): V. TED) EP.1) Bp - EWS - (E) -SE)

FORMULAS Price - (P/E) EPS: VOR. V-D/-) KED) E() + E) - PE - (/earings yield): V. TED) EP.1) Bp - EWS - (E) -SE) - De 1 Covall Cov ( ra) - PAROA: Capital Gain yield - Ps-PayPal : Dividend yield - DIP HPR (Ps-Pa) - DivPs: HPR - Capital Gain Yield Dividend Yield Arithmetic Average Sum of returns in each period divided by number of periods Geometric Return = ((1+r) X (1+)... (1+r)]* - 1. EI) -WE); RETE Consider that the current 10 yr treasury bond yield is 2.3% and that the current earnings yield on the S&P 500 portfolio -50% the earnings per share for the S&P 500 is expected to be $160 this year, then what should be the level of the S&P 500 index O 2,750 O 3.500 3,000 3,200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts