Question: Formulate a simple financial plan for your clients, Larry & Margie. Address their concerns and recommend suitable strategies that will meet their needs. Make appropriate

Formulate a simple financial plan for your clients, Larry & Margie. Address their concerns and recommend suitable strategies that will meet their needs. Make appropriate assumptions if necessary and address your concerns or limitations, if any. Use point form to highlight your recommended strategies and give a brief summary at the end.

Circumstances

Larry is now 53 and has worked for the same company for 32 years. He never thought he could retire before age 62. He and his wife, Margie, would like to retire early so they can enjoy their hobbies and spend time with their grandchildren.

Since most of their net worth is in the private stock of Larrys company, they do not have much experience investing money and generating income from their investments.

They have many financial goals at the moment:

-

- They want to know if they can retire at age 55.

-

- They want to know the benefits of working to age 57 when they get 100% of their medical

benefits paid by the company.

-

- They want to know if they should diversify Larrys company stock.

-

- They want to know where their income will come from at retirement.

-

- They want to be sure they dont have to ever go back to work, because they are already financially secure.

-

- They want to set up a trust for their grandchildren to pay for their future education when they both pass away.

The Numbers

Larry earns HKD800,000 per year and would like to retire at age 55. He would like to replace 100% of his income at retirement (i.e. continue to maintain the same income after retirement) but would like to spend some money right away on a new car and take several trips with Margie.

If Larry works until age 57, his company will cover 100% of the cost of health insurance for both Larry and Margie.

Margies mother is currently in poor health and Margie is concerned about needing to get some help taking care of her.

Larry will receive $8000 in pension every month from his company after he retires.

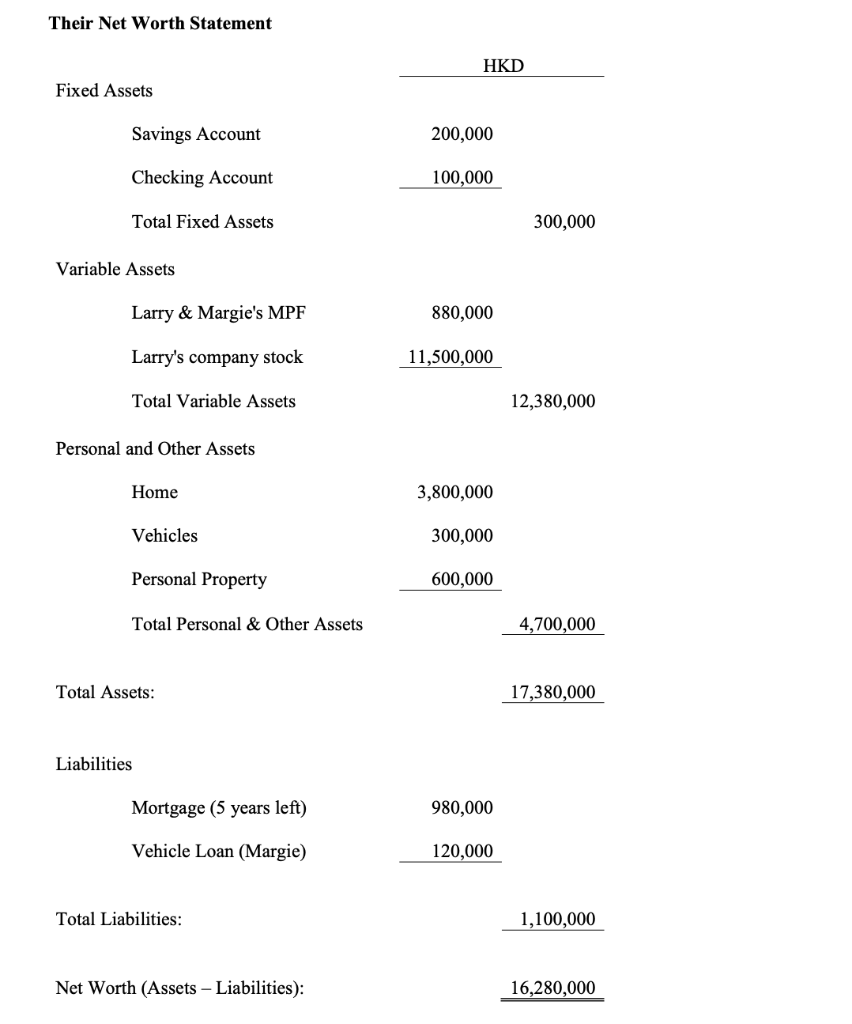

Their Net Worth Statement HKD Fixed Assets Savings Account 200,000 Checking Account 100,000 Total Fixed Assets 300,000 Variable Assets Larry & Margie's MPF 880,000 Larry's company stock 11,500,000 Total Variable Assets 12,380,000 Personal and Other Assets Home 3,800,000 Vehicles 300,000 Personal Property 600,000 Total Personal & Other Assets 4,700,000 Total Assets: 17,380,000 Liabilities Mortgage (5 years left) 980,000 Vehicle Loan (Margie) 120,000 Total Liabilities: 1,100,000 Net Worth (Assets - Liabilities): 16,280,000 Their Net Worth Statement HKD Fixed Assets Savings Account 200,000 Checking Account 100,000 Total Fixed Assets 300,000 Variable Assets Larry & Margie's MPF 880,000 Larry's company stock 11,500,000 Total Variable Assets 12,380,000 Personal and Other Assets Home 3,800,000 Vehicles 300,000 Personal Property 600,000 Total Personal & Other Assets 4,700,000 Total Assets: 17,380,000 Liabilities Mortgage (5 years left) 980,000 Vehicle Loan (Margie) 120,000 Total Liabilities: 1,100,000 Net Worth (Assets - Liabilities): 16,280,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts