Question: Formulate but do not solve the following exercise as a linear programming problem. Ashley has earmarked at most $280,000 for investment in three mutual

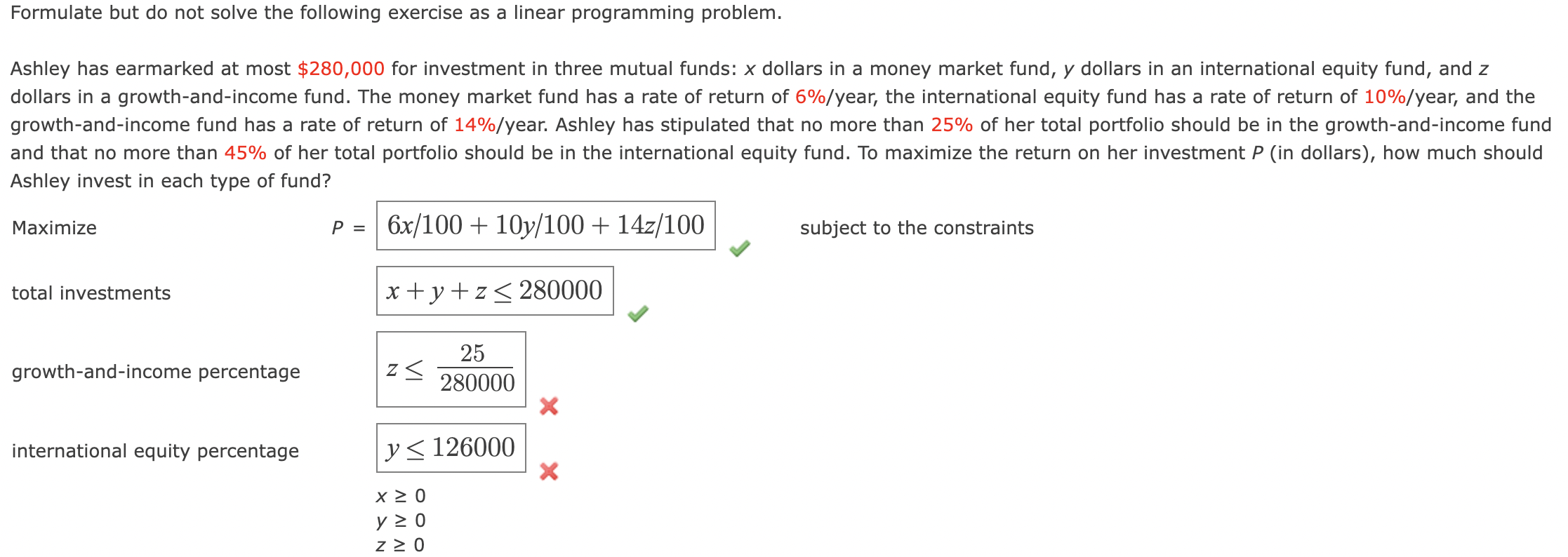

Formulate but do not solve the following exercise as a linear programming problem. Ashley has earmarked at most $280,000 for investment in three mutual funds: x dollars in a money market fund, y dollars in an international equity fund, and z dollars in a growth-and-income fund. The money market fund has a rate of return of 6%/year, the international equity fund has a rate of return of 10%/year, and the growth-and-income fund has a rate of return of 14%/year. Ashley has stipulated that no more than 25% of her total portfolio should be in the growth-and-income fund and that no more than 45% of her total portfolio should be in the international equity fund. To maximize the return on her investment P (in dollars), how much should Ashley invest in each type of fund? Maximize total investments P = 6x/100+10y/100 + 14z/100 x+y+z280000 subject to the constraints growth-and-income percentage international equity percentage z 25 280000 y 126000 X 0 y 0 Z O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts