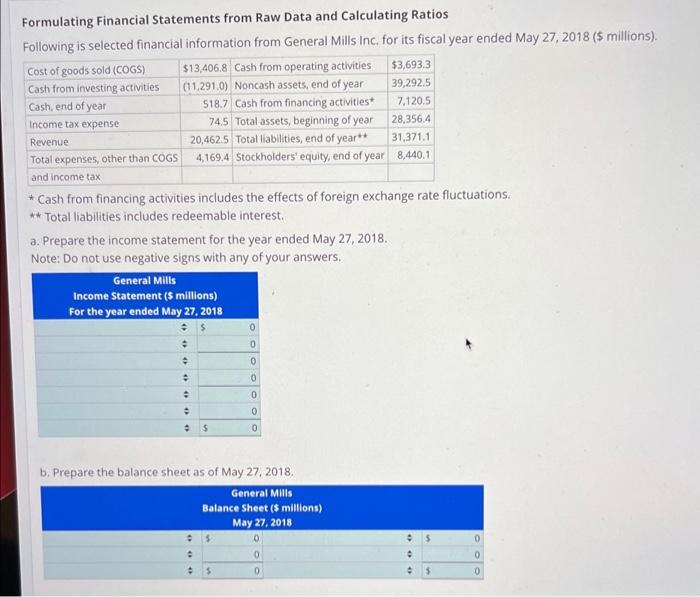

Question: Formulating Financial Statements from Raw Data and Calculating Ratios Following is selected financial information from General Mills Inc, for its fiscal year ended May 27,2018

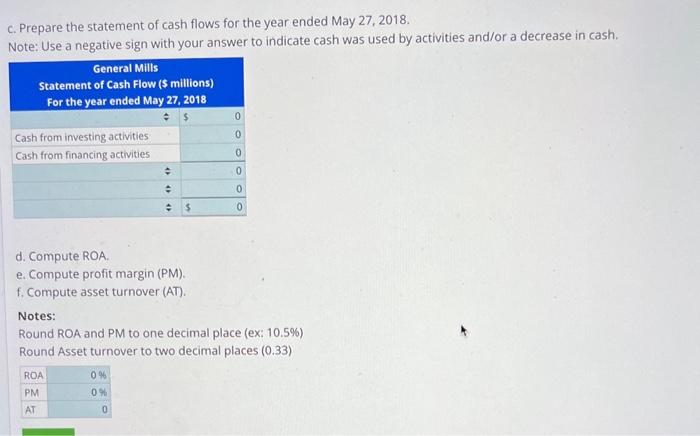

Formulating Financial Statements from Raw Data and Calculating Ratios Following is selected financial information from General Mills Inc, for its fiscal year ended May 27,2018 ( $ millions). * Cash from financing activities includes the effects of foreign exchange rate fluctuations. ** Total liabilities includes redeemable interest. a. Prepare the income statement for the year ended May 27,2018. Note: Do not use negative signs with any of your answers. b. Prepare the balance sheet as of May 27, 2018. c. Prepare the statement of cash flows for the year ended May 27, 2018. Note: Use a negative sign with your answer to indicate cash was used by activities and/or a decrease in cash. d. Compute ROA. e. Compute profit margin (PM). f. Compute asset turnover (AT). Notes: Round ROA and PM to one decimal place (ex: 10.5\%) Round Asset turnover to two decimal places (0.33) Formulating Financial Statements from Raw Data and Calculating Ratios Following is selected financial information from General Mills Inc, for its fiscal year ended May 27,2018 ( $ millions). * Cash from financing activities includes the effects of foreign exchange rate fluctuations. ** Total liabilities includes redeemable interest. a. Prepare the income statement for the year ended May 27,2018. Note: Do not use negative signs with any of your answers. b. Prepare the balance sheet as of May 27, 2018. c. Prepare the statement of cash flows for the year ended May 27, 2018. Note: Use a negative sign with your answer to indicate cash was used by activities and/or a decrease in cash. d. Compute ROA. e. Compute profit margin (PM). f. Compute asset turnover (AT). Notes: Round ROA and PM to one decimal place (ex: 10.5\%) Round Asset turnover to two decimal places (0.33)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts