Question: Forty multiple choice exercises / problems appear below. You must answer all of them. For each problem you answer, insert the letter which indicates the

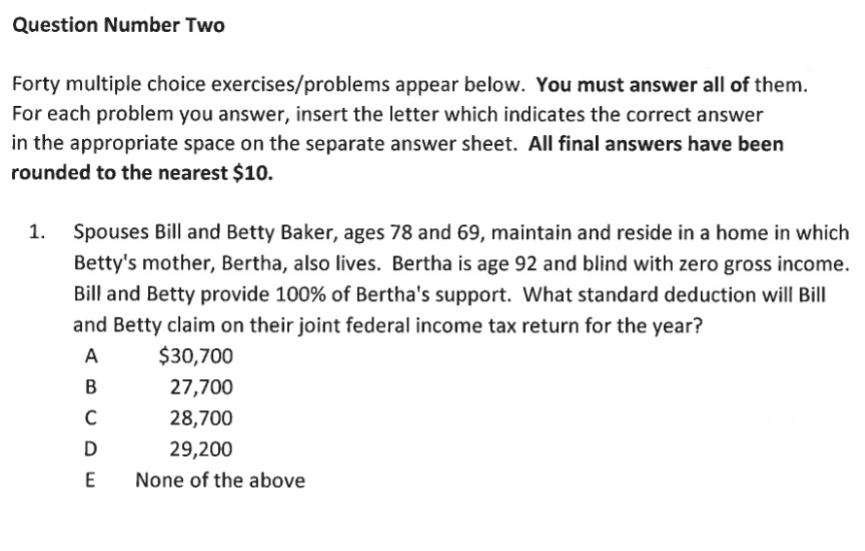

Forty multiple choice exercisesproblems appear below. You must answer all of them. For each problem you answer, insert the letter which indicates the correct answer in the appropriate space on the separate answer sheet. All final answers have been rounded to the nearest $

Spouses Bill and Betty Baker, ages and maintain and reside in a home in which Betty's mother, Bertha, also lives. Bertha is age and blind with zero gross income. Bill and Betty provide of Bertha's support. What standard deduction will Bill and Betty claim on their joint federal income tax return for the year?

A $

c D

Thomas Taylor, who was injured in an automobile accident caused by another driver, Flash Fisher, received $ from Flash's insurance company to cover medical bills related to Thomas' injuries, $ in damages because of the injury, and $ in in punitive damages, all during x Thomas also earned $ from a parttime job prior to the accident, received $ of United States series EE savings bond interest, and collected $ in unemployment benefits while out of work during the year. What is Thomas' adjusted gross for the year?

income for the year?

A $

c D

E None of the above

Ben Baker purchased Ajax Company stock five years ago for $ which he gifted to Anne Able at a time when the stock's market value was $ Subsequently, Anne sold the stock for $ What will be the amount of Anne's gain or loss on the sale?

$ gain

gain c gain

gain or loss

None of the above

In x Russell Rogers is single with net investment income of $ and modified adjusted gross income of $ What is the amount of Russell's net investment income tax for the year?

$

c

D

None of the above

Judith Jones, single, reports four sales of capital assets during as set out below.

Longterm capital gain $

Long term capital loss

Short term capital loss

Short term capital gain

Judith's only other income for the year is salary of $ What is Judith's adjusted gross income for the year?

$

c D

E None of the above

Answer all questions and problems appearing on this examination under rules governing federal income taxation. Unless instructed otherwise, assume the relevant year to be

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock