Question: FORUM DESCRIPTION Predetermined Overhead Application Rate (POHAR) = Estimated total Annual Overhead Costs/ Estimated total Annual overhead application base. The application the allocation base has

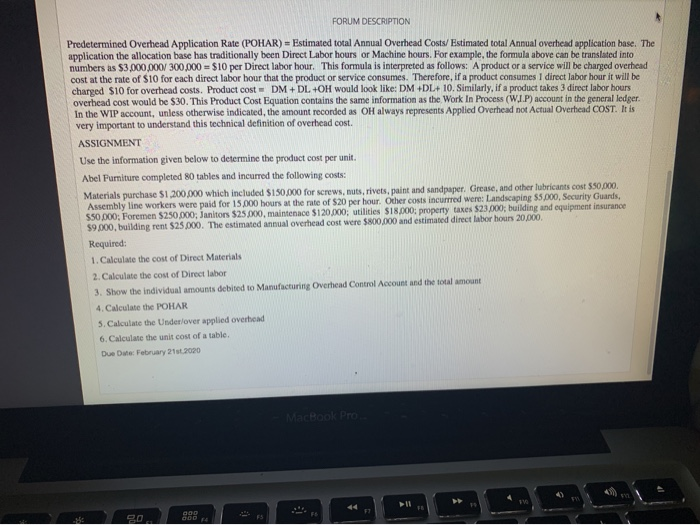

FORUM DESCRIPTION Predetermined Overhead Application Rate (POHAR) = Estimated total Annual Overhead Costs/ Estimated total Annual overhead application base. The application the allocation base has traditionally been Direct Labor hours or Machine hours. For example, the formula above can be translated into numbers as $3.000.000/ 300,000 = $10 per Direct labor hour. This formula is interpreted as follows: A product or a service will be charged overhead cost at the rate of $10 for each direct labor bour that the product or service consumes. Therefore, if a product consumes 1 direct labor hour it will be charged $10 for overhead costs. Product cost-DM + DL +OH would look like: DM +DL+10. Similarly, if a product takes 3 direct labor hours overhead cost would be $30. This Product Cost Equation contains the same information as the Work In Process (W.I.P) account in the general ledger. In the WIP account, unless otherwise indicated the amount recorded as OH always represents Applied Overhead not Actual Overhead COST. It is very important to understand this technical definition of overhead cost. ASSIGNMENT Use the information given below to determine the product cost per unit. Abel Furniture completed 80 tables and incurred the following costs: Materials purchase 1,200,000 which included $150,000 for screws, nuts, rivets, paint and sandpaper. Grease, and other lubricants cost $50,000 Assembly line workers were paid for 15.000 hours at the rate of $20 per hour. Other costs incurred were: Landscaping $5.000, Security Guards, 550.000; Foremen $250.000; Janitors $25.000, maintenace $120,000; utilities $18.000: property taxes $23.000; building and equipment insurance $9.000, building rent $25.000. The estimated annual overhead cost were $800,000 and estimated direct labor hours 20,000 Required: 1. Calculate the cost of Direct Materials 2. Calculate the cost of Direct labor 3. Show the individual amounts debited to Manufacturing Overhead Control Account and the total amount 4. Calculate the POHAR 5. Calculate the under over applied overhead 6. Calculate the unit cost of a table. Due Date: February 21 2020 MacBook Pro 4 11 000 BO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts