Question: Forward contracts are customized agreements in which one party agrees to buy a commodity at a specific price on a specific future date, and the

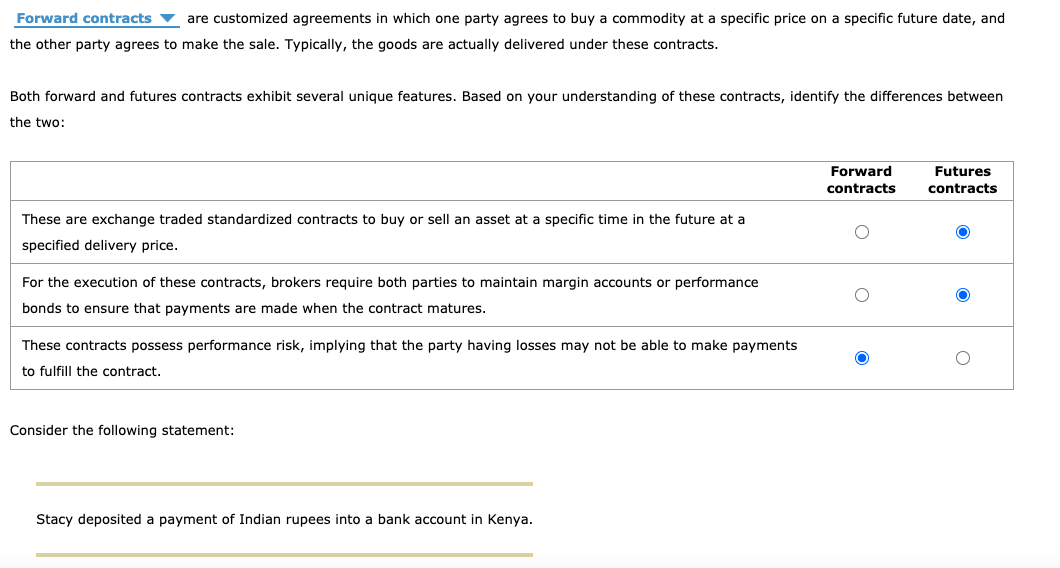

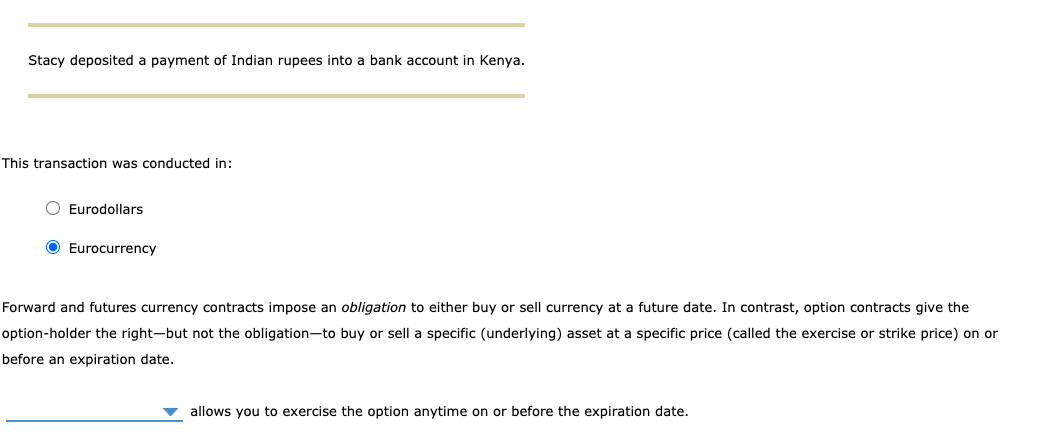

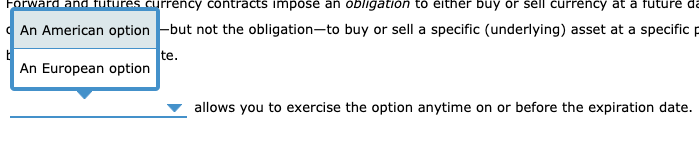

Forward contracts are customized agreements in which one party agrees to buy a commodity at a specific price on a specific future date, and the other party agrees to make the sale. Typically, the goods are actually delivered under these contracts. Both forward and futures contracts exhibit several unique features. Based on your understanding of these contracts, identify the differences between the two: Forward contracts Futures contracts These are exchange traded standardized contracts to buy or sell an asset at a specific time in the future at a specified delivery price. For the execution of these contracts, brokers require both parties to maintain margin accounts or performance bonds to ensure that payments are made when the contract matures. 0 These contracts possess performance risk, implying that the party having losses may not be able to make payments to fulfill the contract. 0 Consider the following statement: Stacy deposited a payment of Indian rupees into a bank account in Kenya. Stacy deposited a payment of Indian rupees into a bank account in Kenya. This transaction was conducted in: O Eurodollars O Eurocurrency Forward and futures currency contracts impose an obligation to either buy or sell currency at a future date. In contrast, option contracts give the option-holder the right-but not the obligation-to buy or sell a specific (underlying) asset at a specific price (called the exercise or strike price) on or before an expiration date. allows you to exercise the option anytime on or before the expiration date. Forward and futures currency contracts impose an obligation to either buy or sell currency at a future da An American option--but not the obligation-to buy or sell a specific (underlying) asset at a specific p te. An European option allows you to exercise the option anytime on or before the expiration date

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts