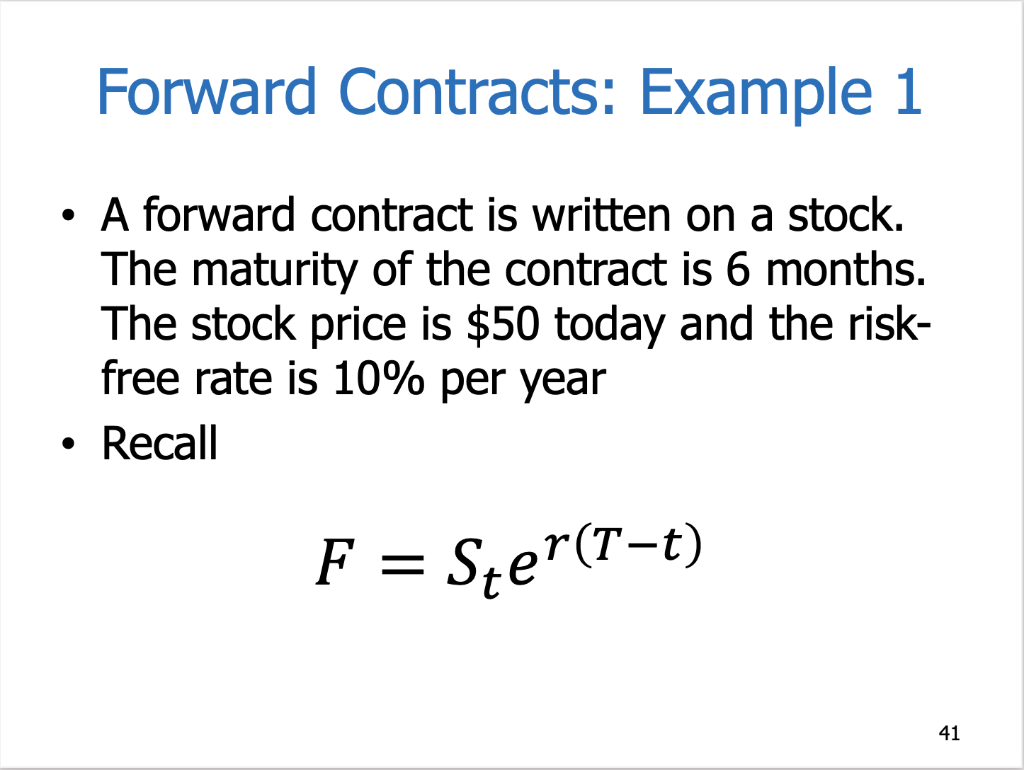

Question: Forward Contracts: Example 1 . A forward contract is written on a stock. The maturity of the contract is 6 months. The stock price is

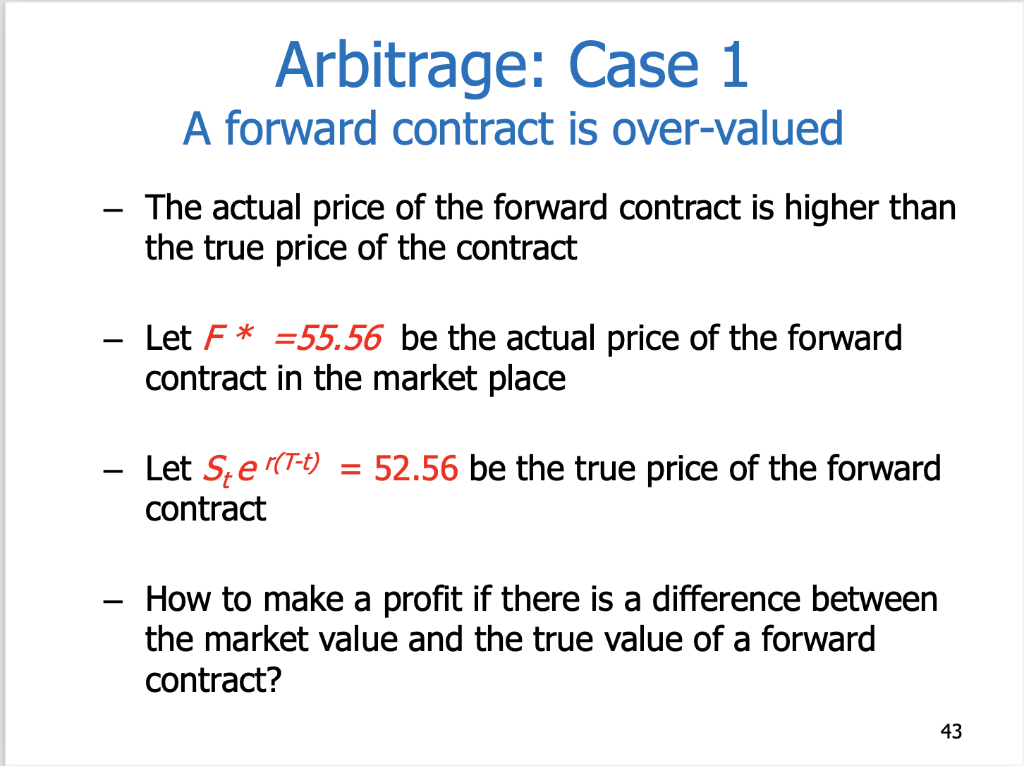

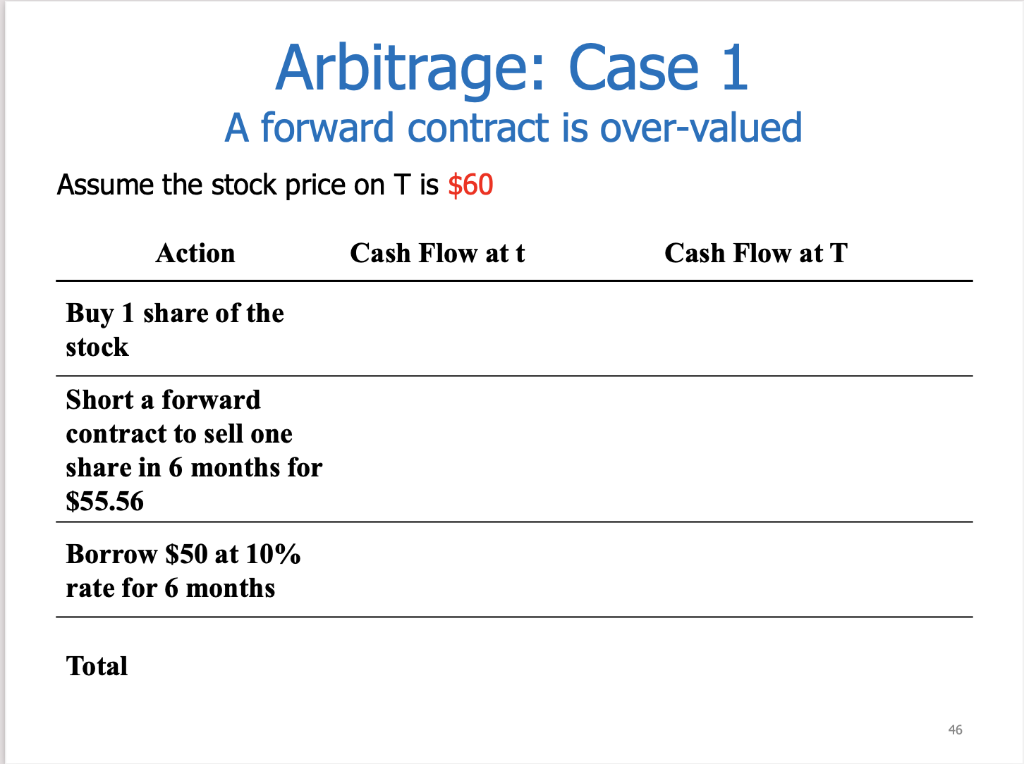

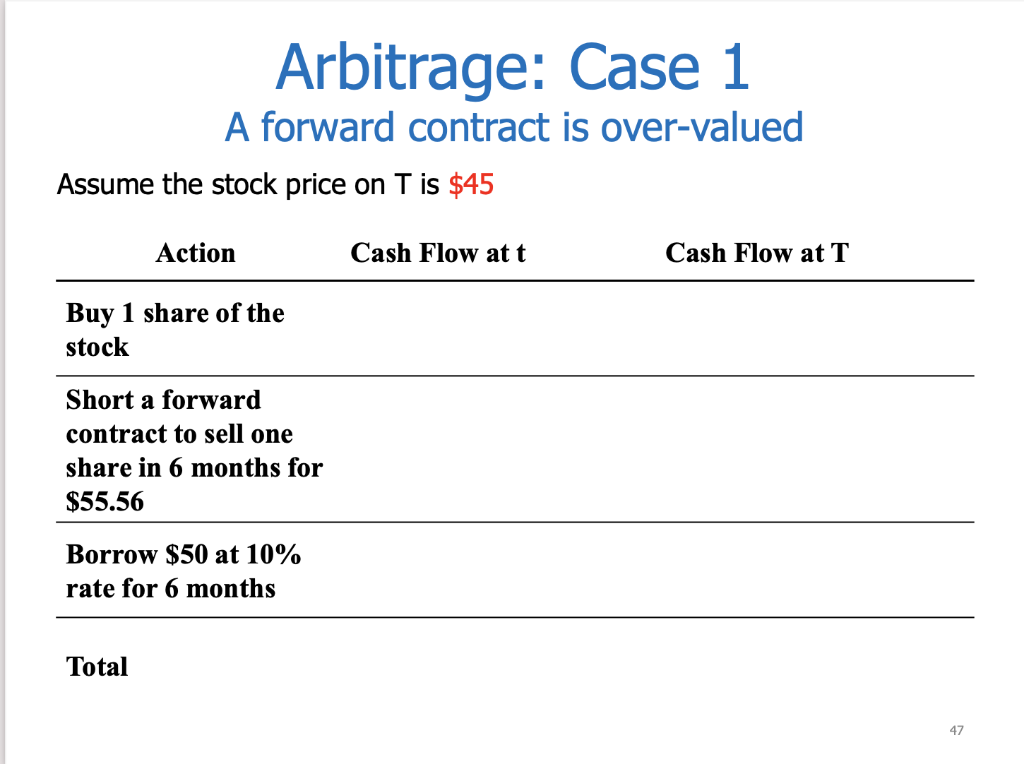

Forward Contracts: Example 1 . A forward contract is written on a stock. The maturity of the contract is 6 months. The stock price is $50 today and the risk- free rate is 10% per year Recall F = Ster(T-t) 41 Arbitrage: Case 1 A forward contract is over-valued The actual price of the forward contract is higher than the true price of the contract Let F* =55.56 be the actual price of the forward contract in the market place Let Ste r(T-t) contract = 52.56 be the true price of the forward How to make a profit if there is a difference between the market value and the true value of a forward contract? 43 Arbitrage: Case 1 A forward contract is over-valued Assume the stock price on T is $60 Action Cash Flow at t Cash Flow at T Buy 1 share of the stock Short a forward contract to sell one share in 6 months for $55.56 Borrow $50 at 10% rate for 6 months Total 46 Arbitrage: Case 1 A forward contract is over-valued Assume the stock price on T is $45 Action Cash Flow at t Cash Flow at T Buy 1 share of the stock Short a forward contract to sell one share in 6 months for $55.56 Borrow $50 at 10% rate for 6 months Total 47

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts