Question: Forward Position Hedge: Forward Position Hedge ($/) Can you please advise if the three calculations are correct for the five Forward spot Exchange Rates? The

Forward Position Hedge:

Forward Position Hedge ($/)

- Can you please advise if the three calculations are correct for the five Forward spot Exchange Rates? The three calculations are:

- Unhedged Position

- Hedged Position

- Gain/Losses from Hedge

Unhedged Position (10,000,000)

= 10,000,000 x 1.30 = 13,000,000

= 10,000,000 x 1.40 = 14,000,000

= 10,000,000 x 1.46 = 14,600,000

= 10,000,000 x 1.50 = 15,000,000

= 10,000,000 x 1.60 = 16,000,000

Hedged Position

= 10,000,000 x 1.46 = 14,600,000 (for each of the five spot exchange rates)

Gains/Losses from Hedge

(1.30): 1,600,000 = 14,600,000 - 13,000,000

(1.40): 600,000 = 14,600,000 - 14,000,000

(1.46): 0 = 14,600,000 - 14,600,000

(1.50): -400,000 = 14,600,000 - 15,000,000

(1.60): -1,400,000 = 14,600,000 - 16,000,000

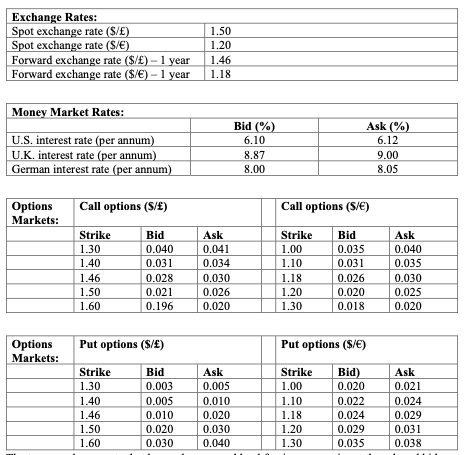

\begin{tabular}{|l|l|} \hline Exchange Rates: \\ \hline Spot exchange rate ($/) & 1.50 \\ \hline Spot exchange rate ($/) & 1.20 \\ \hline Forward exchange rate ($/)1 year & 1.46 \\ \hline Forward exchange rate ($/)1 year & 1.18 \\ \hline \end{tabular} \begin{tabular}{|l|c|c|} \hline \multicolumn{3}{|l|}{ Money Market Rates: } \\ \hline & Bid (\%) & Ask (\%) \\ \hline U.S. interest rate (per annum) & 6.10 & 6.12 \\ \hline U.K. interest rate (per annum) & 8.87 & 9.00 \\ \hline German interest rate (per annum) & 8.00 & 8.05 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline \multirow{2}{*}{OptionsMarkets:} & \multicolumn{3}{|c|}{ Call options (S/) } & \multicolumn{3}{|c|}{ Call options (S/) } \\ \hline & Strike & Bid & Ask & Strike & Bid & Ask \\ \hline & 1.30 & 0.040 & 0.041 & 1.00 & 0.035 & 0.040 \\ \hline & 1.40 & 0.031 & 0.034 & 1.10 & 0.031 & 0.035 \\ \hline & 1.46 & 0.028 & 0.030 & 1.18 & 0.026 & 0.030 \\ \hline & 1.50 & 0.021 & 0.026 & 1.20 & 0.020 & 0.025 \\ \hline & 1.60 & 0.196 & 0.020 & 1.30 & 0.018 & 0.020 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|l|l|} \hline OptionsMarkets: & \multicolumn{2}{l|}{ Put options (\$/f) } & \multicolumn{2}{l|}{ Put options (\$/) } \\ \hline & Strike & Bid & Ask & Strike & Bid) & Ask \\ \hline & 1.30 & 0.003 & 0.005 & 1.00 & 0.020 & 0.021 \\ \hline & 1.40 & 0.005 & 0.010 & 1.10 & 0.022 & 0.024 \\ \hline & 1.46 & 0.010 & 0.020 & 1.18 & 0.024 & 0.029 \\ \hline & 1.50 & 0.020 & 0.030 & 1.20 & 0.029 & 0.031 \\ \hline & 1.60 & 0.030 & 0.040 & 1.30 & 0.035 & 0.038 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts