Question: Forward Rates A Forward Rate represents a future interest rate between two points in the future, i.e. the 7 year interest rate starting three years

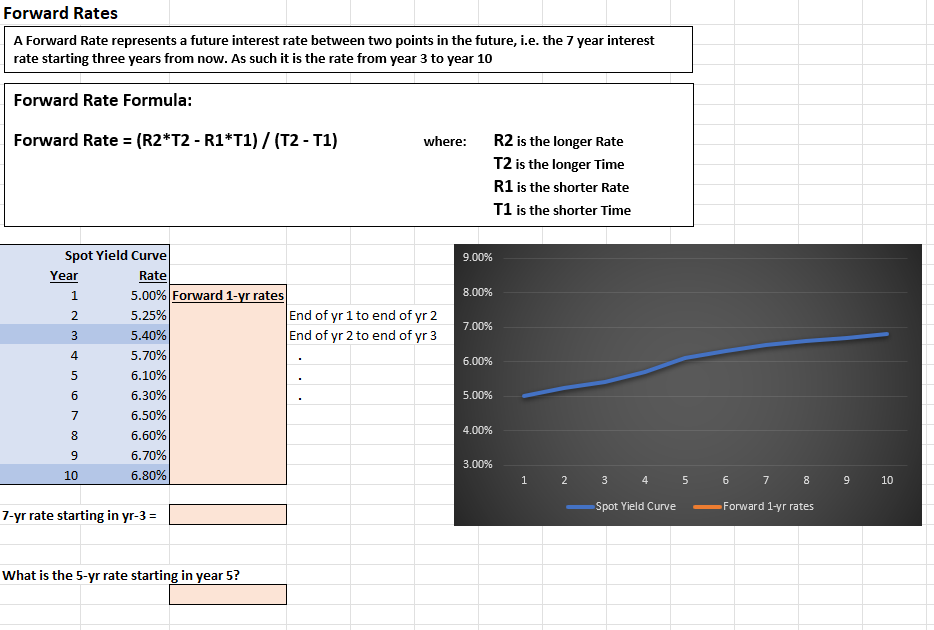

Forward Rates A Forward Rate represents a future interest rate between two points in the future, i.e. the 7 year interest rate starting three years from now. As such it is the rate from year 3 to year 10 Forward Rate Formula: Forward Rate = (R2*T2 - R1*11)/(T2 - T1) where: R2 is the longer Rate T2 is the longer Time R1 is the shorter Rate T1 is the shorter Time 9.00% 8.00% 7.00% Spot Yield Curve Year Rate 1 5.00% Forward 1-yr rates 2 5.25% End of yr 1 to end of yr 2 3 5.40% End of yr 2 to end of yr 3 4 5.70% 5 6.10% 6 6.30% 7 6.50% 8 6.60% 9 6.70% 10 6.80% 6.00% 5.00% 0 000 4.00% 3.00% 1 2 3 4 5 9 10 6 7 8 Forward 1-yr rates Spot Yield Curve 7-yr rate starting in yr-3 = What is the 5-yr rate starting in year 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts