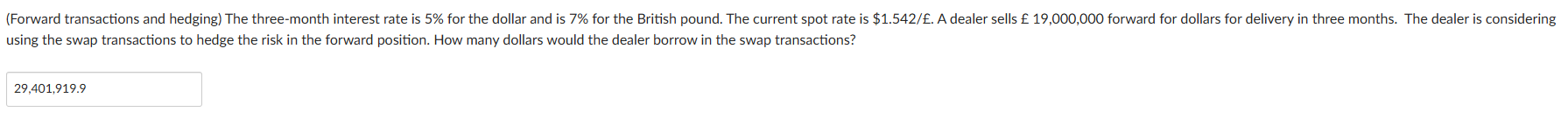

Question: ( Forward transactions and hedging ) The three - month interest rate is 5 % for the dollar and is 7 % for the British

Forward transactions and hedging The threemonth interest rate is for the dollar and is for the British pound. The current spot rate is $ A dealer sells forward for dollars for delivery in three months. The dealer is considering using the swap transactions to hedge the risk in the forward position. How many dollars would the dealer borrow in the swap transactions?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock