Question: Four projects are being studied by RTC Inc. The table below provides the first cost as wel as the overall and incremental Internal Rate of

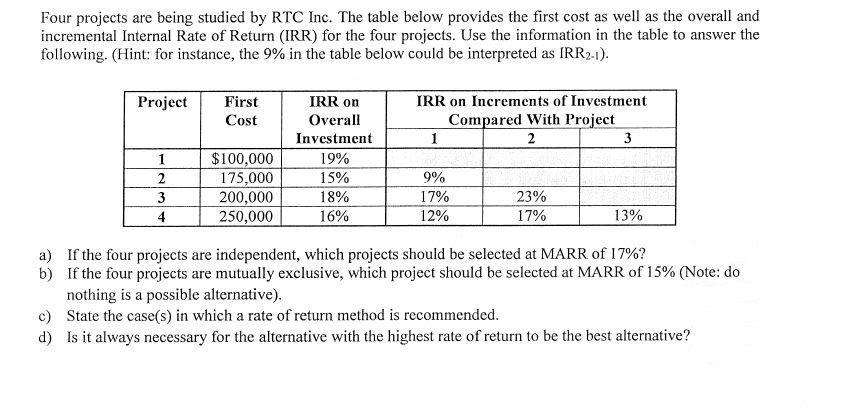

Four projects are being studied by RTC Inc. The table below provides the first cost as wel as the overall and incremental Internal Rate of Return (IRR) for the four projects. Use the information in the table to answer the following. (Hint: for instance, the 9% in the table below could be interpreted as IRR IRR on Overall Investment 19% 15% 18% 16% Project IRR on Increments of Investment First Cost Compared With Project $100,000 175,000 200,000 250,000 9% 17% 12% 23% 17% 13% If the four projects are independent, which projects should be selected at MARR of 17%? If the four projects are mutually exclusive, which project should be selected at MARR of 15% (Note: do nothing is a possible alternative) a) b) c) State the case(s) in which a rate of return method is recommended d) Is always necessary for the alternative with the highest rate of return to be the best alternative

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts