Question: FQ2. PLEASE WRITE CLEAR, VERY CLEAR. SHOW ALL THE STEPS FOR THE QUESTION TO BE WORTH ANY MARKS. WACC and NPV Retniw Inc. is evaluating

FQ2. PLEASE WRITE CLEAR, VERY CLEAR. SHOW ALL THE STEPS FOR THE QUESTION TO BE WORTH ANY MARKS.

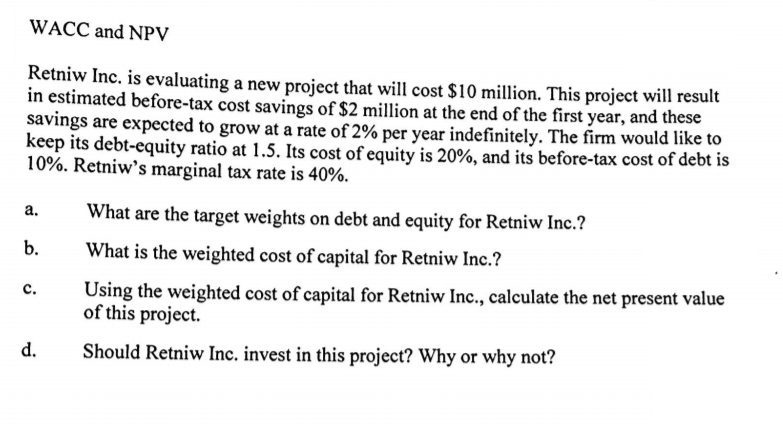

WACC and NPV Retniw Inc. is evaluating a new project that will cost $10 million. This project will result in estimated before-tax cost savings of $2 million at the end of the first year, and these savings are expected to grow at a rate of 2% per year indefinitely. The firm would like to keep its debt-equity ratio at 1.5 Its cost of equity is 20% and its before-tax cost of debt is 10%. Retniw's marginal tax rate is 40%. a. What are the target weights on debt and equity for Retniw Inc.? b. What is the weighted cost of capital for Retniw Inc.? c. Using the weighted cost of capital for Retniw Inc., calculate the net present value of this project. d. Should Retniw Inc. invest in this project? Why or why not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts