Question: Frances's Fine Fluffs, Inc., During the second year FFF bought 10 Fluffs and sold 9 Fluffs. Same prices as last year. When FFF bought the

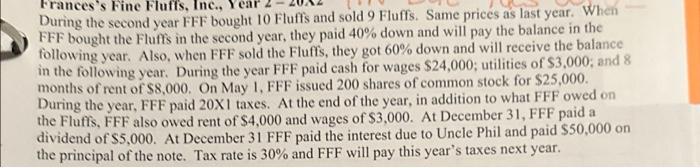

During the second year FFF bought 10 Fluffs and sold 9 Fluffs. Same prices as last year. When FFF bought the Fluffs in the second year, they paid 40% down and will pay the balance in the following year. Also, when FFF sold the Fluffs, they got 60% down and will receive the balance in the following year. During the year FFF paid cash for wages $24,000; utilities of $3,000; and 8 months of rent of $8,000. On May I, FFF issued 200 shares of common stock for $25,000. During the year, FFF paid 20X1 taxes. At the end of the year, in addition to what FFF owed on the Fluffs, FFF also owed rent of $4,000 and wages of $3,000. At December 31 , FFF paid a dividend of $5,000. At December 31 FFF paid the interest due to Uncle Phil and paid $50,000 on the principal of the note. Tax rate is 30% and FFF will pay this year's taxes next year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts