Question: franciaclassroom.com Lessem I Rease RII Guime Thesement Clemer SPIOS Eatale PIanning Estate Planning Final: Exam Section Section 1 ol 1 7 1 0 . 0

franciaclassroom.com

Lessem I Rease RII Guime

Thesement Clemer

SPIOS Eatale PIanning

Estate Planning Final: Exam Section

Section ol

Complete

Fooleor

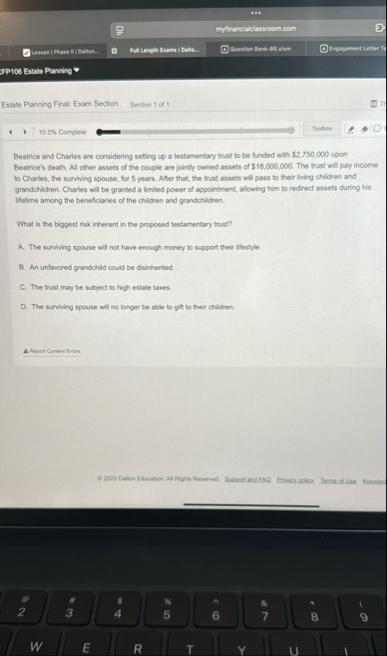

Beatrice and Charles are considering setting up a lestamentary trust to be funded with $ upon Beatice's death. All other assets of the couple are jointly owned assets of $ The trust will pay income to Charles, the survining spouse, for years. Alser that, the Inal assels will pass to their thing children and grandchildren. Charles will be granted a limited power of appointment, allowing him to redirect assets during his lifetime among the beneficiaries of the children and grandchildren.

What is the biggest risk inherent in the proposed lestamentary lrust?

A The surviving spouse will not have enough money to support their llestyle.

Thu untavored grandchild could be disisherled.

C The trust may be subject to high estate taxes.

The surviting spouse with no longer be abte to git to their children.

Repon Content Enom

Dation Education. Al Rights fleserved. Sussortand FAQ

Et many

Thermastuat

KO

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock