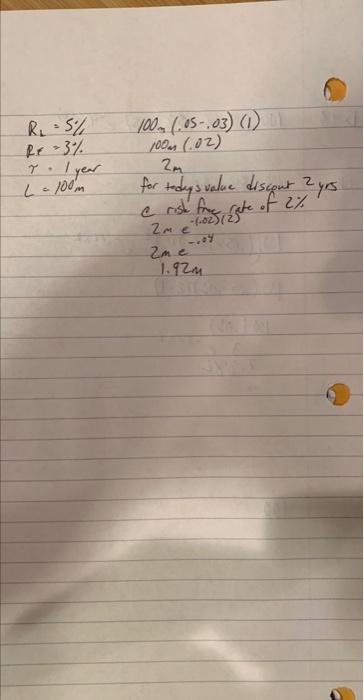

Question: FRAs: Both the question and my incorrect answer are in the pics. Please help me understand why my solution is incorrect. I don't understand why

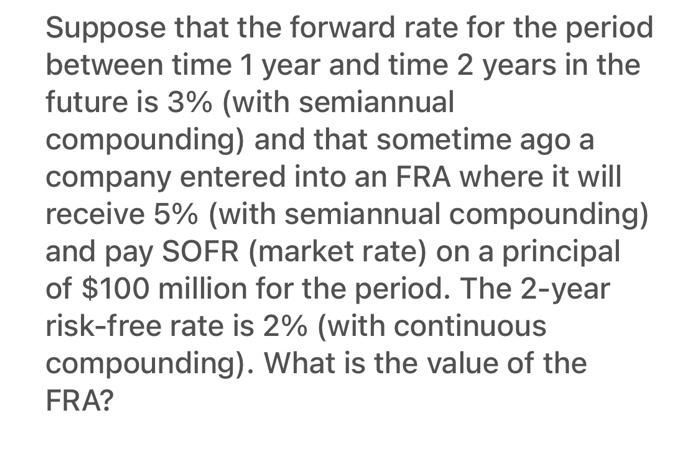

RL=5%RF=3%=1yearL=100m100m(.05.03)(1)100m(.02)2mfortodusveluediscont2yrscristfrecrateof2%2me(.02)(2)2me.041.92m Suppose that the forward rate for the period between time 1 year and time 2 years in the future is 3% (with semiannual compounding) and that sometime ago a company entered into an FRA where it will receive 5% (with semiannual compounding) and pay SOFR (market rate) on a principal of $100 million for the period. The 2-year risk-free rate is 2% (with continuous compounding). What is the value of the FRA? RL=5%RF=3%=1yearL=100m100m(.05.03)(1)100m(.02)2mfortodusveluediscont2yrscristfrecrateof2%2me(.02)(2)2me.041.92m Suppose that the forward rate for the period between time 1 year and time 2 years in the future is 3% (with semiannual compounding) and that sometime ago a company entered into an FRA where it will receive 5% (with semiannual compounding) and pay SOFR (market rate) on a principal of $100 million for the period. The 2-year risk-free rate is 2% (with continuous compounding). What is the value of the FRA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts