Question: Frauds R'Us has some serious challenges. In 2 0 2 1 , they had a decent positive net income, but this year, their sales have

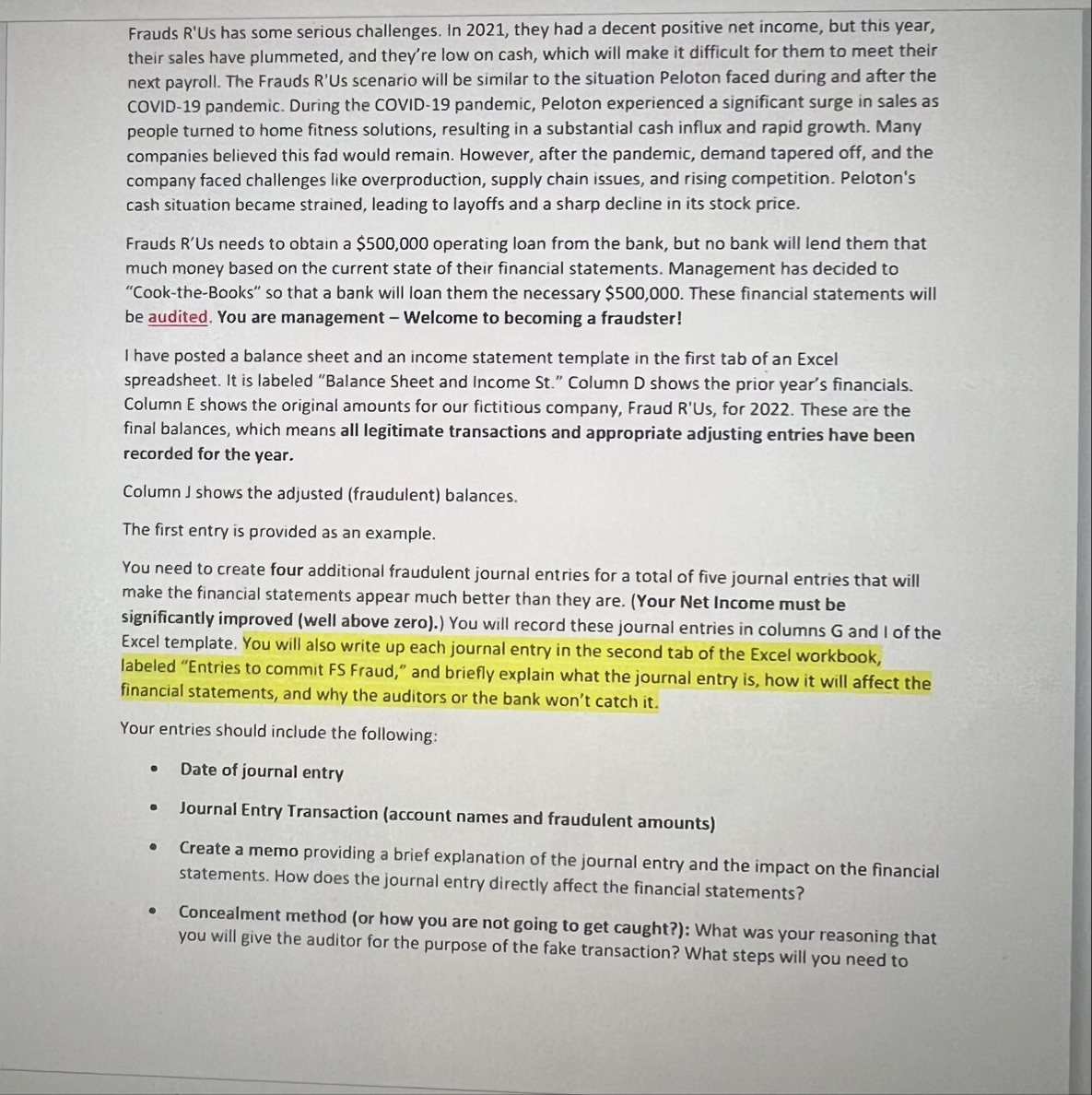

Frauds R'Us has some serious challenges. In they had a decent positive net income, but this year, their sales have plummeted, and they're low on cash, which will make it difficult for them to meet their next payroll. The Frauds R'Us scenario will be similar to the situation Peloton faced during and after the COVID pandemic. During the COVID pandemic, Peloton experienced a significant surge in sales as people turned to home fitness solutions, resulting in a substantial cash influx and rapid growth. Many companies believed this fad would remain. However, after the pandemic, demand tapered off, and the company faced challenges like overproduction, supply chain issues, and rising competition. Peloton's cash situation became strained, leading to layoffs and a sharp decline in its stock price.

Frauds R'Us needs to obtain a $ operating loan from the bank, but no bank will lend them that much money based on the current state of their financial statements. Management has decided to "CooktheBooks" so that a bank will loan them the necessary $ These financial statements will be audited. You are management Welcome to becoming a fraudster!

I have posted a balance sheet and an income statement template in the first tab of an Excel spreadsheet. It is labeled "Balance Sheet and Income St Column D shows the prior year's financials. Column E shows the original amounts for our fictitious company, Fraud R'Us, for These are the final balances, which means all legitimate transactions and appropriate adjusting entries have been recorded for the year.

Column darr shows the adjusted fraudulent balances.

The first entry is provided as an example.

You need to create four additional fraudulent journal entries for a total of five journal entries that will make the financial statements appear much better than they are. Your Net Income must be significantly improved well above zero You will record these journal entries in columns G and I of the Excel template. You will also write up each journal entry in the second tab of the Excel workbook, labeled "Entries to commit FS Fraud," and briefly explain what the journal entry is how it will affect the financial statements, and why the auditors or the bank won't catch it

Your entries should include the following:

Date of journal entry

Journal Entry Transaction account names and fraudulent amounts

Create a memo providing a brief explanation of the journal entry and the impact on the financial statements. How does the journal entry directly affect the financial statements?

Concealment method or how you are not going to get caught?: What was your reasoning that you will give the auditor for the purpose of the fake transaction? What steps will you need to

transaction may be legitimate?

Here is the first entry:

Date:

Journal Entry:

Accounts Receivable $

Sales

$

Memo: I have created a phony customers and created a fake sale to that company on account. This will increase assets, sales, and net income by $

Concealment Method:

If the auditors inquire about the unusually high value of the sales journal entry, I will explain that the company is expanding its client base. This sale comes from a new customer who recently moved into the area, resulting in an order that was larger than typical due to the customer's initial bulk purchase to get started.

To conceal this transaction, I will create a fictitious customer by establishing a shell company with a professional business name similar to those of existing customers. The company will have plausible contact information and a website. The contact information will not match mine or any close relatives, as this could lead back to me

Next, I will generate falsified documentation to support the sale, including a forged purchase order, bill of lading, sales invoice, and any other necessary customer order details. I'll also create fake shipping records and delivery confirmations, using fabricated thirdparty logistics providers or an internal shipping department. These records would be designed to align with the company's typical shipping practices, including accurate tracking numbers, shipping dates, and delivery confirmations, ensuring consistency with internal controls and authorization processes to make the transaction appear legitimate.

You will notice that cells I D E and J of the Balance Sheet and Income St tab are red. These cells should always have a zero balance after a journal entry has been entered, as they contain formulas to ensure that all accounts remain balanced and the income statement reconciles with the balance sheet.

Methods of Financial Statement Fraud

Fictitious Revenues Disguising phony Accounts Receivable

a The auditor usually audits by sending neg

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock