Question: Frazier Fudge, Inc. is considering 2 mutually exclusive projects with the following cash flows. Which project should be accepted? Assume a cost of capital of

Frazier Fudge, Inc. is considering 2 mutually exclusive projects with the following cash flows. Which project should be accepted? Assume a cost of capital of 10%.

Years Project X Project Y

0 ($350) ($350)

1 $130 $200

2 $150 $120

3 $180 $120

a. Project X because NPV is $27.4

b. Project Y because NPV is $31

c. Project X because IRR is 13.7%

d. Project Y because IRR is 12.2%

Show step by step calculations

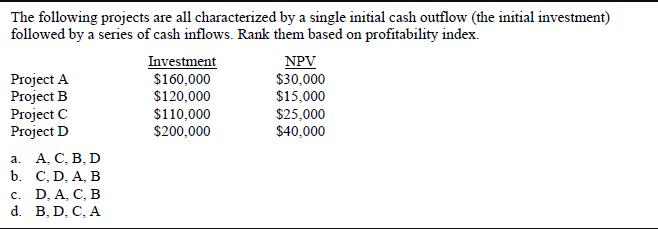

The following projects are all characterized by a single initial cash outflow (the initial investment) followed by a series of cash inflows. Rank them based on profitability index. Project A Project B Project C Project D a. A, C, B, D b. C, D, A, B c. D, A, C, B d. B, D, C, A Investment $160,000 $120,000 $110,000 $200,000 NPV $30,000 $15,000 $25,000 $40,000

Step by Step Solution

3.32 Rating (152 Votes )

There are 3 Steps involved in it

To determine which project should be accepted we will calculate the Net Present Value NPV and Intern... View full answer

Get step-by-step solutions from verified subject matter experts