Question: frist dropdown options are should / should not. second drop down options are in the money/ out of the money. in the bottom dropdowns frist

frist dropdown options are should / should not.

second drop down options are in the money/ out of the money.

in the bottom dropdowns

frist dropdown options are should / should not.

second drop down options are in the money/ out of the money / at the money.

any other information required, please comment

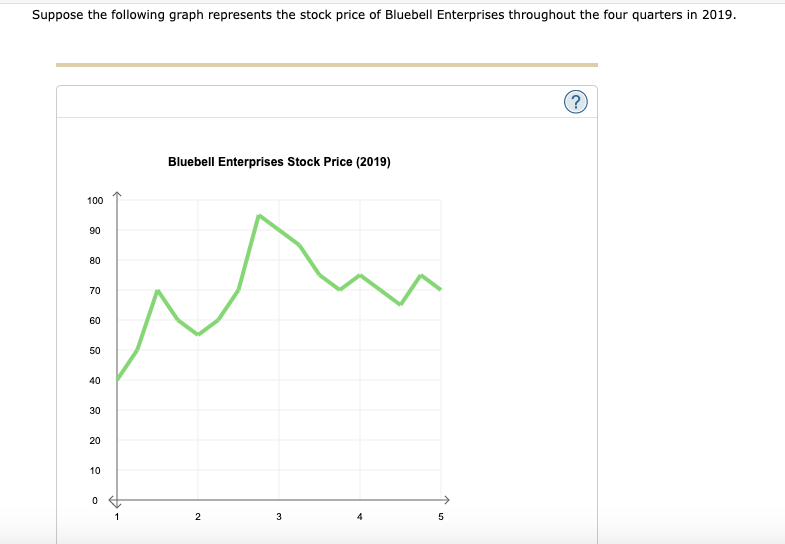

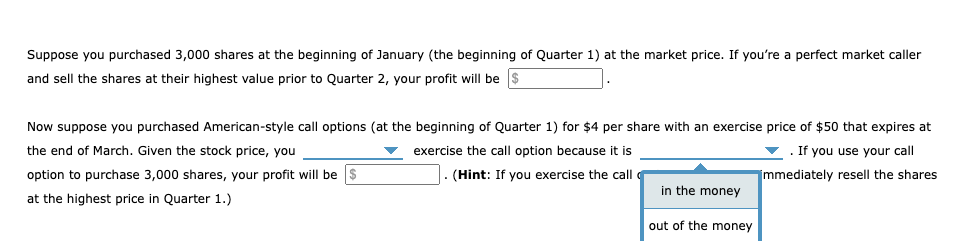

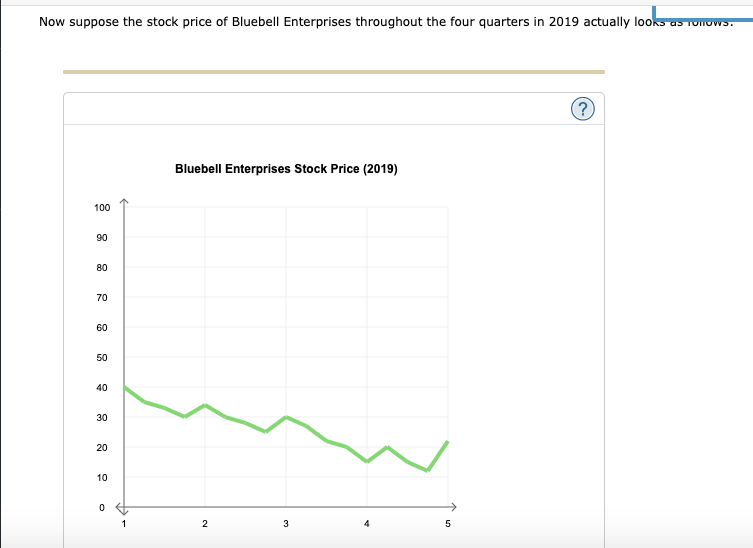

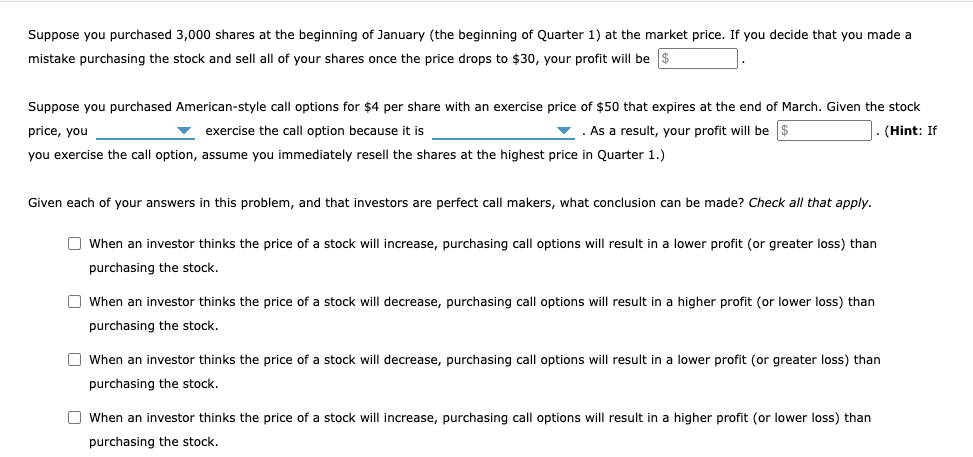

Suppose the following graph represents the stock price of Bluebell Enterprises throughout the four quarters in 2019. ? Bluebell Enterprises Stock Price (2019) ? 100 90 80 70 60 50 40 30 20 10 0 1 2 3 5 Suppose you purchased 3,000 shares at the beginning of January (the beginning of Quarter 1) at the market price. If you're a perfect market caller and sell the shares at their highest value prior to Quarter 2, your profit will be $ Now suppose you purchased American-style call options at the beginning of Quarter 1) for $4 per share with an exercise price of $50 that expires at the end of March. Given the stock price, you exercise the call option because it is . If you use your call option to purchase 3,000 shares, your profit will be $ . (Hint: If you exercise the call immediately resell the shares in the money at the highest price in Quarter 1.) out of the money Now suppose the stock price of Bluebell Enterprises throughout the four quarters in 2019 actually looks as Tonows. ? Bluebell Enterprises Stock Price (2019) 100 90 80 70 60 50 40 30 20 10 0 1 2 3 4 5 Suppose you purchased 3,000 shares at the beginning of January (the beginning of Quarter 1) at the market price. If you decide that you made a mistake purchasing the stock and sell all of your shares once the price drops to $30, your profit will be $ Suppose you purchased American-style call options for $4 per share with an exercise price of $50 that expires at the end of March. Given the stock price, you exercise the call option because it is . As a result, your profit will be $ . (Hint: If you exercise the call option, assume you immediately resell the shares at the highest price in Quarter 1.) Given each of your answers in this problem, and that investors are perfect call makers, what conclusion can be made? Check all that apply. When an investor thinks the price of a stock will increase, purchasing call options will result in a lower profit (or greater loss) than purchasing the stock. When an investor thinks the price of a stock will decrease, purchasing call options will result in a higher profit (or lower loss) than purchasing the stock. When an investor thinks the price of a stock will decrease, purchasing call options will result in a lower profit (or greater loss) than purchasing the stock. When an investor thinks the price of a stock will increase, purchasing call options will result in a higher profit (or lower loss) than purchasing the stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts