Question: From 1 9 8 8 to 1 9 9 4 Mexico pegged its currency, the peso ( MXN ) , to the US dollar to

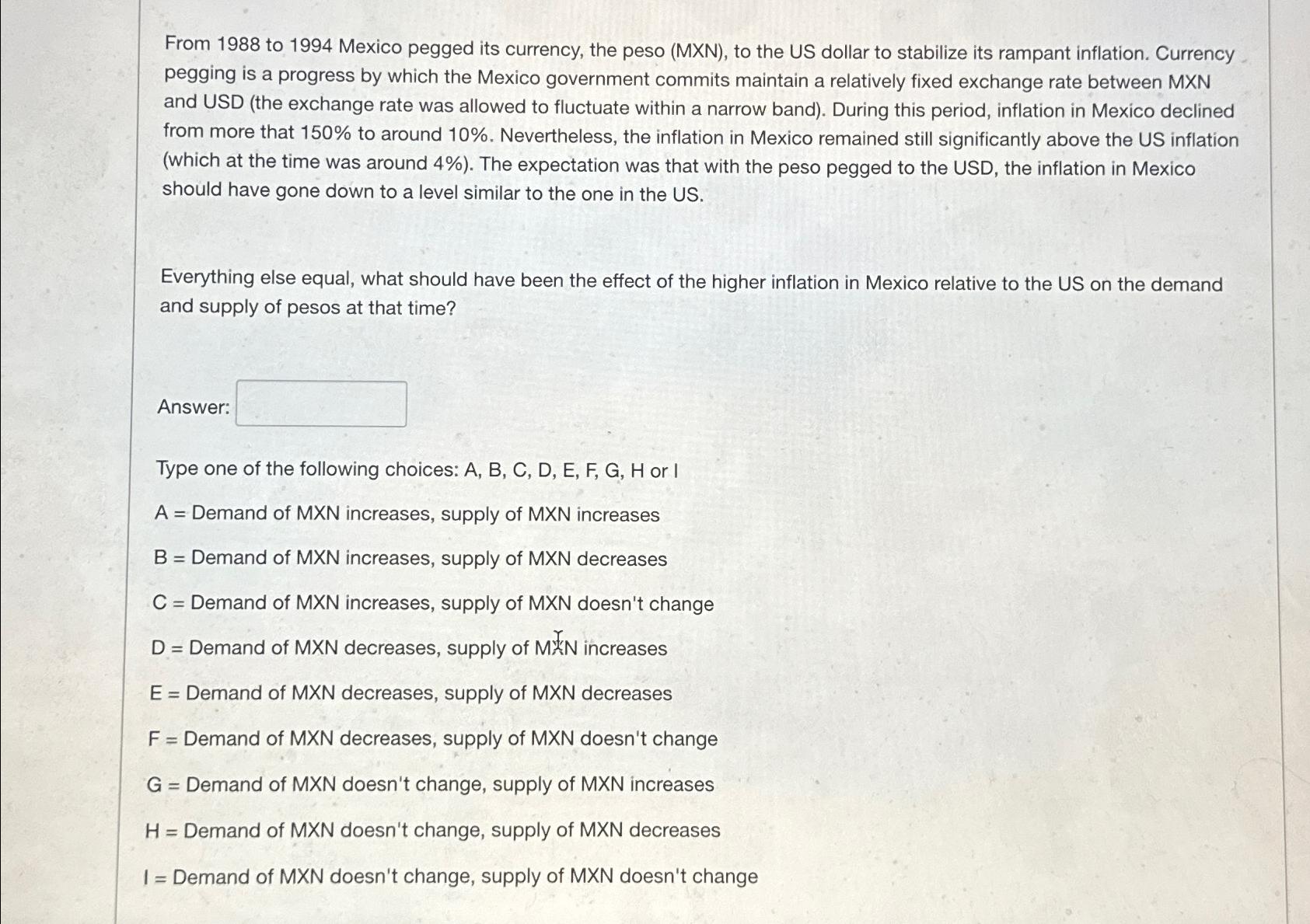

From to Mexico pegged its currency, the peso MXN to the US dollar to stabilize its rampant inflation. Currency pegging is a progress by which the Mexico government commits maintain a relatively fixed exchange rate between and USD the exchange rate was allowed to fluctuate within a narrow band During this period, inflation in Mexico declined from more that to around Nevertheless, the inflation in Mexico remained still significantly above the US inflation which at the time was around The expectation was that with the peso pegged to the USD, the inflation in Mexico should have gone down to a level similar to the one in the US

Everything else equal, what should have been the effect of the higher inflation in Mexico relative to the US on the demand and supply of pesos at that time?

Answer:

Type one of the following choices: A B C D E F G H or I

Demand of MXN increases, supply of MXN increases

Demand of MXN increases, supply of MXN decreases

Demand of MXN increases, supply of MXN doesn't change

Demand of MXN decreases, supply of MAN increases

Demand of MXN decreases, supply of MXN decreases

Demand of MXN decreases, supply of MXN doesn't change

Demand of MXN doesn't change, supply of MXN increases

Demand of MXN doesn't change, supply of MXN decreases

I Demand of MXN doesn't change, supply of MXN doesn't change

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock