Question: from (a) and (b). Describe and discuss why differences might exist between high-quality and low-quality corporate debt securities 4-Assume that you can borrow $175,000 for

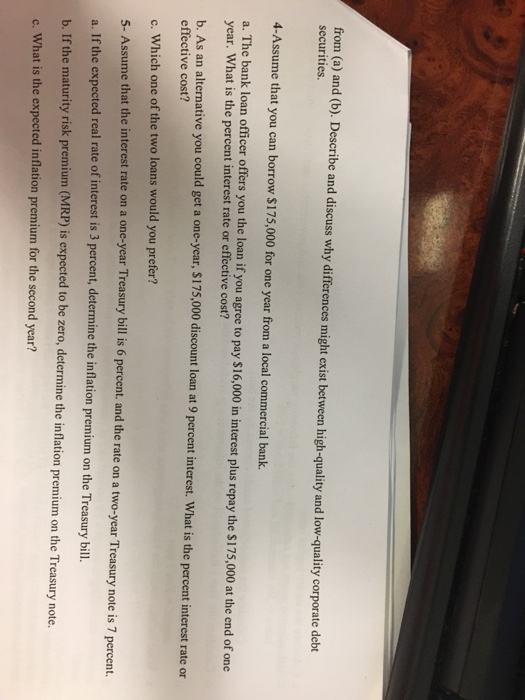

from (a) and (b). Describe and discuss why differences might exist between high-quality and low-quality corporate debt securities 4-Assume that you can borrow $175,000 for one year from a local commercial bank. a. The bank loan officer offers you the loan if you agree to pay $16,000 in interest plus repay the $175,000 at the end of one year. What is the percent interest rate or effective cost? b. As an alternative you could get a one-year, $175,000 discount loan at 9 percent interest. What is the percent interest rate or effective cost? c. Which one of the two loans would you prefer? S- Assu a. If the expected real rate of interest is 3 percent, determine the inflation premium on the Trea b. If the maturity risk premium (MRP) is expected to be zero, determine the inflation premium on the Treasury not c. What is the expected inflation premium for the second year? ne that the interest rate on a one-year Treasury bill is 6 percent. and the rate on a two-year Treasury note is 7 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts