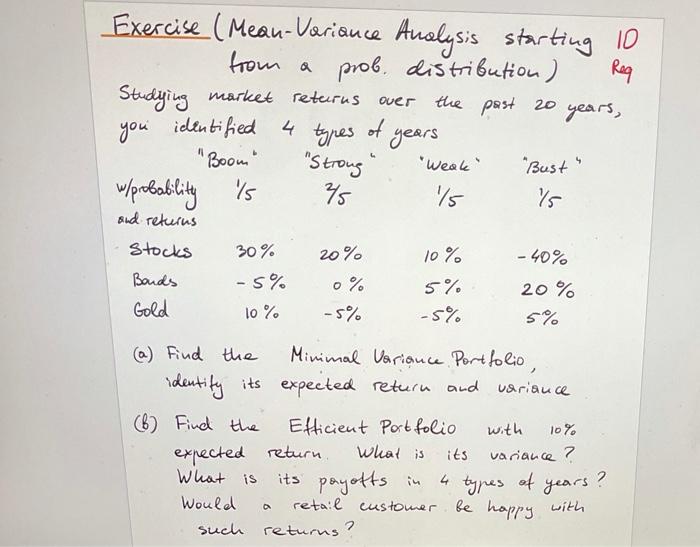

Question: from a Req ouer Exercise ( Meau-Variance Analysis starting 10 prob. distribution) Studying market returns the past 20 years, types of years Boom Strong Weak

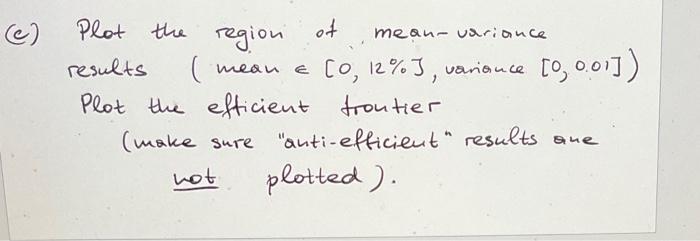

from a Req ouer Exercise ( Meau-Variance Analysis starting 10 prob. distribution) Studying market returns the past 20 years, types of years "Boom" "Strong" "Weak" Bust" w/probability you identified 4 Ys s Vs 15 20% and returns stocks Bonds Gold 30% - 5% 10% 0% -5% 10% 5% -5% - 40% 20 % 5% 10% (a) Find the Minimal Variance Portfolio identity its expected return and variance (6) Find the Efficient Portfolio with What is its variance ? What its payoffs Would retail customer be happy with such returns ? expected return is in types of years? a 2 mean-variance Plot the regioni of results ( mean & Co, 12% I, variance [0, o [0, 0.011) Plot the efficient troutier (make sure "anti-efficient" results are not plotted). from a Req ouer Exercise ( Meau-Variance Analysis starting 10 prob. distribution) Studying market returns the past 20 years, types of years "Boom" "Strong" "Weak" Bust" w/probability you identified 4 Ys s Vs 15 20% and returns stocks Bonds Gold 30% - 5% 10% 0% -5% 10% 5% -5% - 40% 20 % 5% 10% (a) Find the Minimal Variance Portfolio identity its expected return and variance (6) Find the Efficient Portfolio with What is its variance ? What its payoffs Would retail customer be happy with such returns ? expected return is in types of years? a 2 mean-variance Plot the regioni of results ( mean & Co, 12% I, variance [0, o [0, 0.011) Plot the efficient troutier (make sure "anti-efficient" results are not plotted)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts