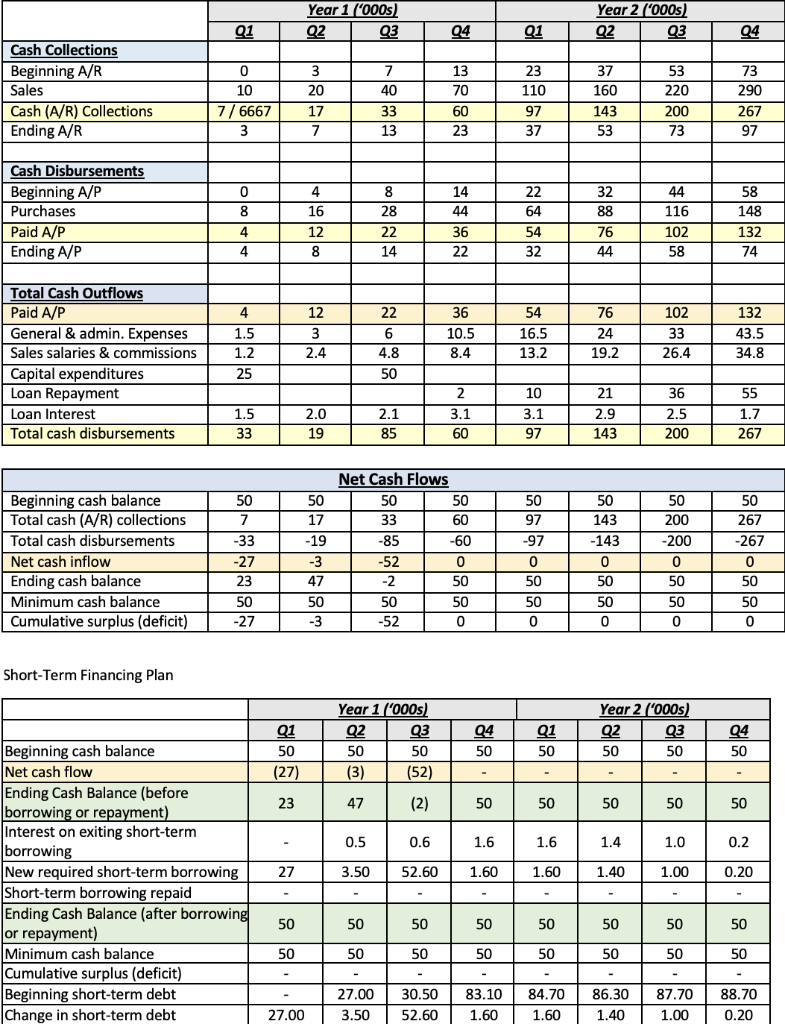

Question: From below, does the company require any short-term financing? Explain. (50 100 words) What are your thoughts on the viability of the expansion? Consider both

- From below, does the company require any short-term financing? Explain. (50 100 words)

- What are your thoughts on the viability of the expansion? Consider both the below budgets.

Year 1 ('000s) Q2 Q3 Year 2 ('000s) Q2 Q3 01 94 01 04 Cash Collections Beginning A/R Sales Cash (A/R) Collections Ending A/R 0 10 7/6667 3 3 20 17 7 71989 40 33 13 13 70 60 23 110 97 37 37 160 143 53 53 220 200 73 73 290 267 97 23 Cash Disbursements Beginning A/P Purchases Paid A/P Ending A/P 0 8 4 4 16 12 8 8 8 28 22 14 14 44 36 22 22 64 54 32 32 88 76 44 44 116 102 58 58 148 132 74 4 4 1.5 1.2 25 12 3 2.4 22 6 4.8 50 36 10.5 8.4 54 16.5 13.2 76 24 19.2 Total Cash Outflows Paid A/P General & admin. Expenses Sales salaries & commissions Capital expenditures Loan Repayment Loan Interest Total cash disbursements 102 33 26.4 132 43.5 34.8 1.5 2.0 19 2.1 85 2 3.1 60 10 3.1 97 21 2.9 143 36 2.5 200 55 1.7 267 33 Beginning cash balance Total cash (A/R) collections Total cash disbursements Net cash inflow Ending cash balance Minimum cash balance Cumulative surplus (deficit) 50 7 -33 -27 23 50 -27 50 17 -19 -3 47 50 -3 Net Cash Flows 50 50 33 60 -85 -60 -52 0 0 -2 50 50 50 -52 0 50 97 -97 0 50 50 0 50 143 -143 0 50 50 0 50 200 -200 0 50 50 0 50 267 -267 0 50 50 0 Short-Term Financing Plan Q1 50 (27) Year 1 ('000s) Q2 Q3 50 50 (3) (52) 04 50 Q1 50 Year 2 ('000s) Q2 03 50 50 94 50 23 47 (2) 50 50 50 50 50 0.5 0.6 1.6 1.6 1.4 1.0 0.2 P. 27 3.50 52.60 1.60 1.60 1.40 1.00 ol 0.20 Beginning cash balance Net cash flow Ending Cash Balance (before borrowing or repayment) Interest on exiting short-term borrowing New required short-term borrowing Short-term borrowing repaid Ending Cash Balance (after borrowing or repayment) Minimum cash balance Cumulative surplus (deficit) Beginning short-term debt Change in short-term debt " 50 50 50 50 50 50 50 50 " 50 50 50 50 50 50 50 50 - 27.00 3.50 H 30.50 52.60 83.10 1.60 F 84.70 1.60 i 1 86.30 1.40 F 87.70 1.00 1 H 88.70 0.20 27.00 Year 1 ('000s) Q2 Q3 Year 2 ('000s) Q2 Q3 01 94 01 04 Cash Collections Beginning A/R Sales Cash (A/R) Collections Ending A/R 0 10 7/6667 3 3 20 17 7 71989 40 33 13 13 70 60 23 110 97 37 37 160 143 53 53 220 200 73 73 290 267 97 23 Cash Disbursements Beginning A/P Purchases Paid A/P Ending A/P 0 8 4 4 16 12 8 8 8 28 22 14 14 44 36 22 22 64 54 32 32 88 76 44 44 116 102 58 58 148 132 74 4 4 1.5 1.2 25 12 3 2.4 22 6 4.8 50 36 10.5 8.4 54 16.5 13.2 76 24 19.2 Total Cash Outflows Paid A/P General & admin. Expenses Sales salaries & commissions Capital expenditures Loan Repayment Loan Interest Total cash disbursements 102 33 26.4 132 43.5 34.8 1.5 2.0 19 2.1 85 2 3.1 60 10 3.1 97 21 2.9 143 36 2.5 200 55 1.7 267 33 Beginning cash balance Total cash (A/R) collections Total cash disbursements Net cash inflow Ending cash balance Minimum cash balance Cumulative surplus (deficit) 50 7 -33 -27 23 50 -27 50 17 -19 -3 47 50 -3 Net Cash Flows 50 50 33 60 -85 -60 -52 0 0 -2 50 50 50 -52 0 50 97 -97 0 50 50 0 50 143 -143 0 50 50 0 50 200 -200 0 50 50 0 50 267 -267 0 50 50 0 Short-Term Financing Plan Q1 50 (27) Year 1 ('000s) Q2 Q3 50 50 (3) (52) 04 50 Q1 50 Year 2 ('000s) Q2 03 50 50 94 50 23 47 (2) 50 50 50 50 50 0.5 0.6 1.6 1.6 1.4 1.0 0.2 P. 27 3.50 52.60 1.60 1.60 1.40 1.00 ol 0.20 Beginning cash balance Net cash flow Ending Cash Balance (before borrowing or repayment) Interest on exiting short-term borrowing New required short-term borrowing Short-term borrowing repaid Ending Cash Balance (after borrowing or repayment) Minimum cash balance Cumulative surplus (deficit) Beginning short-term debt Change in short-term debt " 50 50 50 50 50 50 50 50 " 50 50 50 50 50 50 50 50 - 27.00 3.50 H 30.50 52.60 83.10 1.60 F 84.70 1.60 i 1 86.30 1.40 F 87.70 1.00 1 H 88.70 0.20 27.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts