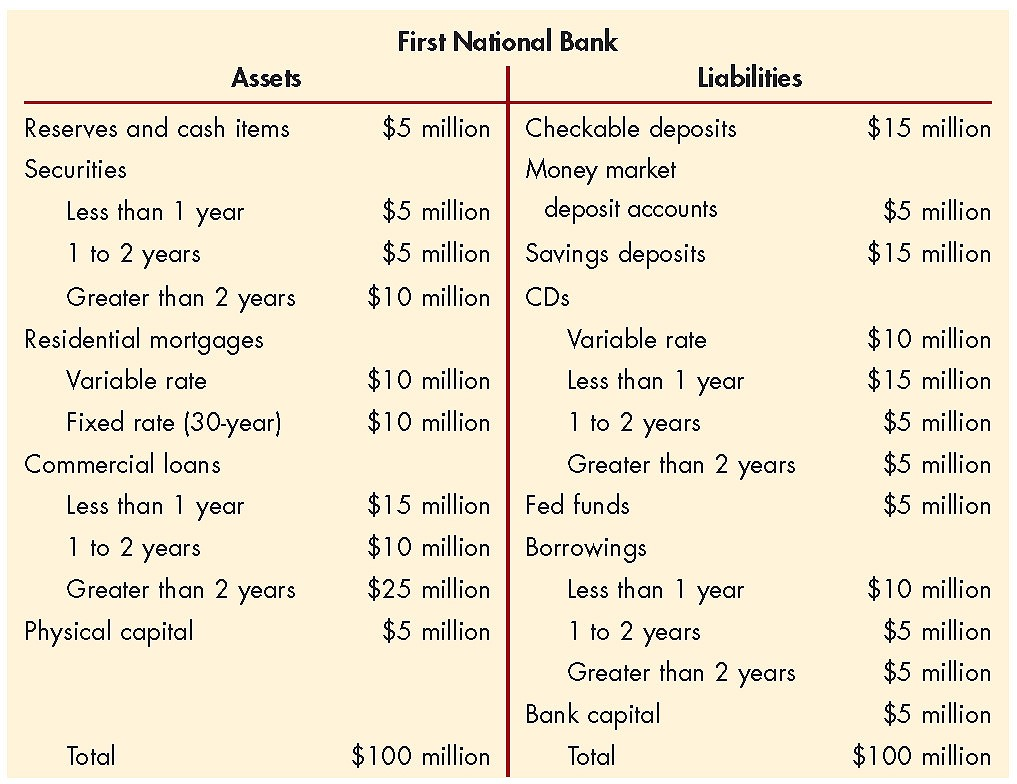

Question: From following statement identify all the rate sensitive assets and liabilities. If interest rate increases by 5%, what would be the income gap between rate

- From following statement identify all the rate sensitive assets and liabilities. If interest rate increases by 5%, what would be the income gap between rate sensitive assets and liabilities. Assume 20% of fixed rate mortgages, 10% of checkable deposits and 20% of savings deposits are also rate sensitive?

Assets $15 million $5 million $15 million Reserves and cash items Securities Less than 1 year 1 to 2 years Greater than 2 years Residential mortgages Variable rate Fixed rate (30-year) Commercial loans Less than 1 year 1 to 2 years Greater than 2 years Physical capital First National Bank Liabilities $5 million Checkable deposits Money market $5 million deposit accounts $5 million Savings deposits $10 million CDs Variable rate $10 million Less than 1 year $10 million 1 to 2 years Greater than 2 years $15 million Fed funds $10 million Borrowings $25 million Less than 1 year $5 million 1 to 2 years Greater than 2 years Bank capital $100 million Total $10 million $15 million $5 million $5 million $5 million $10 million $5 million $5 million $5 million $100 million Total Assets $15 million $5 million $15 million Reserves and cash items Securities Less than 1 year 1 to 2 years Greater than 2 years Residential mortgages Variable rate Fixed rate (30-year) Commercial loans Less than 1 year 1 to 2 years Greater than 2 years Physical capital First National Bank Liabilities $5 million Checkable deposits Money market $5 million deposit accounts $5 million Savings deposits $10 million CDs Variable rate $10 million Less than 1 year $10 million 1 to 2 years Greater than 2 years $15 million Fed funds $10 million Borrowings $25 million Less than 1 year $5 million 1 to 2 years Greater than 2 years Bank capital $100 million Total $10 million $15 million $5 million $5 million $5 million $10 million $5 million $5 million $5 million $100 million Total

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts