Question: From Hull's textbook, we know that when the underlying asset pays a dividend expressed as a dividend yield q, the futures price is given by

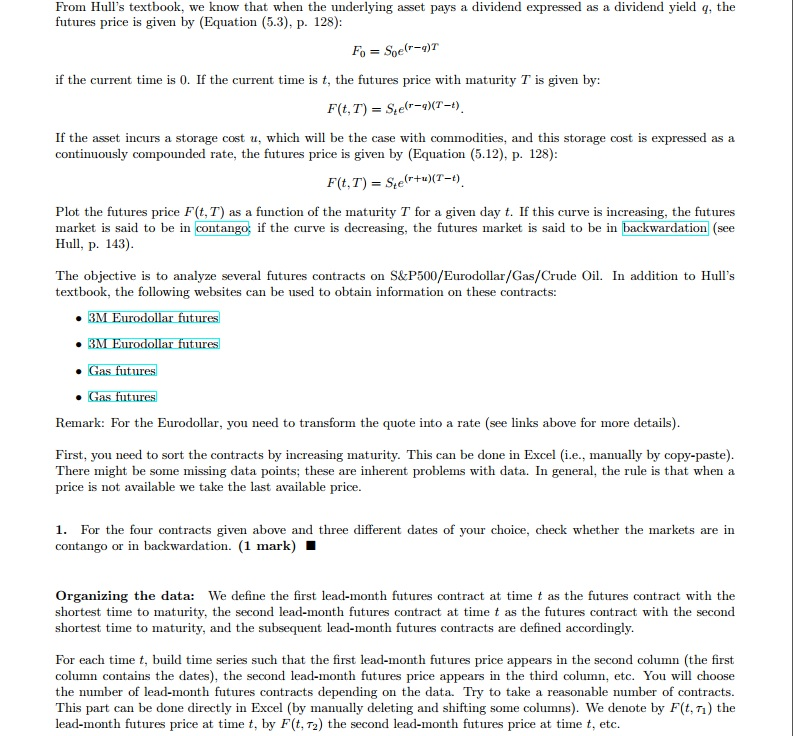

From Hull's textbook, we know that when the underlying asset pays a dividend expressed as a dividend yield q, the futures price is given by (Equation (5.3), p. 128) (r-q)T if the current time is 0. If the current time is t, the futures price with maturity T is given by: F(t, T) St) If the asset incurs a storage cost u, which will be the case with commodities, and this storage cost is expressed as a continuously compounded rate, the futures price is given by (Equation (5.12), p. 128) F(t,T)SetulT-t) Plot the futures price F(t, T) as a function of the maturity T for a given day t. If this curve is increasing, the futures market is said to be in contango if the curve is decreasing, the futures market is said to be in backwardation (see Hull, p. 143) The objective is to analyze several futures contracts on S&P500/Eurodollar/Gas/Crude Oil. In addition to Hull's textbook, the following websites can be used to obtain information on these contracts: Remark: For the Eurodollar, you need to transform the quote into a rate (see links above for more details) First, you need to sort the contracts by increasing maturity. This can be done in Excel (i.e., manually by copy-paste) There might be some missing data points; these are inherent problems with data. In general, the rule is that when a price is not available we take the last available price 1. For the four contracts given above and three different dates of your choice, check whether the markets are in contango or in backwardation. (1 mark) Organizing the data: We define the first lead-month futures contract at time t as the futures contract with the shortest time to maturity, the second lead-month futures contract at time t as the futures contract with the second shortest time to maturity, and the subsequent lead-month futures contracts are defined accordingly. For each time t, build time eries such that the first lead-month futures price appears in the second column (the first column contains the dates), the second lead-month futures price appears in the third column, etc. You will choose the number of lead-month futures contracts depending on the data. Try to take a reasonable number of contracts. This part can be done directly in Excel (by manually deleting and shifting some columns). We denote by F(t,T) the lead-month futures price at time t, by F(t, T2) the second lead-month futures price at time t, etc From Hull's textbook, we know that when the underlying asset pays a dividend expressed as a dividend yield q, the futures price is given by (Equation (5.3), p. 128) (r-q)T if the current time is 0. If the current time is t, the futures price with maturity T is given by: F(t, T) St) If the asset incurs a storage cost u, which will be the case with commodities, and this storage cost is expressed as a continuously compounded rate, the futures price is given by (Equation (5.12), p. 128) F(t,T)SetulT-t) Plot the futures price F(t, T) as a function of the maturity T for a given day t. If this curve is increasing, the futures market is said to be in contango if the curve is decreasing, the futures market is said to be in backwardation (see Hull, p. 143) The objective is to analyze several futures contracts on S&P500/Eurodollar/Gas/Crude Oil. In addition to Hull's textbook, the following websites can be used to obtain information on these contracts: Remark: For the Eurodollar, you need to transform the quote into a rate (see links above for more details) First, you need to sort the contracts by increasing maturity. This can be done in Excel (i.e., manually by copy-paste) There might be some missing data points; these are inherent problems with data. In general, the rule is that when a price is not available we take the last available price 1. For the four contracts given above and three different dates of your choice, check whether the markets are in contango or in backwardation. (1 mark) Organizing the data: We define the first lead-month futures contract at time t as the futures contract with the shortest time to maturity, the second lead-month futures contract at time t as the futures contract with the second shortest time to maturity, and the subsequent lead-month futures contracts are defined accordingly. For each time t, build time eries such that the first lead-month futures price appears in the second column (the first column contains the dates), the second lead-month futures price appears in the third column, etc. You will choose the number of lead-month futures contracts depending on the data. Try to take a reasonable number of contracts. This part can be done directly in Excel (by manually deleting and shifting some columns). We denote by F(t,T) the lead-month futures price at time t, by F(t, T2) the second lead-month futures price at time t, etc

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts