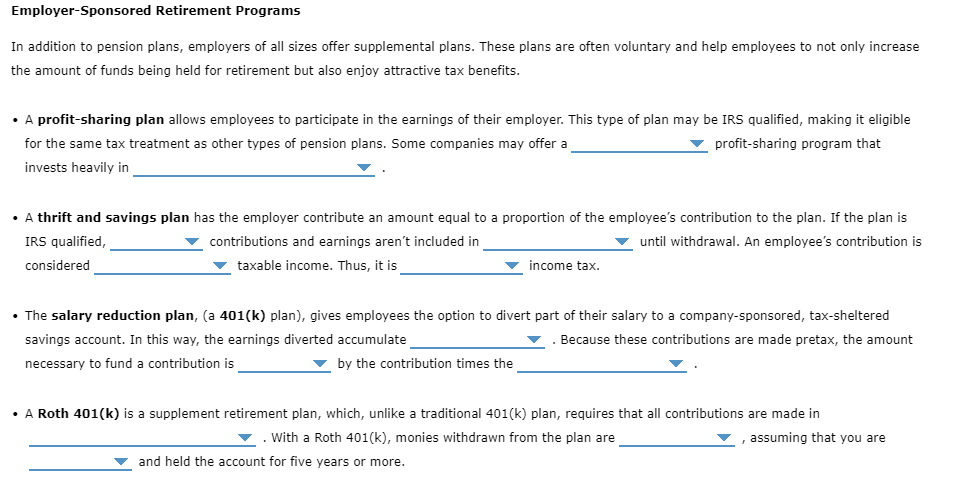

Question: FROM LEFT TO RIGHT: 1. noncontributory / voluntary / contributory 2. a mix of fixed-interest products / stocks and bonds / their own stocks 3.

FROM LEFT TO RIGHT:

FROM LEFT TO RIGHT:

1. noncontributory / voluntary / contributory

2. a mix of fixed-interest products / stocks and bonds / their own stocks

3. employee / employer

4. monthly paycheck / taxable income / annual salary

5. excludable from / part of

6. subject to / not subject to

7. until retirement / tax free

8. increased / reduced

9. individuals tax rate / years to retirement / age at plan inception

10. projected retirement benefits / pretax contributions / after-tax dollars

11. tax free / a set amount

12. age 65 / age 67 / retired / age 59.5

Employer-Sponsored Retirement Programs In addition to pension plans, employers of all sizes offer supplemental plans. These plans are often voluntary and help employees to not only increase the amount of funds being held for retirement but also enjoy attractive tax benefits. A profit-sharing plan allows employees to participate in the earnings of their employer. This type of plan may be IRS qualified, making it eligible for the same tax treatment as other types of pension plans. Some companies may offer a profit-sharing program that invests heavily in A thrift and savings plan has the employer contribute an amount equal to a proportion of the employee's contribution to the plan. If the plan is IRS qualified, contributions and earnings aren't included in until withdrawal. An employee's contribution is considered taxable income. Thus, it is income tax. The salary reduction plan, (a 401(k) plan), gives employees the option to divert part of their salary to a company-sponsored, tax-sheltered savings account. In this way, the earnings diverted accumulate Because these contributions are made pretax, the amount necessary to fund a contribution is by the contribution times the A Roth 401(k) is a supplement retirement plan, which, unlike a traditional 401(k) plan, requires that all contributions are made in . With a Roth 401(k), monies withdrawn from the plan are , assuming that you are and held the account for five years or more. Employer-Sponsored Retirement Programs In addition to pension plans, employers of all sizes offer supplemental plans. These plans are often voluntary and help employees to not only increase the amount of funds being held for retirement but also enjoy attractive tax benefits. A profit-sharing plan allows employees to participate in the earnings of their employer. This type of plan may be IRS qualified, making it eligible for the same tax treatment as other types of pension plans. Some companies may offer a profit-sharing program that invests heavily in A thrift and savings plan has the employer contribute an amount equal to a proportion of the employee's contribution to the plan. If the plan is IRS qualified, contributions and earnings aren't included in until withdrawal. An employee's contribution is considered taxable income. Thus, it is income tax. The salary reduction plan, (a 401(k) plan), gives employees the option to divert part of their salary to a company-sponsored, tax-sheltered savings account. In this way, the earnings diverted accumulate Because these contributions are made pretax, the amount necessary to fund a contribution is by the contribution times the A Roth 401(k) is a supplement retirement plan, which, unlike a traditional 401(k) plan, requires that all contributions are made in . With a Roth 401(k), monies withdrawn from the plan are , assuming that you are and held the account for five years or more

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts