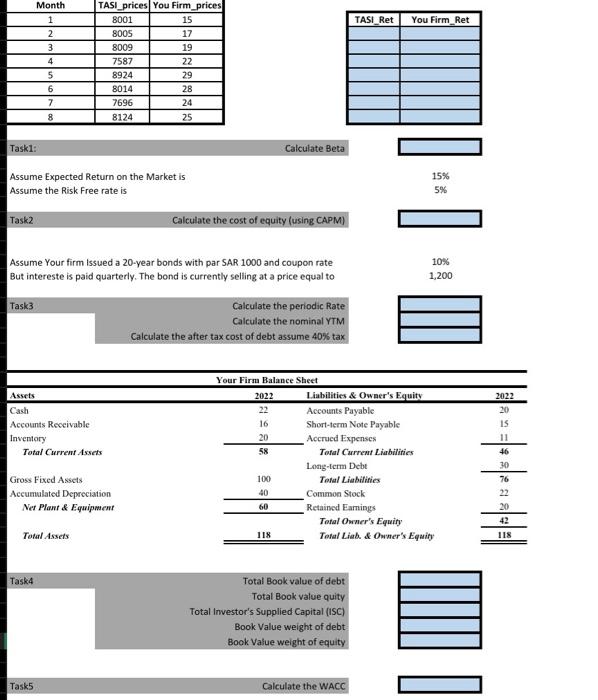

Question: from task 1 to 8 from task 1-8 begin{tabular}{|c|c|c|} hline Month & TASI_prices & You Firm_prices hline 1 & 8001 & 15 hline

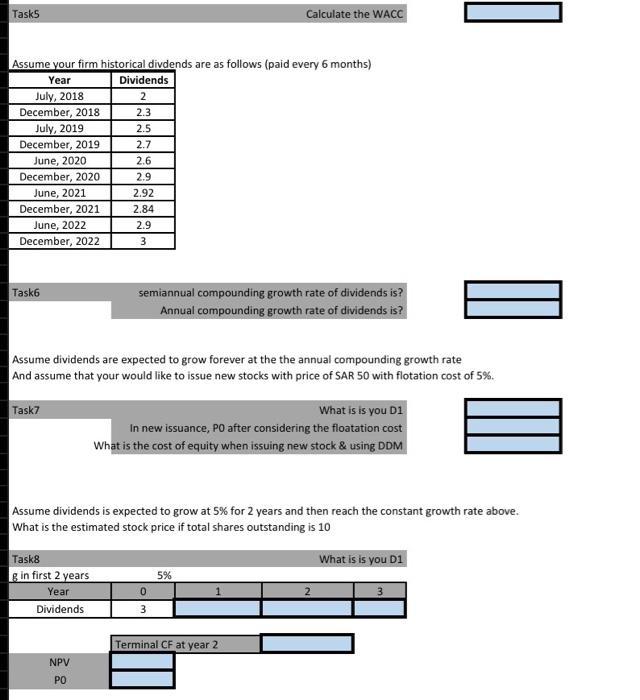

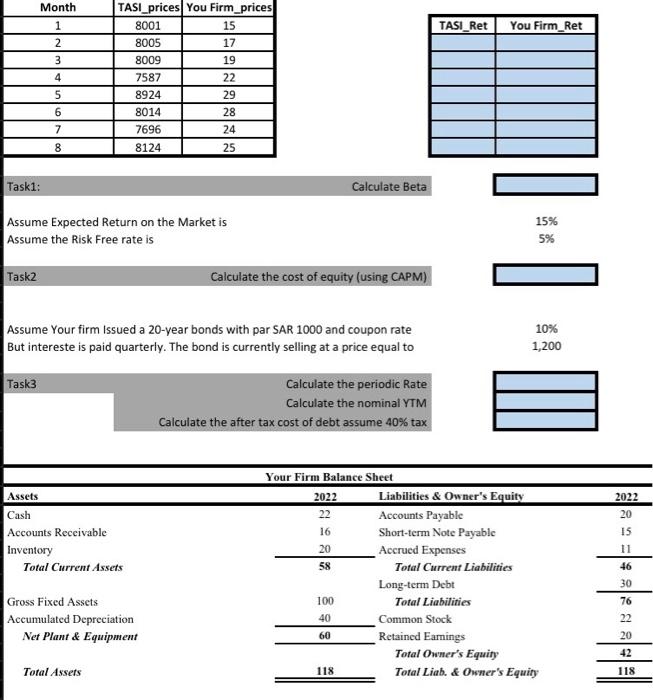

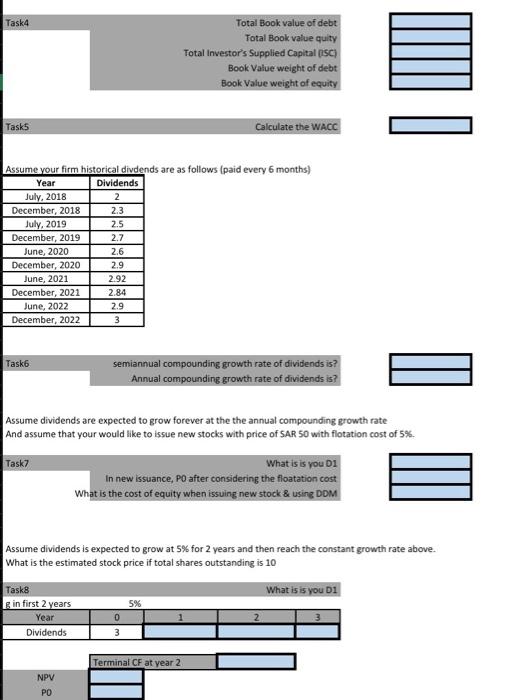

\begin{tabular}{|c|c|c|} \hline Month & TASI_prices & You Firm_prices \\ \hline 1 & 8001 & 15 \\ \hline 2 & 8005 & 17 \\ \hline 3 & 8009 & 19 \\ \hline 4 & 7587 & 22 \\ \hline 5 & 8924 & 29 \\ \hline 6 & 8014 & 28 \\ \hline 7 & 7696 & 24 \\ \hline 8 & 8124 & 25 \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline TASI_Ret & You Firm_Ret \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline \end{tabular} Taskl: Calculate Beta Assume Expected Return on the Market is Assume the Risk Free rate is Task 2 Calculate the cost of equity (using CAPM) Assume Your firm Issued a 20-year bonds with par SAR 1000 and coupon rate But intereste is paid quarterly. The bond is currently selling at a price equal to Assume your firm historical divdends are as follows (paid every 6 months) Task semiannual compounding growth rate of dividends is? Annual compounding growth rate of dividends is? Assume dividends are expected to grow forever at the the annual compounding growth rate And assume that your would like to issue new stocks with price of SAR 50 with flotation cost of 5%. Assume dividends is expected to grow at 5% for 2 years and then reach the constant growth rate above. What is the estimated stock price if total shares outstanding is 10 \begin{tabular}{|c|c|c|} \hline Month & TASI_prices & You Firm_prices \\ \hline 1 & 8001 & 15 \\ \hline 2 & 8005 & 17 \\ \hline 3 & 8009 & 19 \\ \hline 4 & 7587 & 22 \\ \hline 5 & 8924 & 29 \\ \hline 6 & 8014 & 28 \\ \hline 7 & 7696 & 24 \\ \hline 8 & 8124 & 25 \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline TASI_Ret & You Firm_Ret \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline \end{tabular} Task1: Calculate Beta Assume Expected Return on the Market is 15% Assume the Risk Free rate is 5% Task2 Calculate the cost of equity (using CAPM) Assume Your firm Issued a 20-year bonds with par SAR 1000 and coupon rate But intereste is paid quarterly. The bond is currently selling at a price equal to Task 3 Calculate the periodic Rate Calculate the nominal YTM Calculate the after tax cost of debt assume 40% tax Your Firm Balance Sheet Assume vour firm historical divdends are as follows (paid every 6 months) Task 6 semiannual compounding growth rate of dividends is? Annual compounding growth rate of dividends is? Assume dividends are expected to grow forever at the the annual compounding growth rate And assume that your would like to issue new stocks with price of SAR 50 with flotation cost of 5%. Assume dividends is expected to grow at 5% for 2 years and then reach the constant growth rate above. What is the estimated stock price if total shares outstanding is 10 \begin{tabular}{|c|c|c|} \hline Month & TASI_prices & You Firm_prices \\ \hline 1 & 8001 & 15 \\ \hline 2 & 8005 & 17 \\ \hline 3 & 8009 & 19 \\ \hline 4 & 7587 & 22 \\ \hline 5 & 8924 & 29 \\ \hline 6 & 8014 & 28 \\ \hline 7 & 7696 & 24 \\ \hline 8 & 8124 & 25 \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline TASI_Ret & You Firm_Ret \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline \end{tabular} Taskl: Calculate Beta Assume Expected Return on the Market is Assume the Risk Free rate is Task 2 Calculate the cost of equity (using CAPM) Assume Your firm Issued a 20-year bonds with par SAR 1000 and coupon rate But intereste is paid quarterly. The bond is currently selling at a price equal to Assume your firm historical divdends are as follows (paid every 6 months) Task semiannual compounding growth rate of dividends is? Annual compounding growth rate of dividends is? Assume dividends are expected to grow forever at the the annual compounding growth rate And assume that your would like to issue new stocks with price of SAR 50 with flotation cost of 5%. Assume dividends is expected to grow at 5% for 2 years and then reach the constant growth rate above. What is the estimated stock price if total shares outstanding is 10 \begin{tabular}{|c|c|c|} \hline Month & TASI_prices & You Firm_prices \\ \hline 1 & 8001 & 15 \\ \hline 2 & 8005 & 17 \\ \hline 3 & 8009 & 19 \\ \hline 4 & 7587 & 22 \\ \hline 5 & 8924 & 29 \\ \hline 6 & 8014 & 28 \\ \hline 7 & 7696 & 24 \\ \hline 8 & 8124 & 25 \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline TASI_Ret & You Firm_Ret \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline \end{tabular} Task1: Calculate Beta Assume Expected Return on the Market is 15% Assume the Risk Free rate is 5% Task2 Calculate the cost of equity (using CAPM) Assume Your firm Issued a 20-year bonds with par SAR 1000 and coupon rate But intereste is paid quarterly. The bond is currently selling at a price equal to Task 3 Calculate the periodic Rate Calculate the nominal YTM Calculate the after tax cost of debt assume 40% tax Your Firm Balance Sheet Assume vour firm historical divdends are as follows (paid every 6 months) Task 6 semiannual compounding growth rate of dividends is? Annual compounding growth rate of dividends is? Assume dividends are expected to grow forever at the the annual compounding growth rate And assume that your would like to issue new stocks with price of SAR 50 with flotation cost of 5%. Assume dividends is expected to grow at 5% for 2 years and then reach the constant growth rate above. What is the estimated stock price if total shares outstanding is 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts