Question: From that table, write a financial / ratio analysis for apple company in detail mentioning the increase and decrease in the ratios, what it indicates,

From that table, write a financial / ratio analysis for apple company in detail mentioning the increase and decrease in the ratios, what it indicates, and the solution.

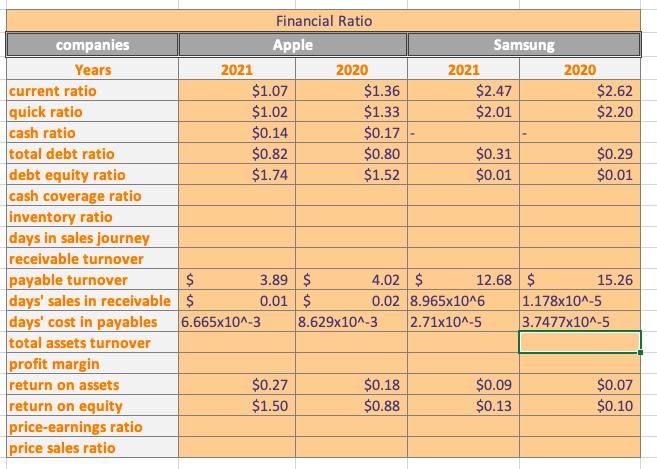

companies Years current ratio quick ratio cash ratio total debt ratio debt equity ratio cash coverage ratio inventory ratio days in sales journey receivable turnover payable turnover days' sales in receivable days' cost in payables total assets turnover profit margin return on assets return on equity price-earnings ratio price sales ratio $ $ 2021 Financial Ratio Apple $1.07 $1.02 $0.14 $0.82 $1.74 3.89 $ 0.01 $ 6.665x10^-3 $0.27 $1.50 2020 $1.36 $1.33 $0.17 $0.80 $1.52 2021 $0.18 $0.88 Samsung $2.47 $2.01 4.02 $ 0.02 8.965x10^6 8.629x10^-3 2.71x10^-5 $0.31 $0.01 12.68 $ $0.09 $0.13 2020 $2.62 $2.20 $0.29 $0.01 15.26 1.178x10^-5 3.7477x10^-5 $0.07 $0.10

Step by Step Solution

3.55 Rating (162 Votes )

There are 3 Steps involved in it

Apple Inc demonstrated some significant changes in the its financial ratios from 2020 to 2021 1 Current Ratio The current ratio declined from 13 in 20... View full answer

Get step-by-step solutions from verified subject matter experts