Question: from the above show the calculation for temporary differences and net deferred tax liability For the year ended December 31, 2023, Kingbird Ltd. reported income

from the above show the calculation for temporary differences and net deferred tax liability

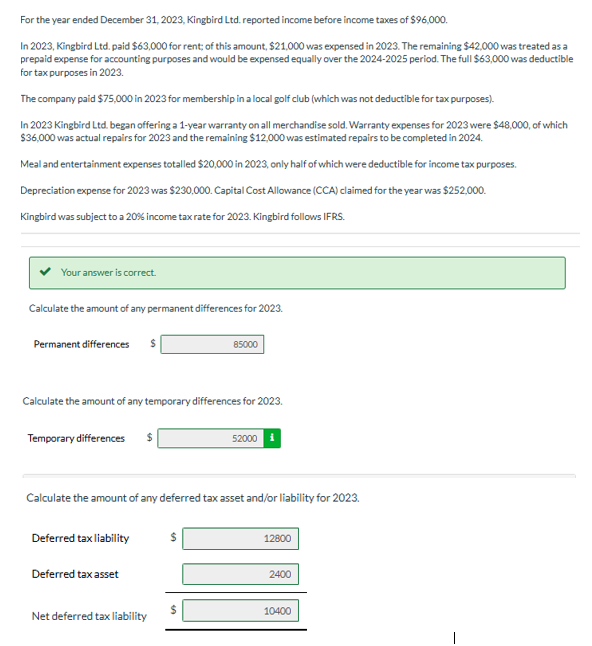

For the year ended December 31, 2023, Kingbird Ltd. reported income before income taxes of $96,000. In 2023, Kingbird Led. paid $63,000 for rent; of this amount, $21,000 was expensed in 2023. The remaining $42,000 was treated as a prepaid expense for accounting purposes and would be expensed equally over the 2024-2025 period. The full $63,000 was deductible for tax purposes in 2023. The company paid $75,000 in 2023 for membership in a local golf club (which was not deductible for tax purposes). In 2023 Kingbird Led. began offering a 1-year warranty on all merchandise sold. Warranty expenses for 2023 were $48,000, of which $36,000 was actual repairs for 2023 and the remaining $12,000 was estimated repairs to be completed in 2024. Meal and entertainment expenses totalled $20,000 in 2023, only half of which were deductible for income tax purposes. Depreciation expense for 2023 was $230,000. Capital Cost Allowance (CCA) claimed for the year was $252,000. Kingbird was subject to a 20% income tax rate for 2023. Kingbird follows IFRS. Your answer is correct. Calculate the amount of any permanent differences for 2023. Permanent differences $ 85000 Calculate the amount of any temporary differences for 2023. Temporary differences 52000 i Calculate the amount of any deferred tax asset and/or liability for 2023. Deferred tax liability 12800 Deferred tax asset 2400 Net deferred tax liability 10400