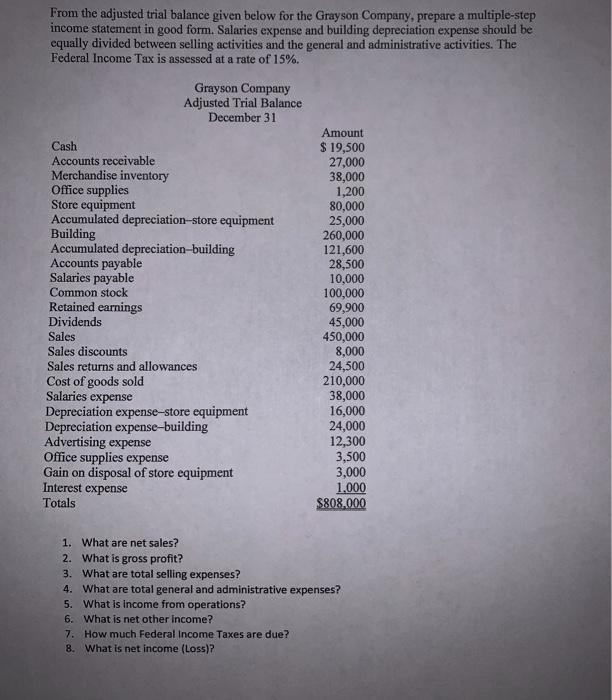

Question: From the adjusted trial balance given below for the Grayson Company, prepare a multiple-step income statement in good form. Salaries expense and building depreciation expense

From the adjusted trial balance given below for the Grayson Company, prepare a multiple-step income statement in good form. Salaries expense and building depreciation expense should be equally divided between selling activities and the general and administrative activities. The Federal Income Tax is assessed at a rate of 15%. Grayson Company Adjusted Trial Balance December 31 Cash Accounts receivable Merchandise inventory Office supplies Store equipment Accumulated depreciation-store equipment Building Accumulated depreciation-building Accounts payable Salaries payable Common stock Retained earnings Dividends Sales Sales discounts Sales returns and allowances Cost of goods sold Salaries expense Depreciation expense-store equipment Depreciation expense-building Advertising expense Office supplies expense Gain on disposal of store equipment Interest expense Totals Amount $ 19,500 27,000 38,000 1,200 80,000 25,000 260,000 121,600 28,500 10,000 100,000 69,900 45,000 450,000 8,000 24,500 210,000 38,000 16,000 24,000 12,300 3,500 3,000 1.000 $808,000 1. What are net sales? 2. What is gross profit? 3. What are total selling expenses? 4. What are total general and administrative expenses? 5. What is income from operations? 6. What is net other Income? 7. How much Federal Income Taxes are due? 8. What is net income (Loss)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts